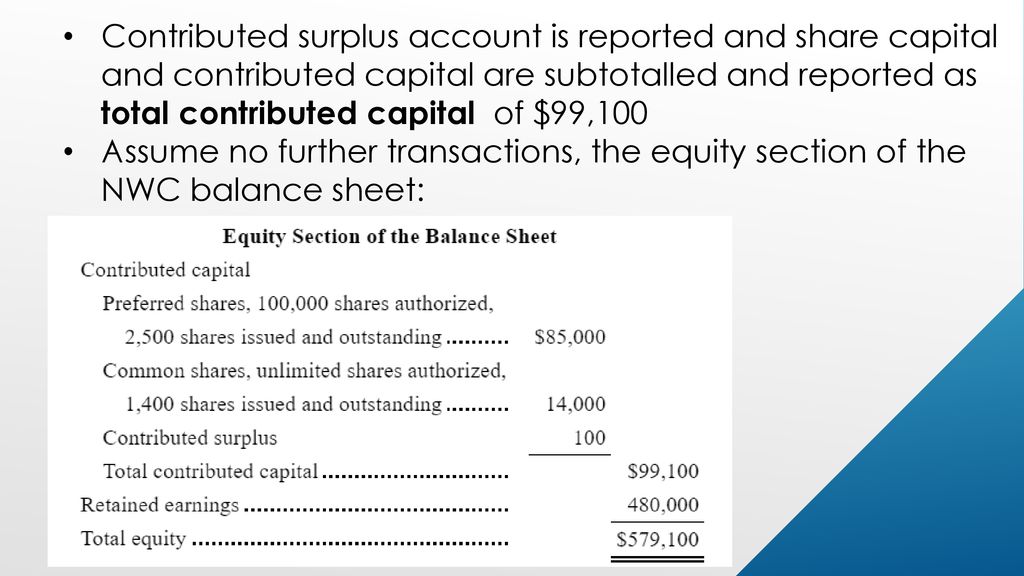

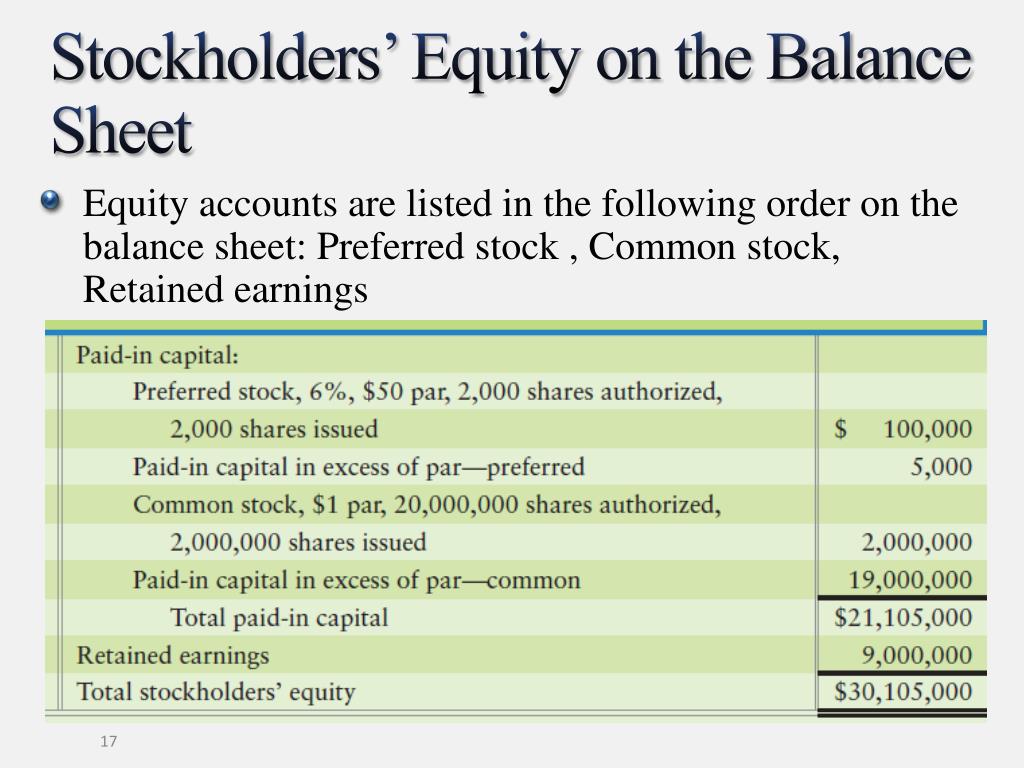

What Is Contributed Capital On A Balance Sheet - Essentially, contributed capital is the total price that a shareholder pays to get a stake in a company in return. What does contributed capital mean? Common stock, preferred stock, and. Contributed capital is the amount the shareholders have given to the company to buy their stake. Contributed capital is the total investment received from shareholders in exchange for issued stock, including both par value and. When a business issues stock, the money it receives from investors—whether at the company’s founding or through later fundraising. Contributed capital is the total value of cash and other assets that shareholders provide to a company in exchange for ownership shares. Calculating contributed capital involves identifying and summing its primary components: It is recorded in the books of accounts as the common. Contributed capital is an element of the total amount of equity recorded by an organization.

What does contributed capital mean? Calculating contributed capital involves identifying and summing its primary components: Contributed capital is the total value of cash and other assets that shareholders provide to a company in exchange for ownership shares. Contributed capital is the amount the shareholders have given to the company to buy their stake. Common stock, preferred stock, and. Contributed capital is the total investment received from shareholders in exchange for issued stock, including both par value and. Essentially, contributed capital is the total price that a shareholder pays to get a stake in a company in return. It can be a separate account within the. It is recorded in the books of accounts as the common. Contributed capital is an element of the total amount of equity recorded by an organization.

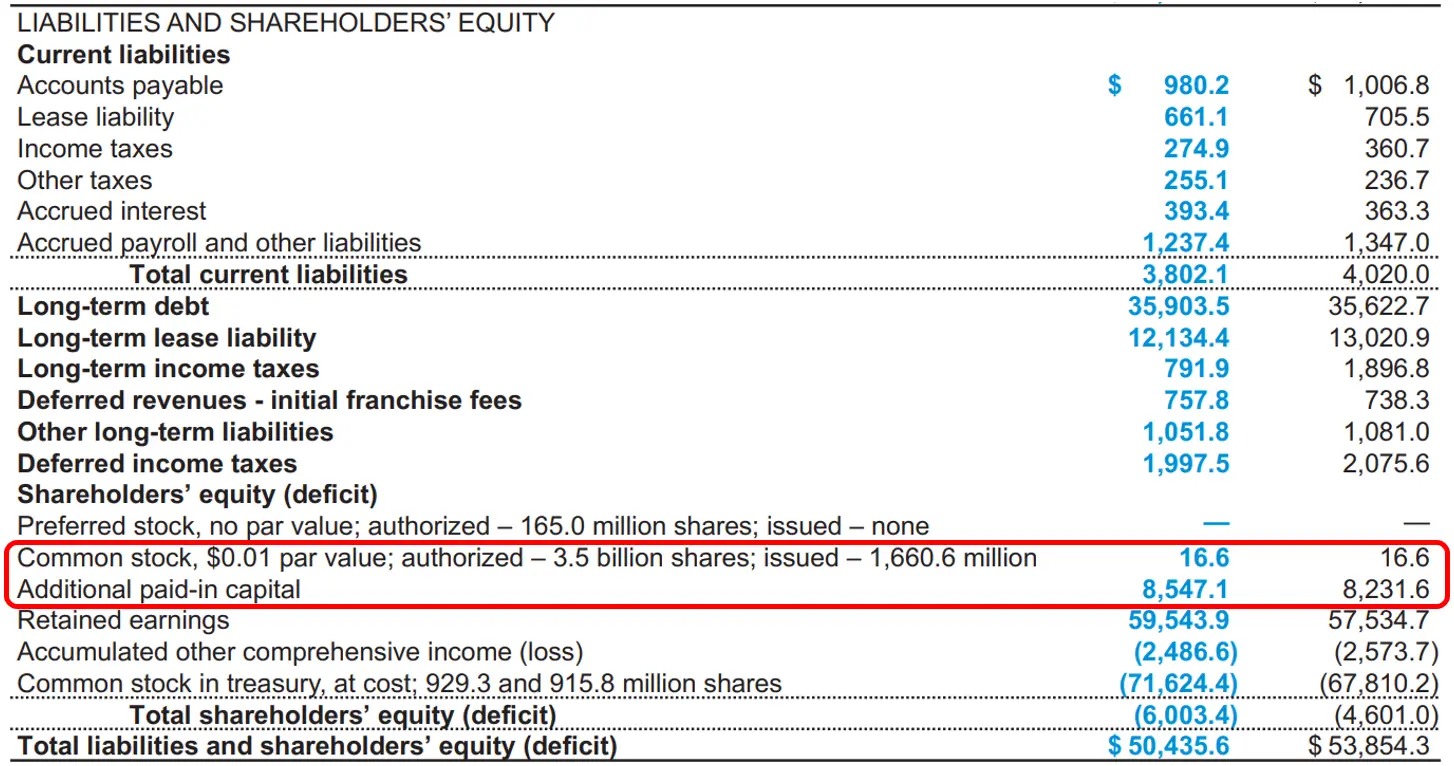

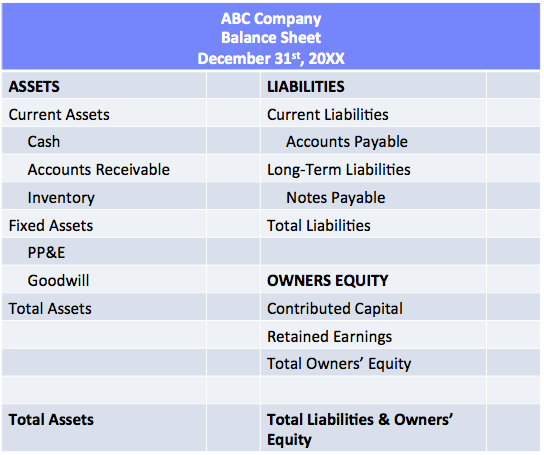

Essentially, contributed capital is the total price that a shareholder pays to get a stake in a company in return. It is recorded in the books of accounts as the common. Contributed capital is reported on the equity section of the balance sheet and usually split into two different. When a business issues stock, the money it receives from investors—whether at the company’s founding or through later fundraising. Contributed capital is an element of the total amount of equity recorded by an organization. Contributed capital is the total value of cash and other assets that shareholders provide to a company in exchange for ownership shares. It can be a separate account within the. What does contributed capital mean? Calculating contributed capital involves identifying and summing its primary components: Contributed capital is part of stockholders' equity, shown on the balance sheet.

Where Is Contributed Capital On The Balance Sheet LiveWell

Contributed capital is reported on the equity section of the balance sheet and usually split into two different. Contributed capital is an element of the total amount of equity recorded by an organization. What does contributed capital mean? Contributed capital is the total investment received from shareholders in exchange for issued stock, including both par value and. Calculating contributed capital.

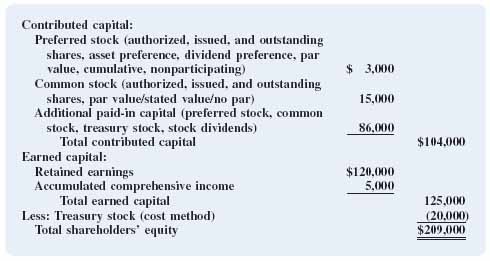

Balance Sheet

Contributed capital is part of stockholders' equity, shown on the balance sheet. Contributed capital is an element of the total amount of equity recorded by an organization. When a business issues stock, the money it receives from investors—whether at the company’s founding or through later fundraising. Contributed capital is the total value of cash and other assets that shareholders provide.

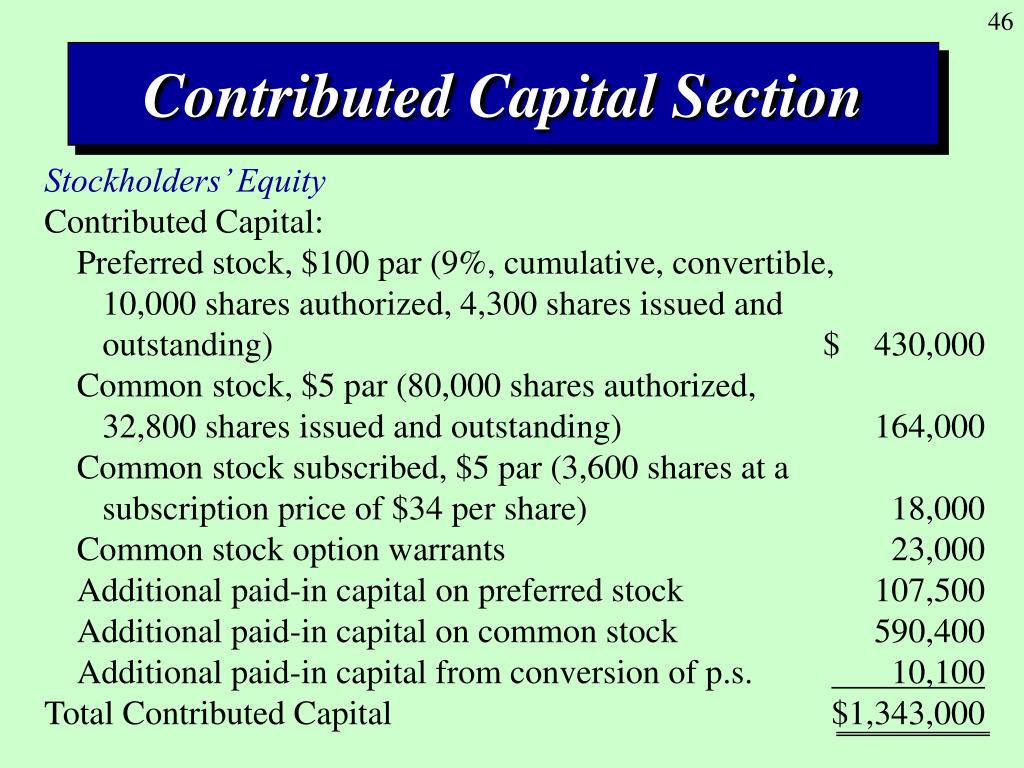

Recording share transactions ppt download

Essentially, contributed capital is the total price that a shareholder pays to get a stake in a company in return. It can be a separate account within the. It is recorded in the books of accounts as the common. When a business issues stock, the money it receives from investors—whether at the company’s founding or through later fundraising. Contributed capital.

PPT Corporations Paidin Capital and the Balance Sheet PowerPoint

Contributed capital is an element of the total amount of equity recorded by an organization. Calculating contributed capital involves identifying and summing its primary components: It is recorded in the books of accounts as the common. Contributed capital is reported on the equity section of the balance sheet and usually split into two different. When a business issues stock, the.

Contributed Capital AwesomeFinTech Blog

Common stock, preferred stock, and. Contributed capital is part of stockholders' equity, shown on the balance sheet. What does contributed capital mean? It can be a separate account within the. Contributed capital is the total value of cash and other assets that shareholders provide to a company in exchange for ownership shares.

Contributed Capital (Definition, Formula) How to Calculate?

What does contributed capital mean? It can be a separate account within the. Common stock, preferred stock, and. Calculating contributed capital involves identifying and summing its primary components: When a business issues stock, the money it receives from investors—whether at the company’s founding or through later fundraising.

ACCOUNTING FOR SHAREHOLDERS' EQUITY Financial Accounting In an

Contributed capital is the total value of cash and other assets that shareholders provide to a company in exchange for ownership shares. Calculating contributed capital involves identifying and summing its primary components: Contributed capital is an element of the total amount of equity recorded by an organization. Essentially, contributed capital is the total price that a shareholder pays to get.

Where Does Working Capital Go On Balance Sheet at Lisa Cunningham blog

It is recorded in the books of accounts as the common. What does contributed capital mean? When a business issues stock, the money it receives from investors—whether at the company’s founding or through later fundraising. Essentially, contributed capital is the total price that a shareholder pays to get a stake in a company in return. Contributed capital is reported on.

PPT Contributed Capital PowerPoint Presentation, free download ID

Contributed capital is the total investment received from shareholders in exchange for issued stock, including both par value and. Contributed capital is an element of the total amount of equity recorded by an organization. When a business issues stock, the money it receives from investors—whether at the company’s founding or through later fundraising. It is recorded in the books of.

Contributed Capital (Definition, Formula) How to Calculate?

Contributed capital is reported on the equity section of the balance sheet and usually split into two different. When a business issues stock, the money it receives from investors—whether at the company’s founding or through later fundraising. Essentially, contributed capital is the total price that a shareholder pays to get a stake in a company in return. What does contributed.

Calculating Contributed Capital Involves Identifying And Summing Its Primary Components:

Contributed capital is the total value of cash and other assets that shareholders provide to a company in exchange for ownership shares. Contributed capital is the amount the shareholders have given to the company to buy their stake. Common stock, preferred stock, and. It is recorded in the books of accounts as the common.

When A Business Issues Stock, The Money It Receives From Investors—Whether At The Company’s Founding Or Through Later Fundraising.

Contributed capital is reported on the equity section of the balance sheet and usually split into two different. Contributed capital is an element of the total amount of equity recorded by an organization. Contributed capital is part of stockholders' equity, shown on the balance sheet. Contributed capital is the total investment received from shareholders in exchange for issued stock, including both par value and.

What Does Contributed Capital Mean?

It can be a separate account within the. Essentially, contributed capital is the total price that a shareholder pays to get a stake in a company in return.