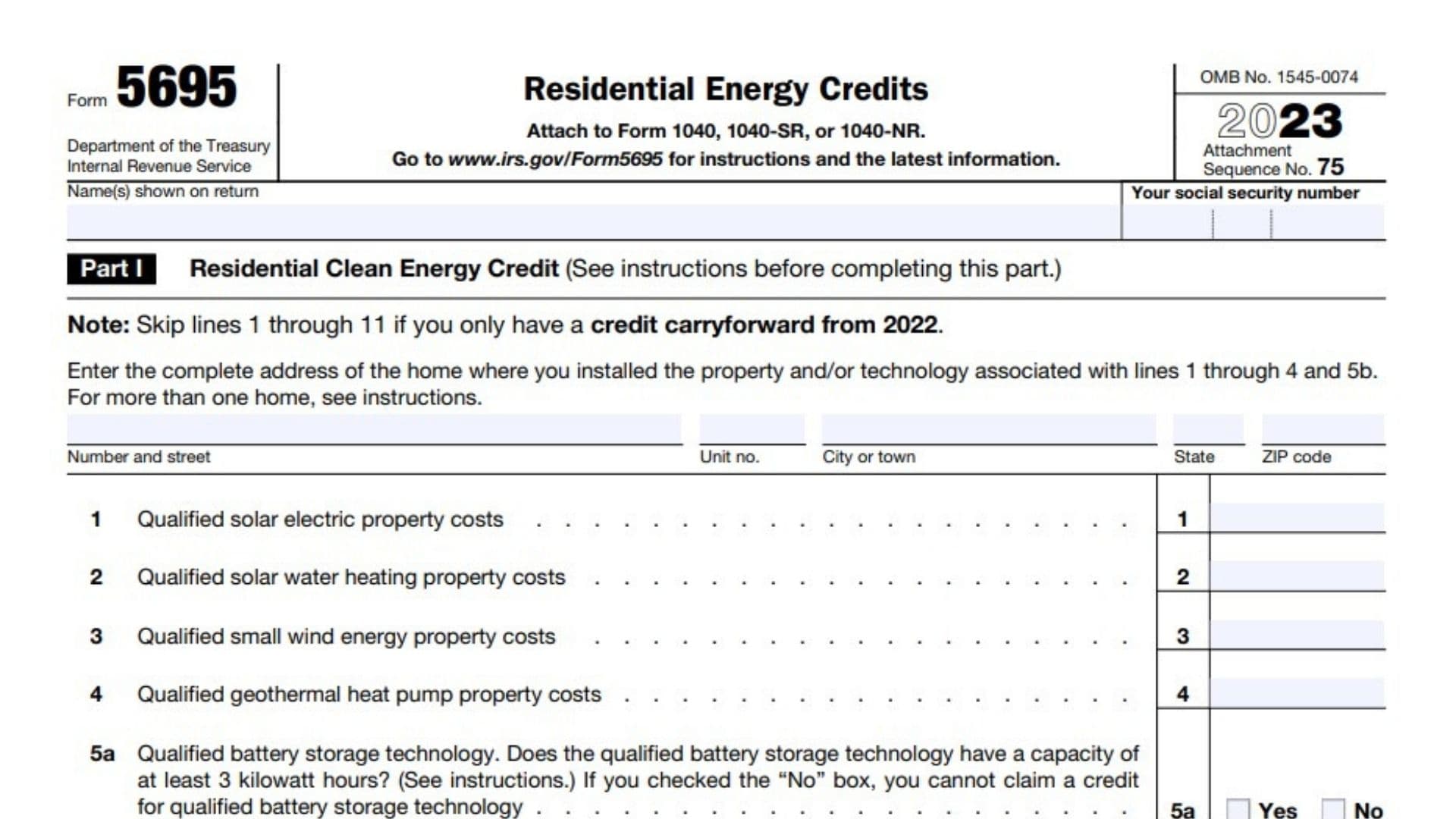

Tax Form 5695 Residential Energy Credits - This guide aims to simplify irs form 5695 for homeowners. Information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. If you checked the “yes” box, you can only claim the energy efficient home improvement credit for qualifying improvements that were not related to. Form 5695 is what you need to fill out to calculate your residential energy tax credits. We'll provide clear instructions and explain the benefits of the energy. These credits are designed to. You need to submit it alongside form 1040. Form 5695 is used to claim the residential energy efficient property credit and the nonbusiness energy property credit.

You need to submit it alongside form 1040. We'll provide clear instructions and explain the benefits of the energy. This guide aims to simplify irs form 5695 for homeowners. Form 5695 is what you need to fill out to calculate your residential energy tax credits. Form 5695 is used to claim the residential energy efficient property credit and the nonbusiness energy property credit. These credits are designed to. If you checked the “yes” box, you can only claim the energy efficient home improvement credit for qualifying improvements that were not related to. Information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file.

Information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. We'll provide clear instructions and explain the benefits of the energy. Form 5695 is used to claim the residential energy efficient property credit and the nonbusiness energy property credit. You need to submit it alongside form 1040. Form 5695 is what you need to fill out to calculate your residential energy tax credits. These credits are designed to. This guide aims to simplify irs form 5695 for homeowners. If you checked the “yes” box, you can only claim the energy efficient home improvement credit for qualifying improvements that were not related to.

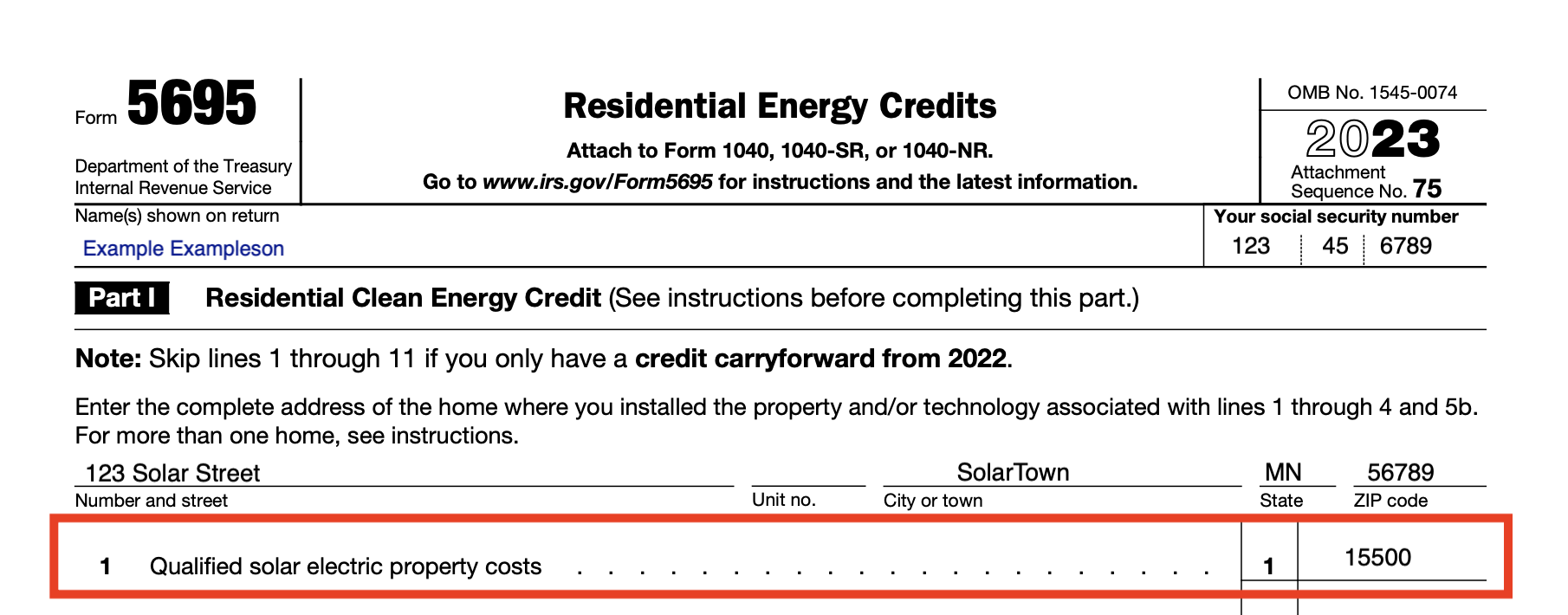

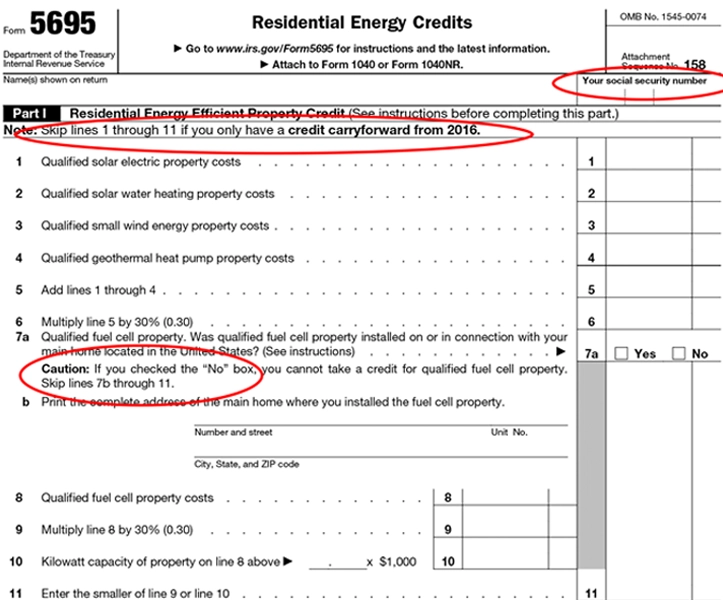

How To Claim The Solar Tax Credit IRS Form 5695 Instructions (2024 tax

We'll provide clear instructions and explain the benefits of the energy. Form 5695 is what you need to fill out to calculate your residential energy tax credits. Information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. Form 5695 is used to claim the residential energy efficient property credit and the nonbusiness.

IRS Form 5695 Residential Energy Tax Credits StepbyStep Guide

Information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. Form 5695 is what you need to fill out to calculate your residential energy tax credits. You need to submit it alongside form 1040. These credits are designed to. If you checked the “yes” box, you can only claim the energy efficient.

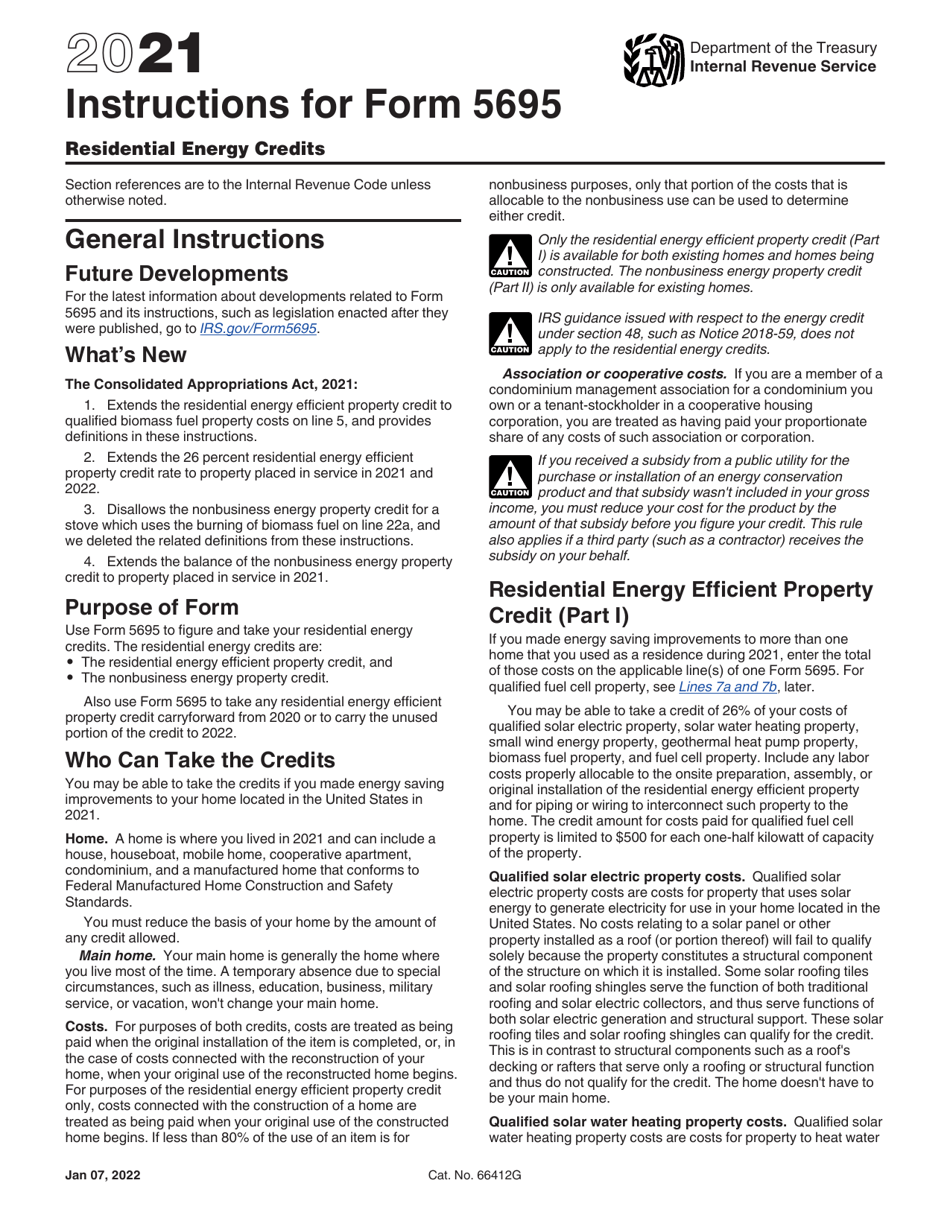

Form 5695 Instructions 2024 2025

This guide aims to simplify irs form 5695 for homeowners. Form 5695 is used to claim the residential energy efficient property credit and the nonbusiness energy property credit. You need to submit it alongside form 1040. If you checked the “yes” box, you can only claim the energy efficient home improvement credit for qualifying improvements that were not related to..

IRS Form 5695. Residential Energy Credits Forms Docs 2023

This guide aims to simplify irs form 5695 for homeowners. Information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. You need to submit it alongside form 1040. We'll provide clear instructions and explain the benefits of the energy. Form 5695 is what you need to fill out to calculate your residential.

Form 5695, Residential Energy Credits Examples and Samples

You need to submit it alongside form 1040. If you checked the “yes” box, you can only claim the energy efficient home improvement credit for qualifying improvements that were not related to. These credits are designed to. This guide aims to simplify irs form 5695 for homeowners. Form 5695 is used to claim the residential energy efficient property credit and.

Download Instructions for IRS Form 5695 Residential Energy Credits PDF

If you checked the “yes” box, you can only claim the energy efficient home improvement credit for qualifying improvements that were not related to. You need to submit it alongside form 1040. These credits are designed to. This guide aims to simplify irs form 5695 for homeowners. Form 5695 is used to claim the residential energy efficient property credit and.

Fillable Online About Form 5695, Residential Energy Credits IRS tax

This guide aims to simplify irs form 5695 for homeowners. Form 5695 is used to claim the residential energy efficient property credit and the nonbusiness energy property credit. If you checked the “yes” box, you can only claim the energy efficient home improvement credit for qualifying improvements that were not related to. These credits are designed to. You need to.

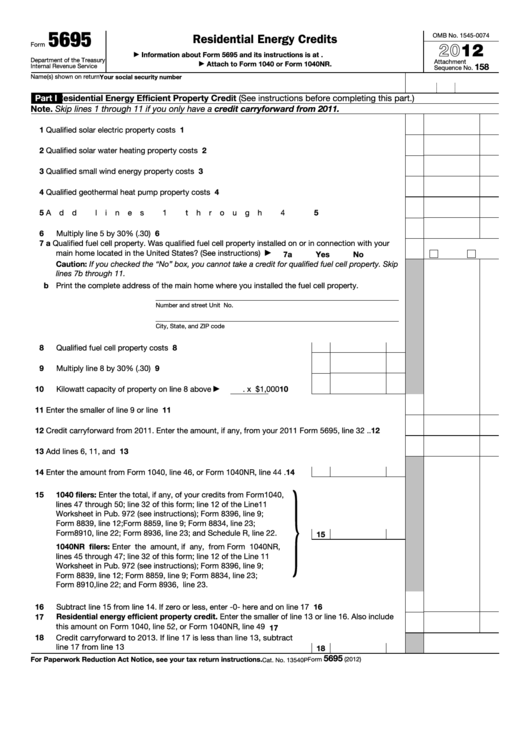

Fillable Form 5695 Residential Energy Credits 2012 printable pdf

Form 5695 is what you need to fill out to calculate your residential energy tax credits. If you checked the “yes” box, you can only claim the energy efficient home improvement credit for qualifying improvements that were not related to. This guide aims to simplify irs form 5695 for homeowners. These credits are designed to. Form 5695 is used to.

Form 5695 Instructions & Information Community Tax

Form 5695 is what you need to fill out to calculate your residential energy tax credits. If you checked the “yes” box, you can only claim the energy efficient home improvement credit for qualifying improvements that were not related to. You need to submit it alongside form 1040. Form 5695 is used to claim the residential energy efficient property credit.

IRS Form 5695 Instructions Residential Energy Credits

This guide aims to simplify irs form 5695 for homeowners. We'll provide clear instructions and explain the benefits of the energy. These credits are designed to. You need to submit it alongside form 1040. Information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file.

These Credits Are Designed To.

This guide aims to simplify irs form 5695 for homeowners. We'll provide clear instructions and explain the benefits of the energy. If you checked the “yes” box, you can only claim the energy efficient home improvement credit for qualifying improvements that were not related to. Form 5695 is used to claim the residential energy efficient property credit and the nonbusiness energy property credit.

You Need To Submit It Alongside Form 1040.

Information about form 5695, residential energy credits, including recent updates, related forms and instructions on how to file. Form 5695 is what you need to fill out to calculate your residential energy tax credits.