Scorp Form - Completing irs form 2553 can unlock a myriad of tax advantages. Upon receipt and review, the irs will then send a. In our guide to s corporation election, you'll learn how and when to. Form 2553 notifies the irs that you want to elect s corp status. Once your business has officially been formed and you’ve obtained a federal tax id number, you can send form 2553 to the irs to. Irs form 2553 is the tax form you must file if you want to elect s corporation status for your business. Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. What is irs form 2553?

Upon receipt and review, the irs will then send a. Form 2553 notifies the irs that you want to elect s corp status. Completing irs form 2553 can unlock a myriad of tax advantages. Irs form 2553 is the tax form you must file if you want to elect s corporation status for your business. Once your business has officially been formed and you’ve obtained a federal tax id number, you can send form 2553 to the irs to. Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. What is irs form 2553? In our guide to s corporation election, you'll learn how and when to.

Form 2553 notifies the irs that you want to elect s corp status. What is irs form 2553? In our guide to s corporation election, you'll learn how and when to. Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. Irs form 2553 is the tax form you must file if you want to elect s corporation status for your business. Upon receipt and review, the irs will then send a. Completing irs form 2553 can unlock a myriad of tax advantages. Once your business has officially been formed and you’ve obtained a federal tax id number, you can send form 2553 to the irs to.

S Corporation (Form 2553) vs C Corporation (Form 8832) Form Pros

Form 2553 notifies the irs that you want to elect s corp status. Completing irs form 2553 can unlock a myriad of tax advantages. Upon receipt and review, the irs will then send a. Once your business has officially been formed and you’ve obtained a federal tax id number, you can send form 2553 to the irs to. What is.

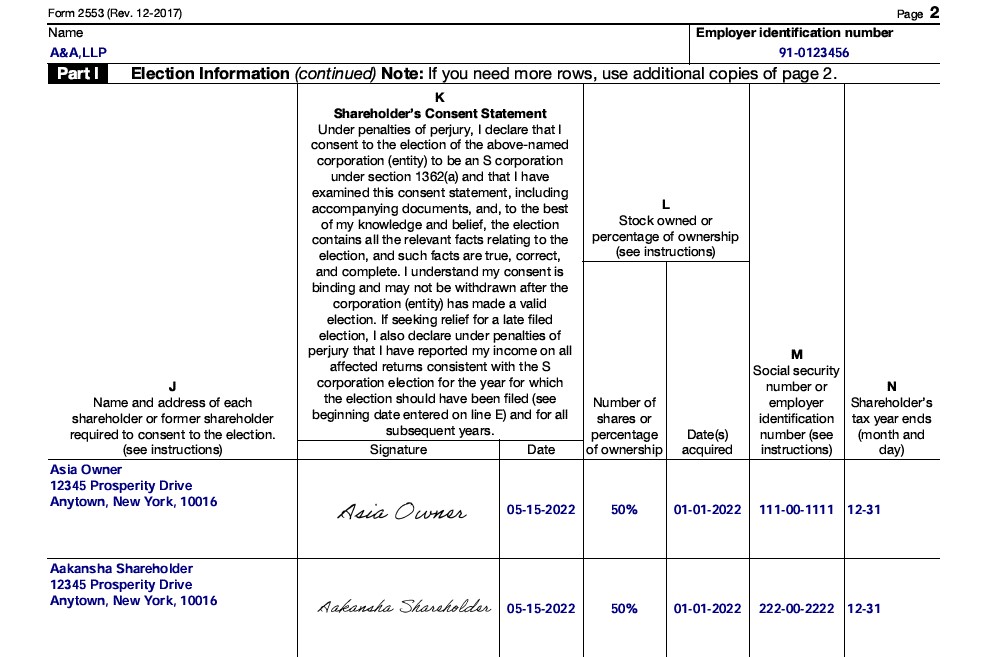

How To Fill Out Form 2553 for Scorps and LLCs

Completing irs form 2553 can unlock a myriad of tax advantages. In our guide to s corporation election, you'll learn how and when to. Form 2553 notifies the irs that you want to elect s corp status. Once your business has officially been formed and you’ve obtained a federal tax id number, you can send form 2553 to the irs.

Stock Transfer Agreement Template

In our guide to s corporation election, you'll learn how and when to. Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. What is irs form 2553? Irs form 2553 is the tax form you must file if you want to elect s corporation status for your business. Once.

Understanding Form 2553 & S Corps GoCo.io

Once your business has officially been formed and you’ve obtained a federal tax id number, you can send form 2553 to the irs to. What is irs form 2553? Completing irs form 2553 can unlock a myriad of tax advantages. Irs form 2553 is the tax form you must file if you want to elect s corporation status for your.

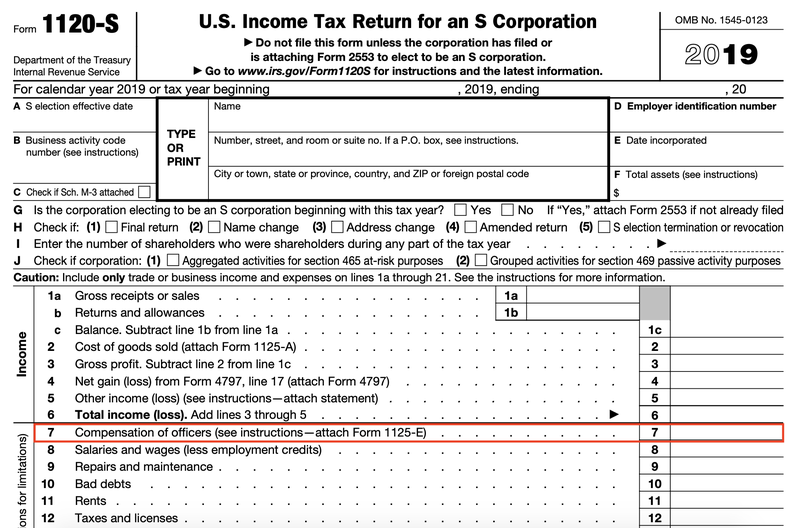

Tax Form For S Corp at Philip Mayers blog

Upon receipt and review, the irs will then send a. Once your business has officially been formed and you’ve obtained a federal tax id number, you can send form 2553 to the irs to. In our guide to s corporation election, you'll learn how and when to. Form 2553 is used by qualifying small business corporations and limited liability companies.

How to Change LLC to S Corp Tax Status tutorial of IRS form 2553 to

Completing irs form 2553 can unlock a myriad of tax advantages. What is irs form 2553? In our guide to s corporation election, you'll learn how and when to. Once your business has officially been formed and you’ve obtained a federal tax id number, you can send form 2553 to the irs to. Upon receipt and review, the irs will.

Which turbotax for s corp culturepilot

Upon receipt and review, the irs will then send a. Irs form 2553 is the tax form you must file if you want to elect s corporation status for your business. What is irs form 2553? Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. In our guide to.

S Corp Tax Return IRS Form 1120S If you want to have a better

Completing irs form 2553 can unlock a myriad of tax advantages. Form 2553 notifies the irs that you want to elect s corp status. Once your business has officially been formed and you’ve obtained a federal tax id number, you can send form 2553 to the irs to. In our guide to s corporation election, you'll learn how and when.

All About Form 1120S for S Corporation Tax Filing

Upon receipt and review, the irs will then send a. Form 2553 notifies the irs that you want to elect s corp status. What is irs form 2553? Once your business has officially been formed and you’ve obtained a federal tax id number, you can send form 2553 to the irs to. Form 2553 is used by qualifying small business.

CAB Resources Partnership Form 1065 and Scorp Form 1120S... Facebook

Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. Upon receipt and review, the irs will then send a. Irs form 2553 is the tax form you must file if you want to elect s corporation status for your business. Completing irs form 2553 can unlock a myriad of.

In Our Guide To S Corporation Election, You'll Learn How And When To.

Irs form 2553 is the tax form you must file if you want to elect s corporation status for your business. Upon receipt and review, the irs will then send a. Form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. Completing irs form 2553 can unlock a myriad of tax advantages.

Form 2553 Notifies The Irs That You Want To Elect S Corp Status.

Once your business has officially been formed and you’ve obtained a federal tax id number, you can send form 2553 to the irs to. What is irs form 2553?