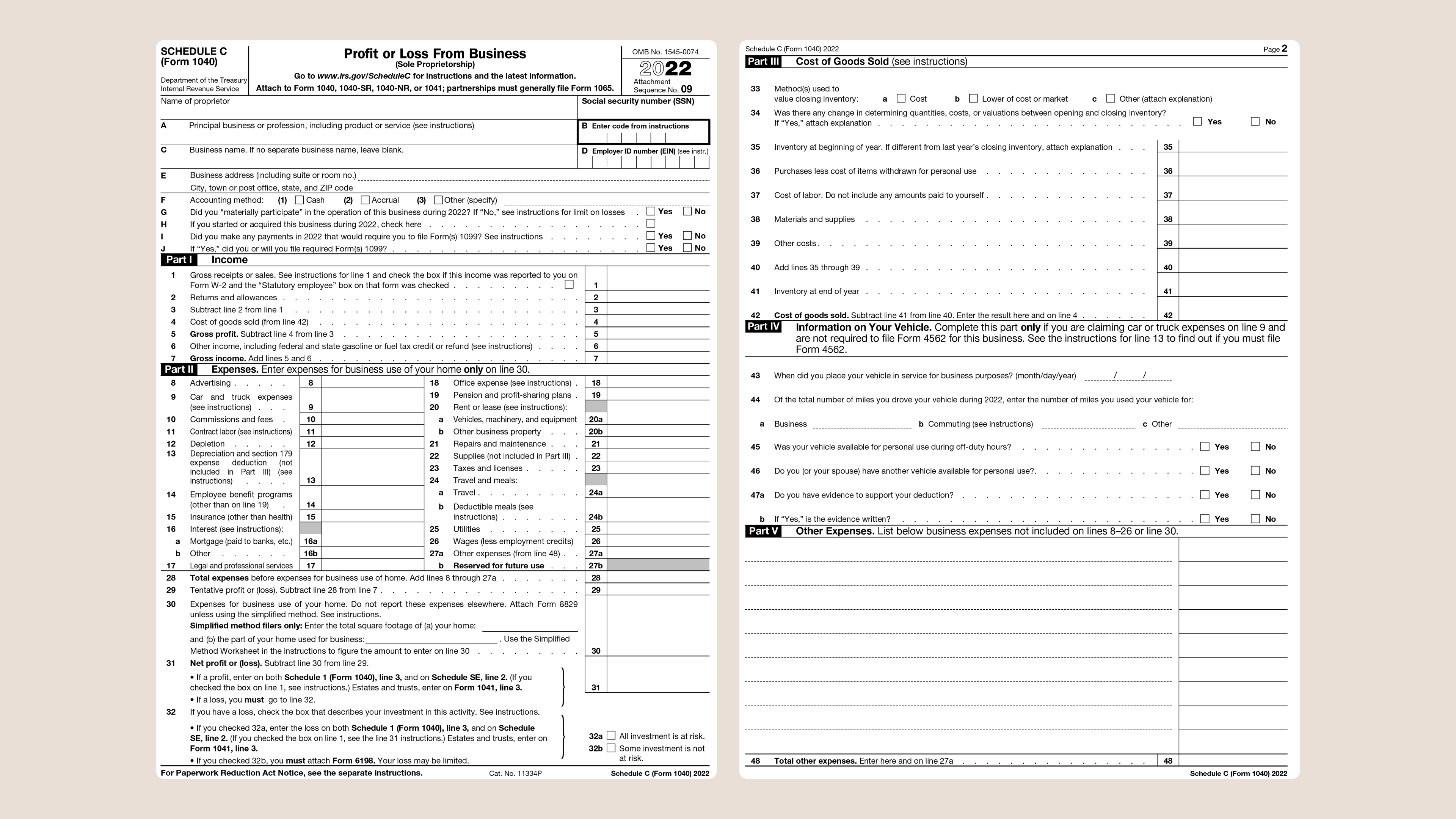

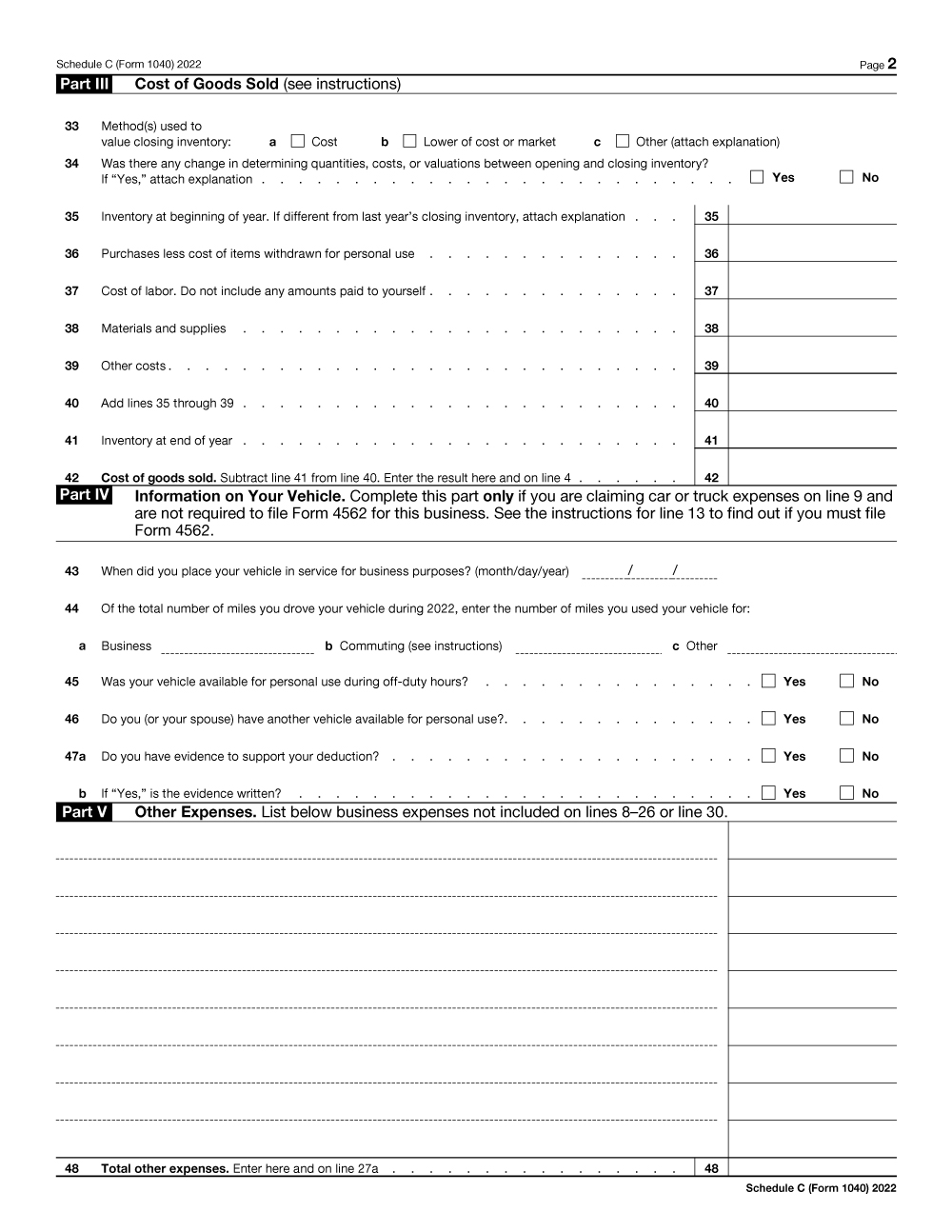

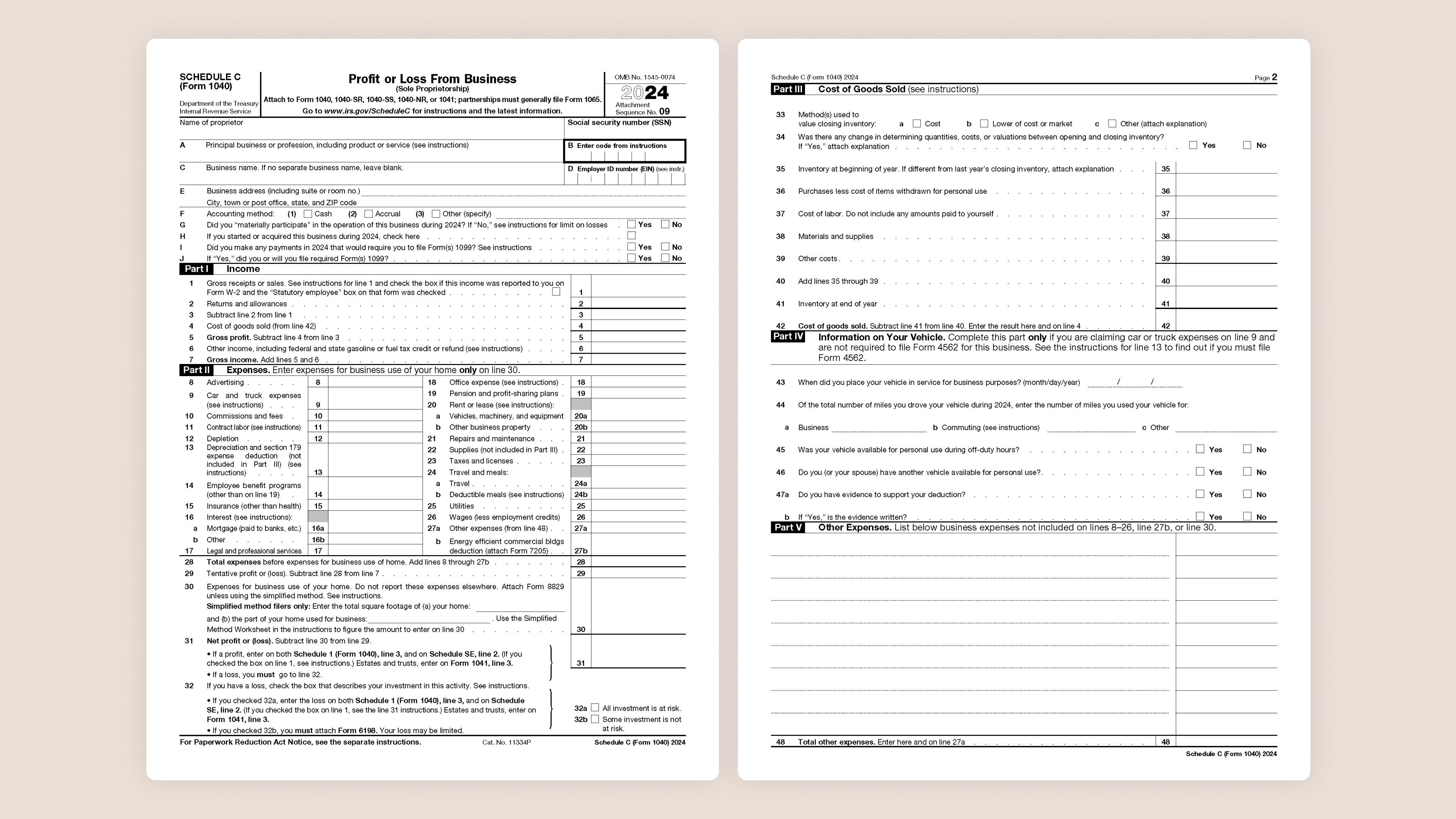

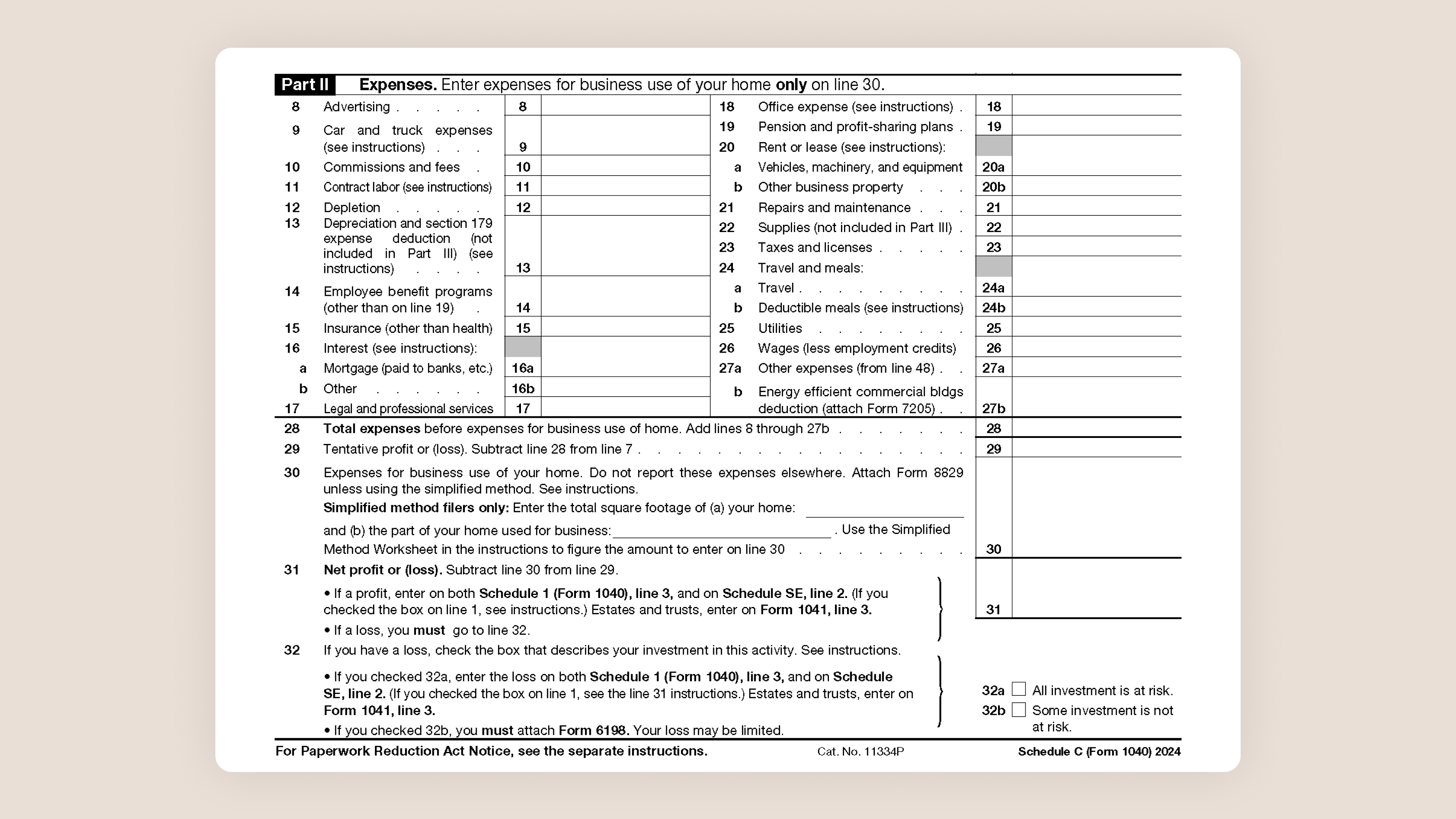

Schedule C Tax Form - See how to fill it out & who needs to file. Irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and expenses for your business. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. (if you checked the box on line 1, see the line 31. You fill out schedule c at tax time and attach it to. Irs schedule c is a tax form for reporting profit or loss from a business.

You fill out schedule c at tax time and attach it to. Irs schedule c is a tax form for reporting profit or loss from a business. (if you checked the box on line 1, see the line 31. See how to fill it out & who needs to file. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and expenses for your business.

(if you checked the box on line 1, see the line 31. Irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and expenses for your business. You fill out schedule c at tax time and attach it to. Irs schedule c is a tax form for reporting profit or loss from a business. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. See how to fill it out & who needs to file.

Schedule C (Form 1040) 2023 Instructions

See how to fill it out & who needs to file. Irs schedule c is a tax form for reporting profit or loss from a business. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Irs schedule c, profit or loss from business, is a tax form.

What is an irs schedule c form Artofit

See how to fill it out & who needs to file. Irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and expenses for your business. Irs schedule c is a tax form for reporting profit or loss from a business. • if you checked 32a, enter the loss.

What is an IRS Schedule C Form? What is 1040 Schedule C? (Everything

Irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and expenses for your business. (if you checked the box on line 1, see the line 31. See how to fill it out & who needs to file. • if you checked 32a, enter the loss on both schedule.

Schedule C Tax Form Printable prntbl.concejomunicipaldechinu.gov.co

• if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. See how to fill it out & who needs to file. Irs schedule c is a tax form for reporting profit or loss from a business. (if you checked the box on line 1, see the line 31..

Understanding the Schedule C Tax Form

See how to fill it out & who needs to file. (if you checked the box on line 1, see the line 31. Irs schedule c is a tax form for reporting profit or loss from a business. You fill out schedule c at tax time and attach it to. Irs schedule c, profit or loss from business, is a.

Schedule C (Form 1040) 2023 Instructions

Irs schedule c is a tax form for reporting profit or loss from a business. You fill out schedule c at tax time and attach it to. Irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and expenses for your business. (if you checked the box on line.

Understanding the Schedule C Tax Form

See how to fill it out & who needs to file. Irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and expenses for your business. (if you checked the box on line 1, see the line 31. You fill out schedule c at tax time and attach it.

Tax Forms Schedule C at Mindy Beaty blog

You fill out schedule c at tax time and attach it to. See how to fill it out & who needs to file. (if you checked the box on line 1, see the line 31. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Irs schedule c,.

Understanding the Schedule C Tax Form

• if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. (if you checked the box on line 1, see the line 31. See how to fill it out & who needs to file. You fill out schedule c at tax time and attach it to. Irs schedule c.

1040 Schedule C 2025 Uma Dawson

(if you checked the box on line 1, see the line 31. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. See how to fill it out & who needs to file. Irs schedule c, profit or loss from business, is a tax form you file with.

Irs Schedule C Is A Tax Form For Reporting Profit Or Loss From A Business.

See how to fill it out & who needs to file. Irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and expenses for your business. (if you checked the box on line 1, see the line 31. You fill out schedule c at tax time and attach it to.

:max_bytes(150000):strip_icc()/ScreenShot2022-12-14at2.10.22PM-ed1958c9bbb642398aec3cacd721b244.png)