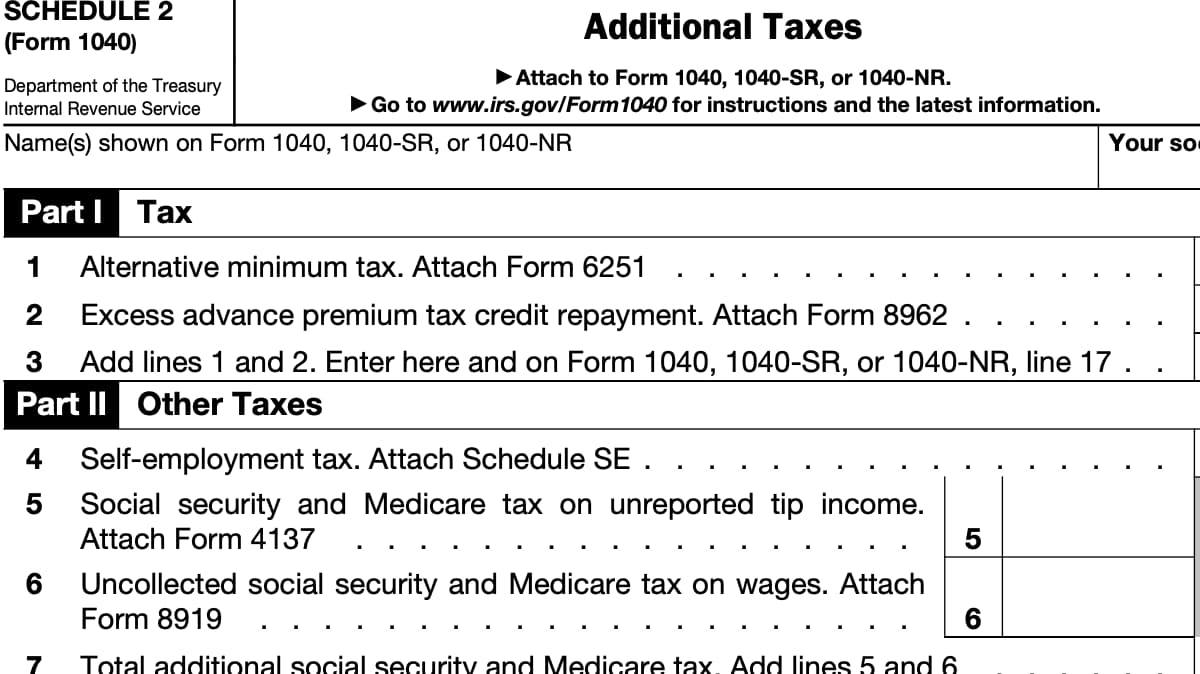

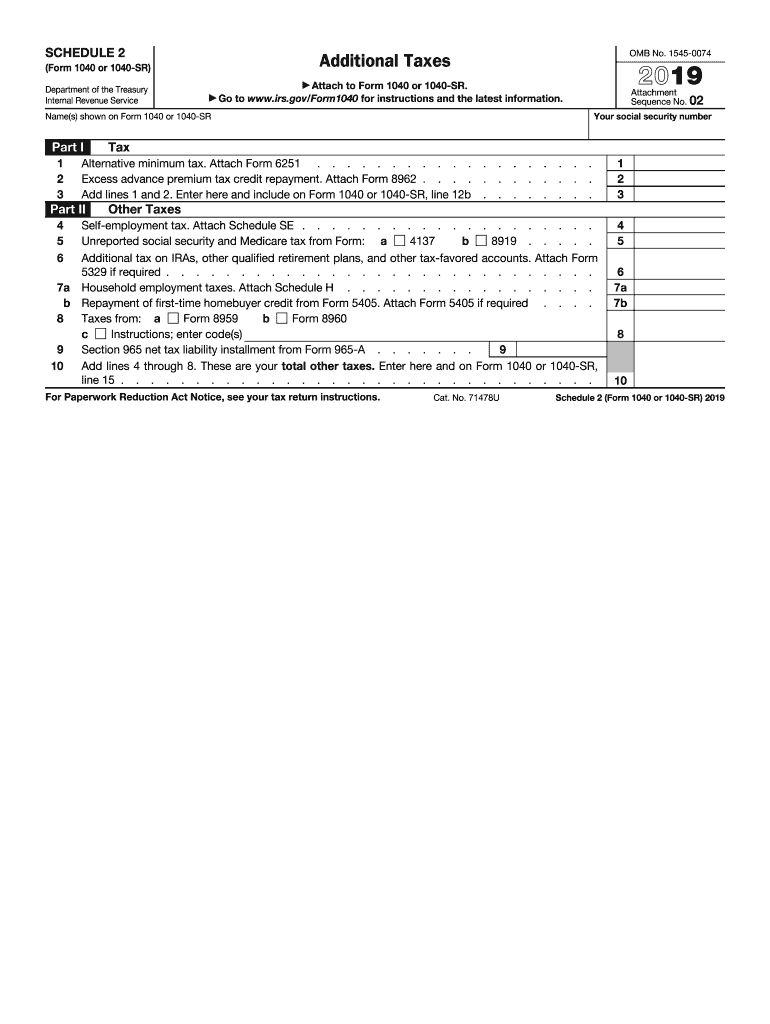

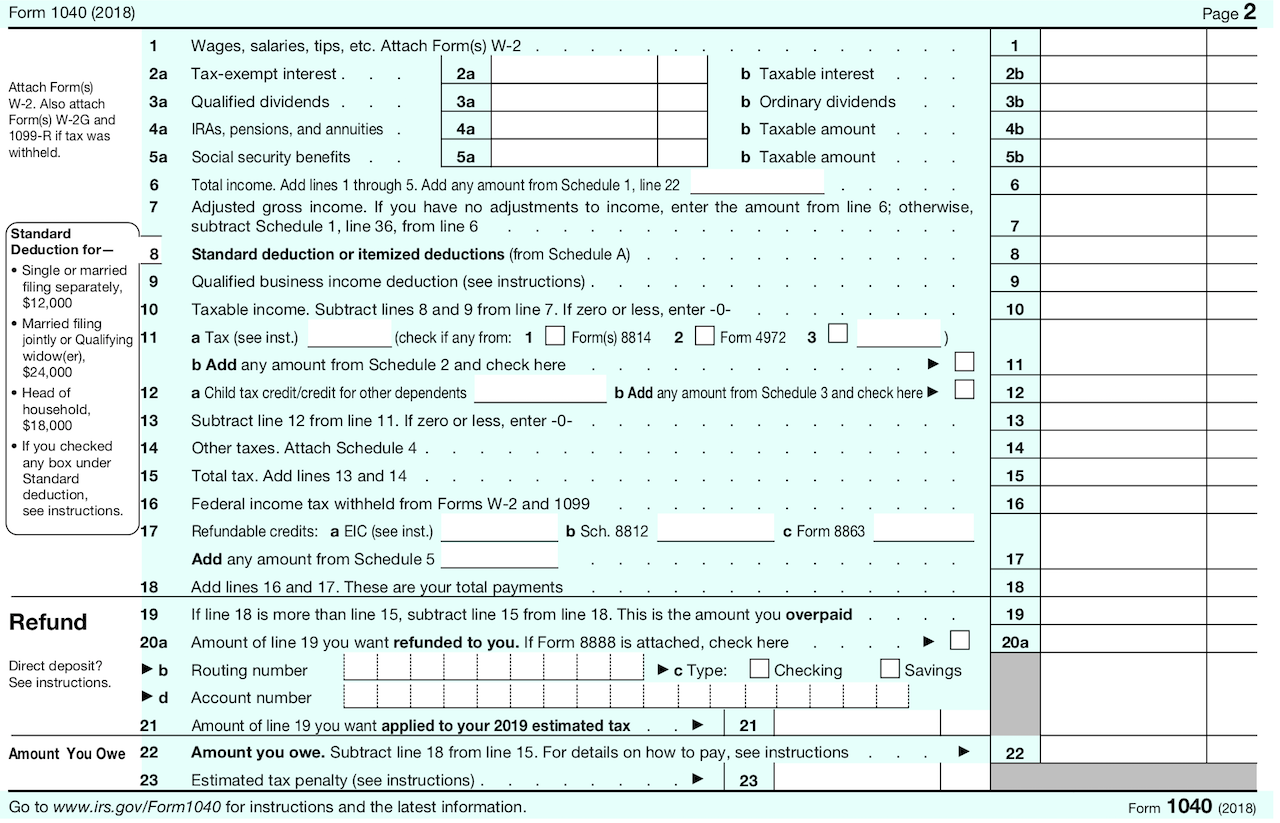

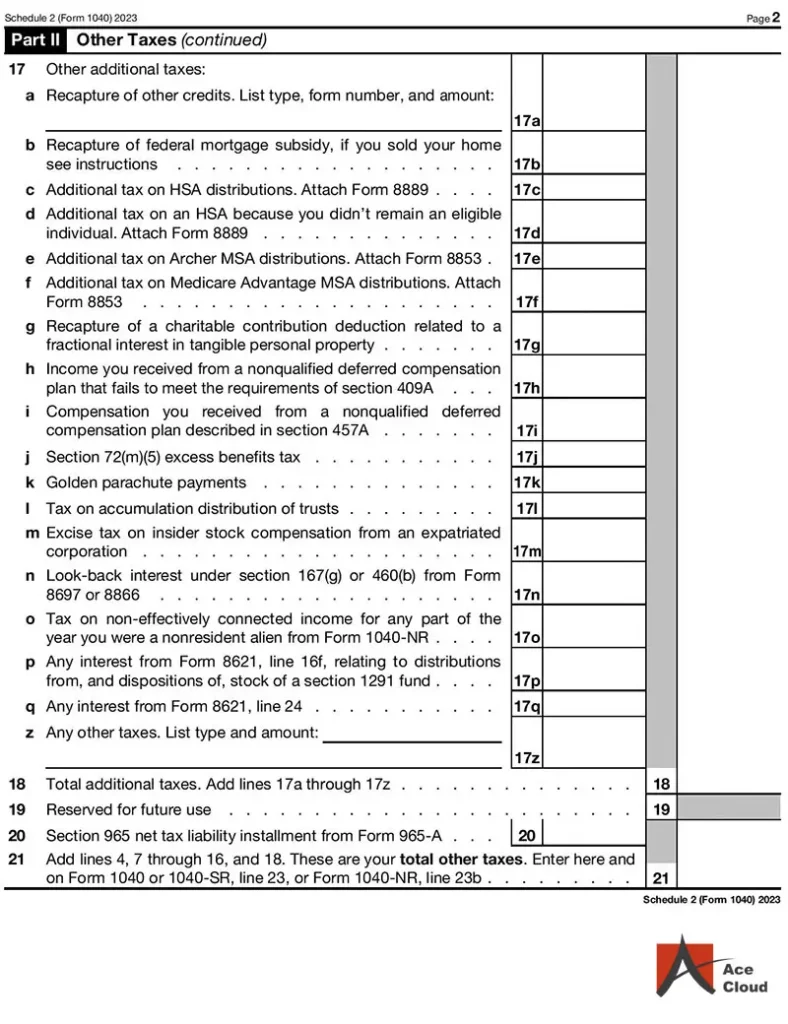

Schedule 2 1040 Form 2024 - Excess advance premium tax credit repayment. Schedule 2 is designed to capture a wide range of additional taxes beyond the standard income tax calculated on form 1040, such as self. Go to www.irs.gov/form1040 for instructions and the latest information. Use part ii of schedule 2 to report the amount you owe for various taxes that aren't reported elsewhere on your form 1040 or other.

Use part ii of schedule 2 to report the amount you owe for various taxes that aren't reported elsewhere on your form 1040 or other. Excess advance premium tax credit repayment. Schedule 2 is designed to capture a wide range of additional taxes beyond the standard income tax calculated on form 1040, such as self. Go to www.irs.gov/form1040 for instructions and the latest information.

Schedule 2 is designed to capture a wide range of additional taxes beyond the standard income tax calculated on form 1040, such as self. Use part ii of schedule 2 to report the amount you owe for various taxes that aren't reported elsewhere on your form 1040 or other. Go to www.irs.gov/form1040 for instructions and the latest information. Excess advance premium tax credit repayment.

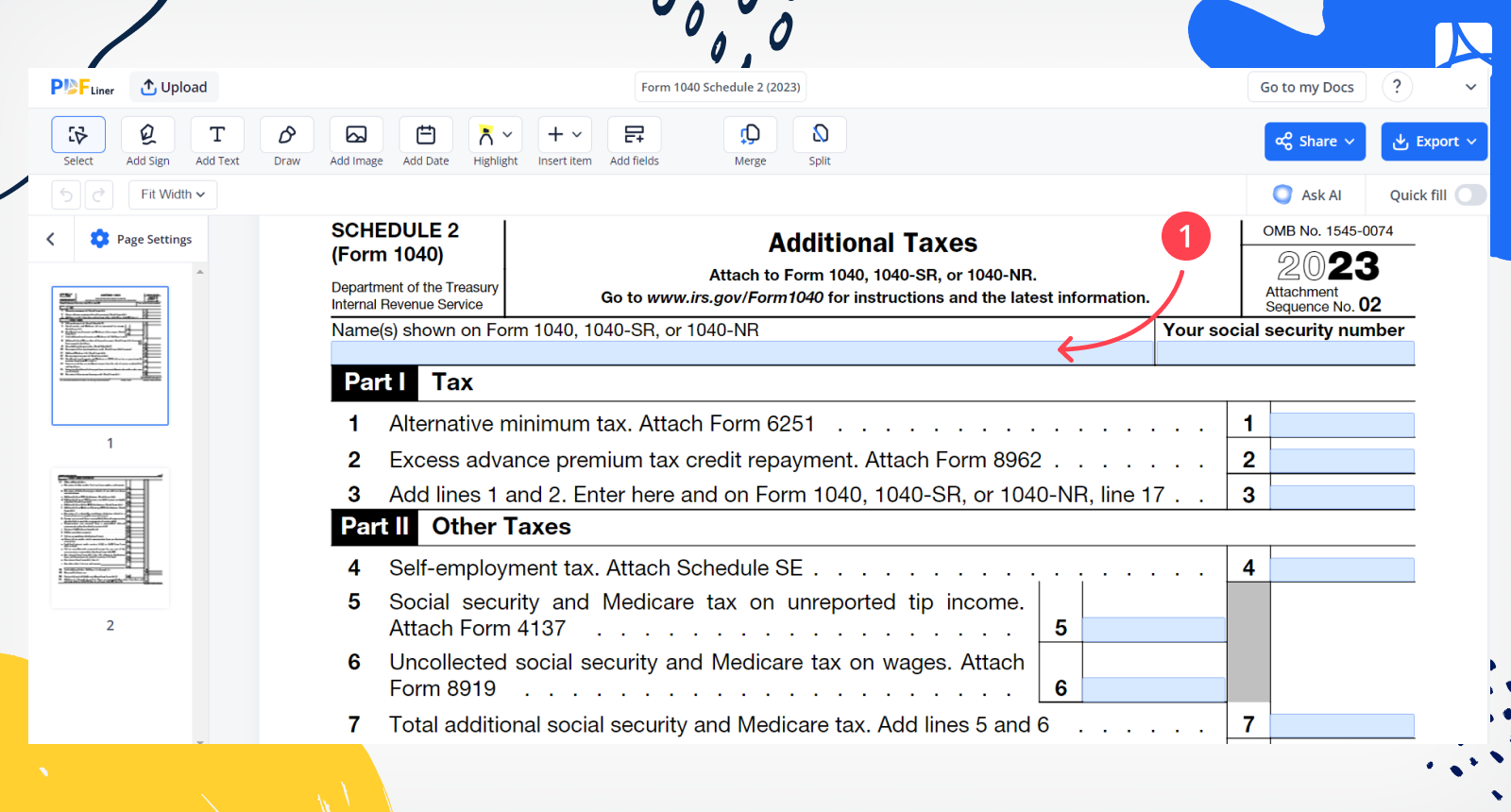

Form 1040 Schedule 2, fill and sign online PDFliner

Go to www.irs.gov/form1040 for instructions and the latest information. Schedule 2 is designed to capture a wide range of additional taxes beyond the standard income tax calculated on form 1040, such as self. Excess advance premium tax credit repayment. Use part ii of schedule 2 to report the amount you owe for various taxes that aren't reported elsewhere on your.

Schedule 2 Line 3 2024 Valma Jacintha

Excess advance premium tax credit repayment. Go to www.irs.gov/form1040 for instructions and the latest information. Use part ii of schedule 2 to report the amount you owe for various taxes that aren't reported elsewhere on your form 1040 or other. Schedule 2 is designed to capture a wide range of additional taxes beyond the standard income tax calculated on form.

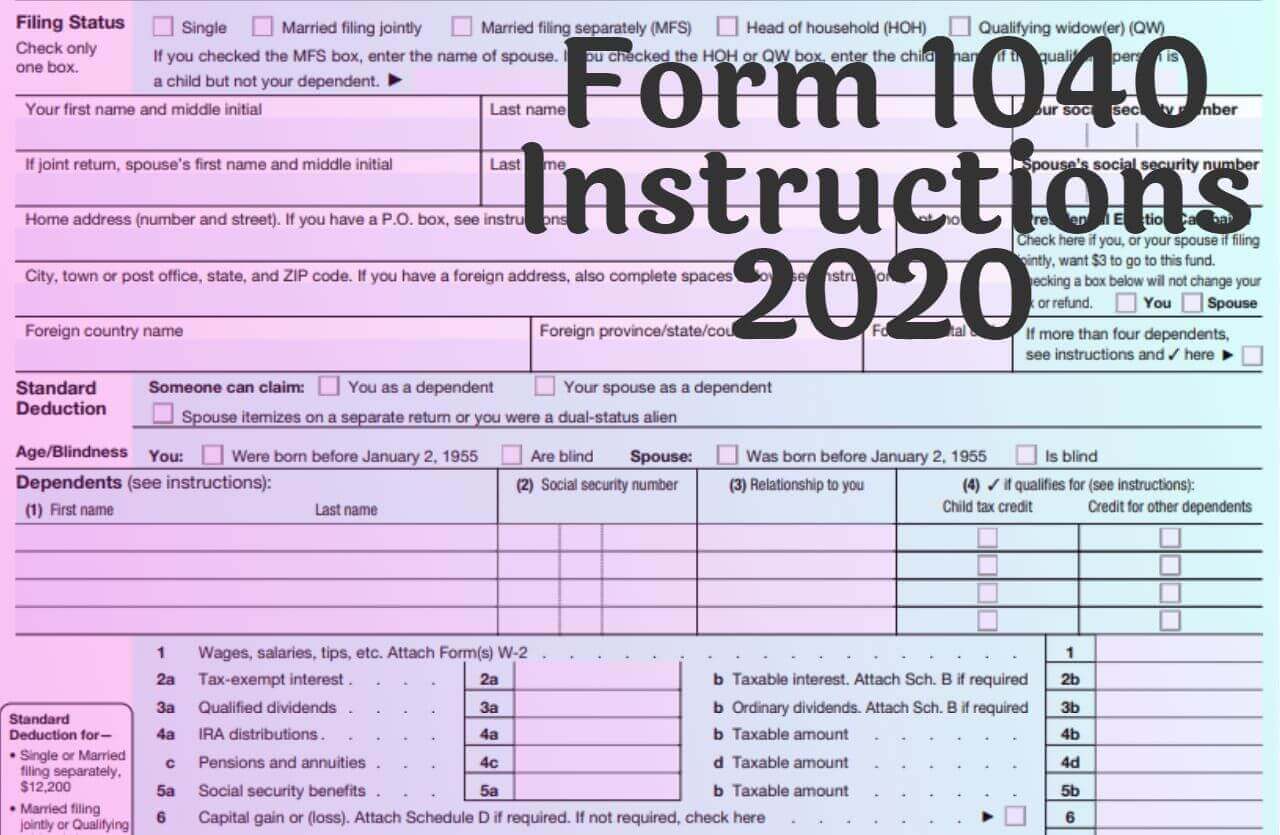

2024 2024 Tax Forms And Instructions Calli Coretta

Schedule 2 is designed to capture a wide range of additional taxes beyond the standard income tax calculated on form 1040, such as self. Use part ii of schedule 2 to report the amount you owe for various taxes that aren't reported elsewhere on your form 1040 or other. Excess advance premium tax credit repayment. Go to www.irs.gov/form1040 for instructions.

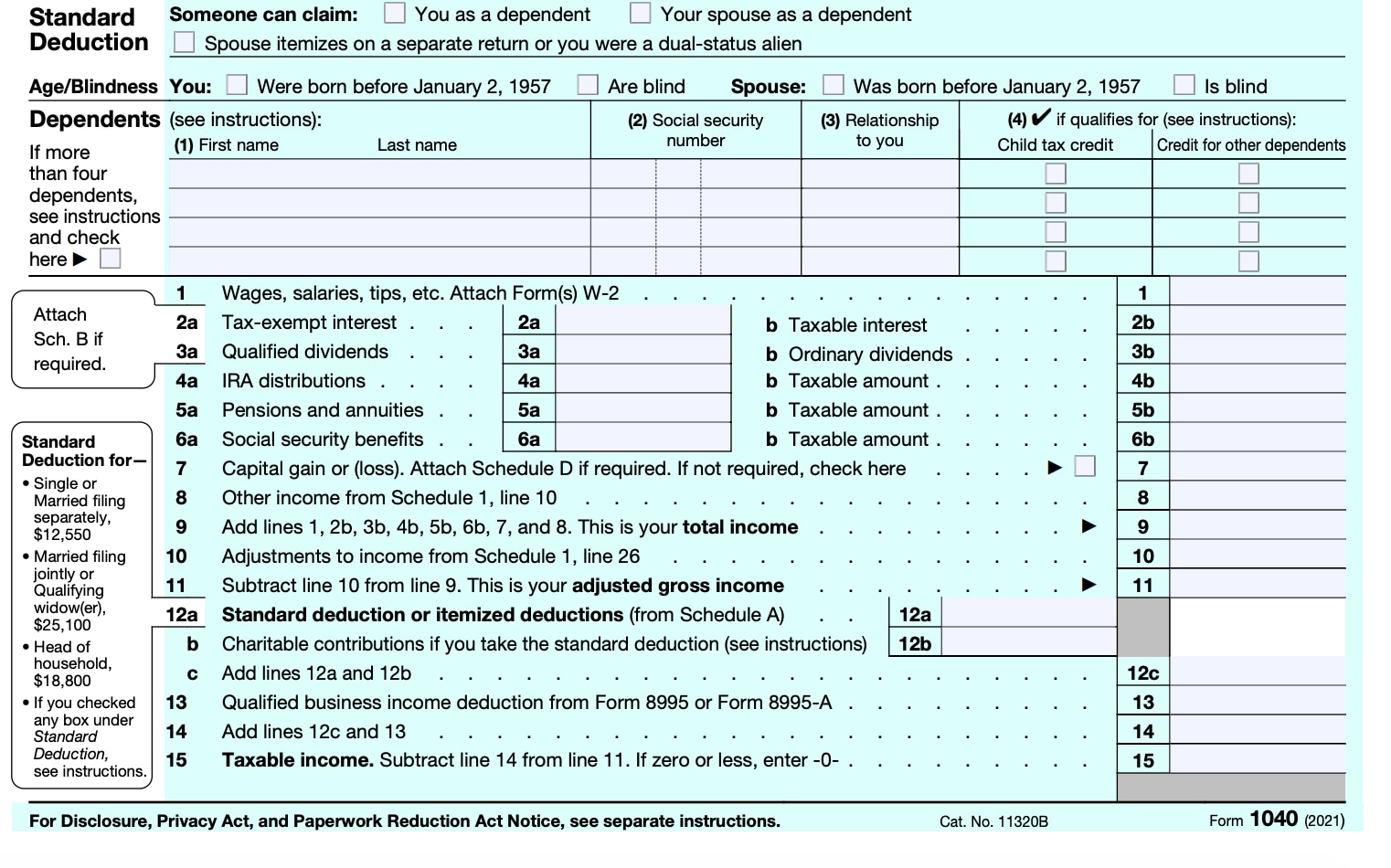

2024 Form 1040 Schedule Exam molli hyacinthe

Excess advance premium tax credit repayment. Use part ii of schedule 2 to report the amount you owe for various taxes that aren't reported elsewhere on your form 1040 or other. Schedule 2 is designed to capture a wide range of additional taxes beyond the standard income tax calculated on form 1040, such as self. Go to www.irs.gov/form1040 for instructions.

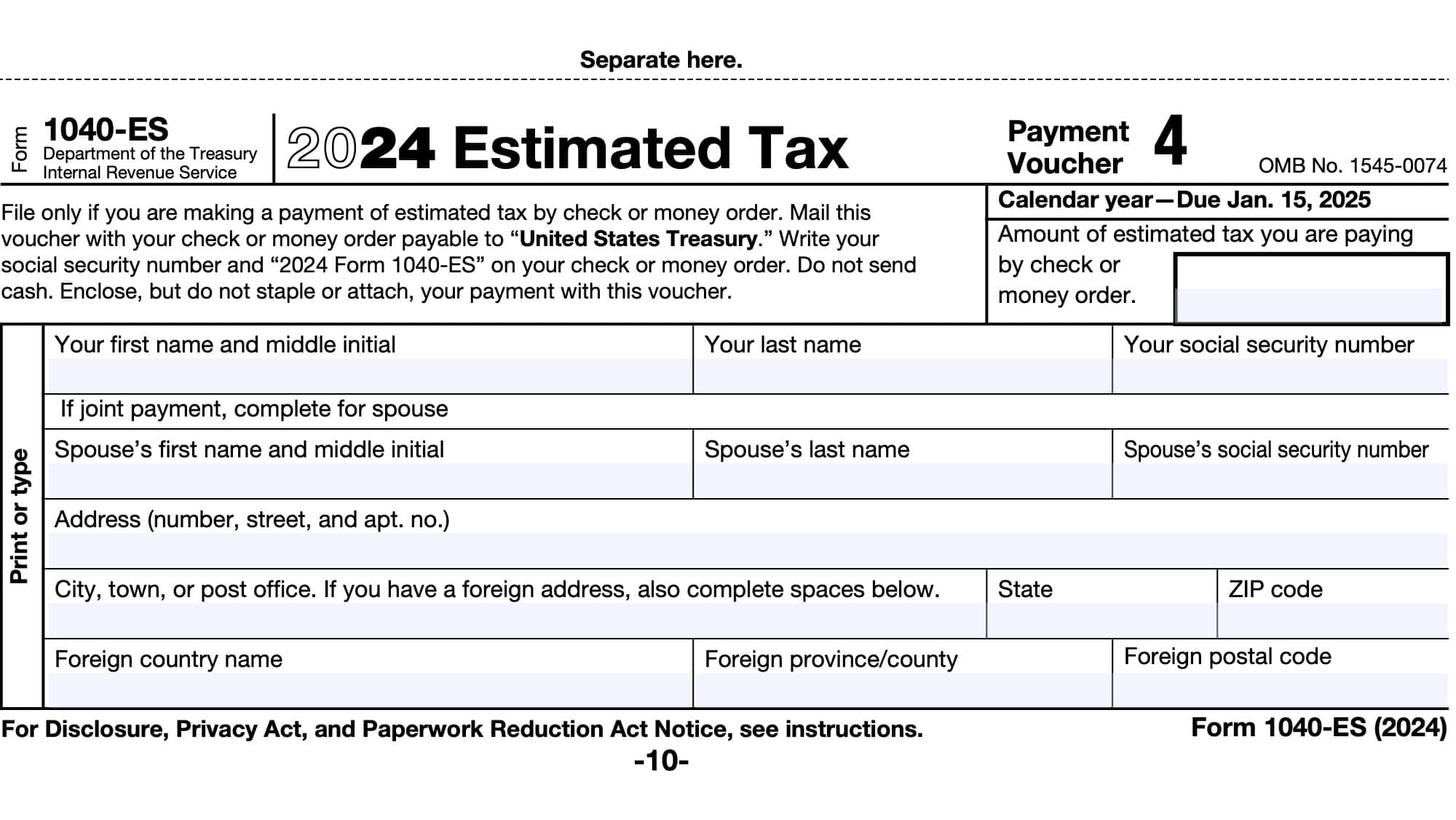

Irs 2024 Quarterly Estimated Tax Forms Benita Trixie

Excess advance premium tax credit repayment. Use part ii of schedule 2 to report the amount you owe for various taxes that aren't reported elsewhere on your form 1040 or other. Go to www.irs.gov/form1040 for instructions and the latest information. Schedule 2 is designed to capture a wide range of additional taxes beyond the standard income tax calculated on form.

2024 Form 1040 Schedule 2 Tax Return Jaime Lillian

Excess advance premium tax credit repayment. Go to www.irs.gov/form1040 for instructions and the latest information. Schedule 2 is designed to capture a wide range of additional taxes beyond the standard income tax calculated on form 1040, such as self. Use part ii of schedule 2 to report the amount you owe for various taxes that aren't reported elsewhere on your.

2024 IRS Tax Forms LawInfoPedia

Schedule 2 is designed to capture a wide range of additional taxes beyond the standard income tax calculated on form 1040, such as self. Excess advance premium tax credit repayment. Go to www.irs.gov/form1040 for instructions and the latest information. Use part ii of schedule 2 to report the amount you owe for various taxes that aren't reported elsewhere on your.

Tax 1040 Form 2024 Dotty Gillian

Use part ii of schedule 2 to report the amount you owe for various taxes that aren't reported elsewhere on your form 1040 or other. Go to www.irs.gov/form1040 for instructions and the latest information. Excess advance premium tax credit repayment. Schedule 2 is designed to capture a wide range of additional taxes beyond the standard income tax calculated on form.

What is IRS Form 1040 Schedule 2 and How to Fill it Correctly

Schedule 2 is designed to capture a wide range of additional taxes beyond the standard income tax calculated on form 1040, such as self. Excess advance premium tax credit repayment. Use part ii of schedule 2 to report the amount you owe for various taxes that aren't reported elsewhere on your form 1040 or other. Go to www.irs.gov/form1040 for instructions.

Irs 1040 2024 Schedule 2 Schedule C 2024

Use part ii of schedule 2 to report the amount you owe for various taxes that aren't reported elsewhere on your form 1040 or other. Go to www.irs.gov/form1040 for instructions and the latest information. Schedule 2 is designed to capture a wide range of additional taxes beyond the standard income tax calculated on form 1040, such as self. Excess advance.

Use Part Ii Of Schedule 2 To Report The Amount You Owe For Various Taxes That Aren't Reported Elsewhere On Your Form 1040 Or Other.

Excess advance premium tax credit repayment. Go to www.irs.gov/form1040 for instructions and the latest information. Schedule 2 is designed to capture a wide range of additional taxes beyond the standard income tax calculated on form 1040, such as self.