Reo Form For Heloc - Real estate owned properties, or reo properties, are houses that have been seized by banks or other lenders from people who are. What is real estate owned (reo)? Foreclosed or reo (real estate owned) properties are typically priced below their actual market value and offer great incentive for homebuyers. Discover reo real estate—what it means, how it works for investors, plus the pros, risks, and where to find the best listings.

What is real estate owned (reo)? Discover reo real estate—what it means, how it works for investors, plus the pros, risks, and where to find the best listings. Real estate owned properties, or reo properties, are houses that have been seized by banks or other lenders from people who are. Foreclosed or reo (real estate owned) properties are typically priced below their actual market value and offer great incentive for homebuyers.

Foreclosed or reo (real estate owned) properties are typically priced below their actual market value and offer great incentive for homebuyers. Discover reo real estate—what it means, how it works for investors, plus the pros, risks, and where to find the best listings. Real estate owned properties, or reo properties, are houses that have been seized by banks or other lenders from people who are. What is real estate owned (reo)?

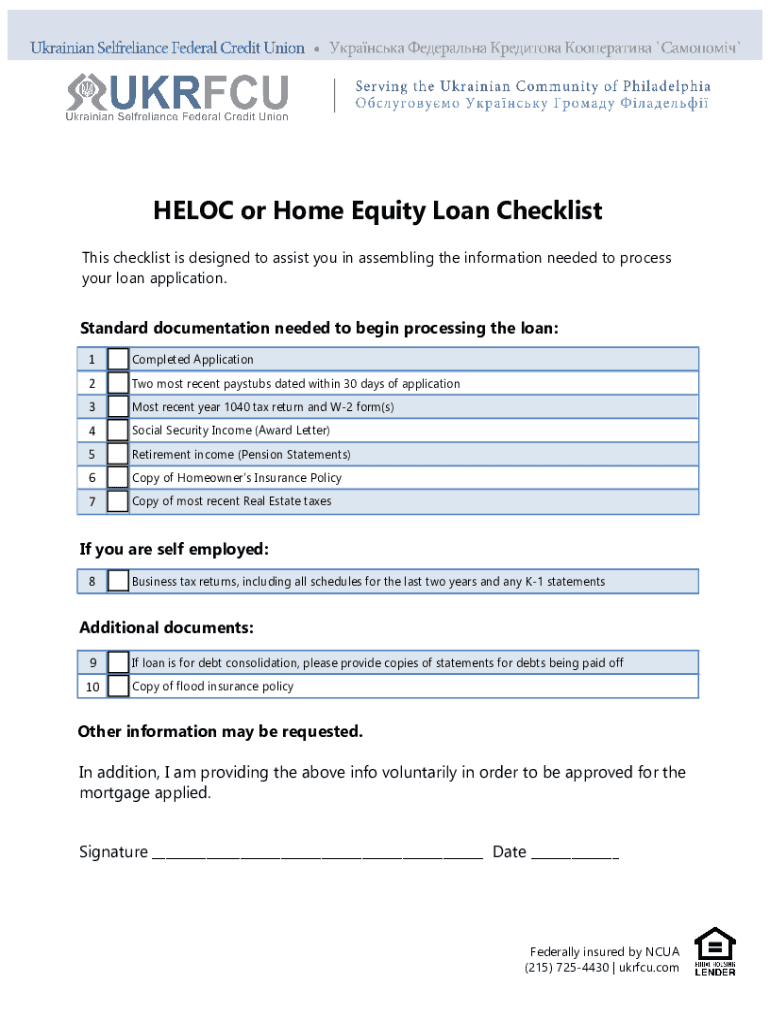

Fillable Online HELOC & Home Equity Loan Application Fax Email Print

Discover reo real estate—what it means, how it works for investors, plus the pros, risks, and where to find the best listings. Foreclosed or reo (real estate owned) properties are typically priced below their actual market value and offer great incentive for homebuyers. Real estate owned properties, or reo properties, are houses that have been seized by banks or other.

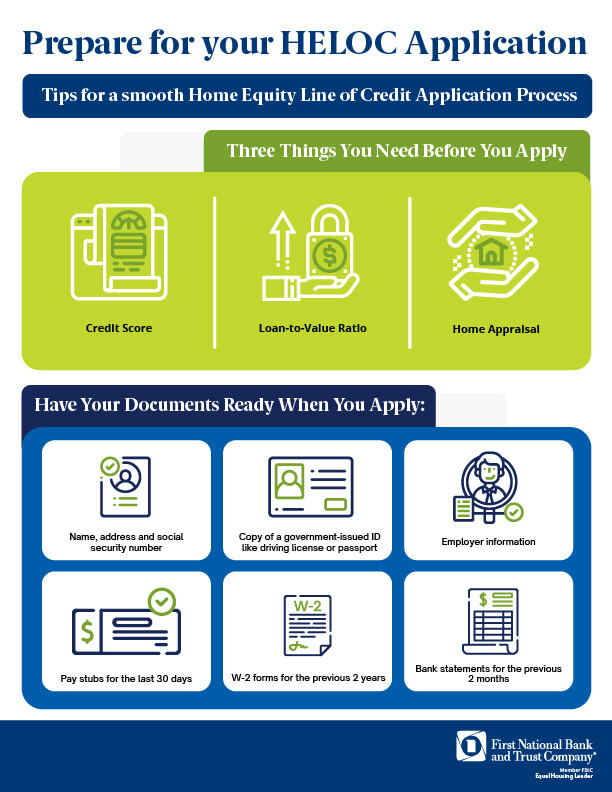

How Long Does It Take To Get A HELOC? FNBT Southern WI & Northern IL

Real estate owned properties, or reo properties, are houses that have been seized by banks or other lenders from people who are. What is real estate owned (reo)? Discover reo real estate—what it means, how it works for investors, plus the pros, risks, and where to find the best listings. Foreclosed or reo (real estate owned) properties are typically priced.

What is A HELOC? Full Form 7 Key Benefits You Must Know

What is real estate owned (reo)? Discover reo real estate—what it means, how it works for investors, plus the pros, risks, and where to find the best listings. Real estate owned properties, or reo properties, are houses that have been seized by banks or other lenders from people who are. Foreclosed or reo (real estate owned) properties are typically priced.

HELOC Do’s and Don’ts A StepbyStep Guide to Home Equity Lines of

Discover reo real estate—what it means, how it works for investors, plus the pros, risks, and where to find the best listings. What is real estate owned (reo)? Real estate owned properties, or reo properties, are houses that have been seized by banks or other lenders from people who are. Foreclosed or reo (real estate owned) properties are typically priced.

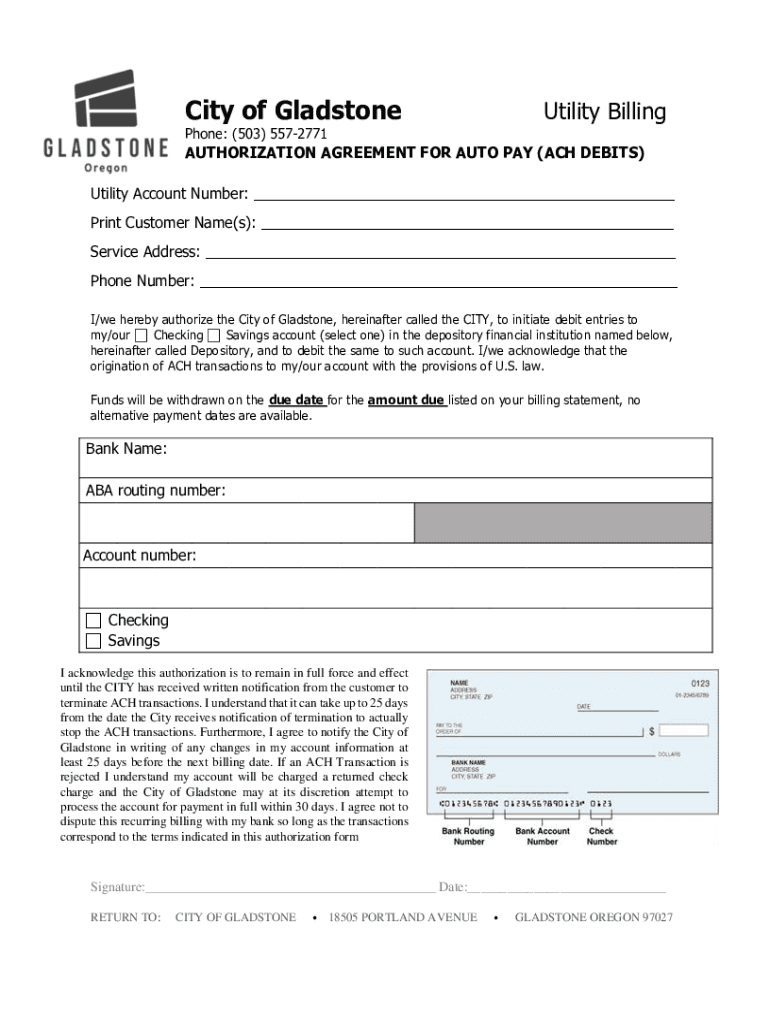

Fillable Online HELOC Automatic Payment (ACH) Authorization Form Fax

Foreclosed or reo (real estate owned) properties are typically priced below their actual market value and offer great incentive for homebuyers. What is real estate owned (reo)? Discover reo real estate—what it means, how it works for investors, plus the pros, risks, and where to find the best listings. Real estate owned properties, or reo properties, are houses that have.

What Is a HELOC Promissory Note?

Real estate owned properties, or reo properties, are houses that have been seized by banks or other lenders from people who are. Foreclosed or reo (real estate owned) properties are typically priced below their actual market value and offer great incentive for homebuyers. Discover reo real estate—what it means, how it works for investors, plus the pros, risks, and where.

What Is A HELOC? Fixr

Discover reo real estate—what it means, how it works for investors, plus the pros, risks, and where to find the best listings. Foreclosed or reo (real estate owned) properties are typically priced below their actual market value and offer great incentive for homebuyers. Real estate owned properties, or reo properties, are houses that have been seized by banks or other.

Loan Signing Agent HELOC Practice Loan Documents HELOC Documents Mobile

Foreclosed or reo (real estate owned) properties are typically priced below their actual market value and offer great incentive for homebuyers. Real estate owned properties, or reo properties, are houses that have been seized by banks or other lenders from people who are. Discover reo real estate—what it means, how it works for investors, plus the pros, risks, and where.

Reo form Fill out & sign online DocHub

Foreclosed or reo (real estate owned) properties are typically priced below their actual market value and offer great incentive for homebuyers. What is real estate owned (reo)? Real estate owned properties, or reo properties, are houses that have been seized by banks or other lenders from people who are. Discover reo real estate—what it means, how it works for investors,.

HELOC vs. Home Equity Loan Fifth Third Bank

Foreclosed or reo (real estate owned) properties are typically priced below their actual market value and offer great incentive for homebuyers. Real estate owned properties, or reo properties, are houses that have been seized by banks or other lenders from people who are. Discover reo real estate—what it means, how it works for investors, plus the pros, risks, and where.

Real Estate Owned Properties, Or Reo Properties, Are Houses That Have Been Seized By Banks Or Other Lenders From People Who Are.

What is real estate owned (reo)? Foreclosed or reo (real estate owned) properties are typically priced below their actual market value and offer great incentive for homebuyers. Discover reo real estate—what it means, how it works for investors, plus the pros, risks, and where to find the best listings.