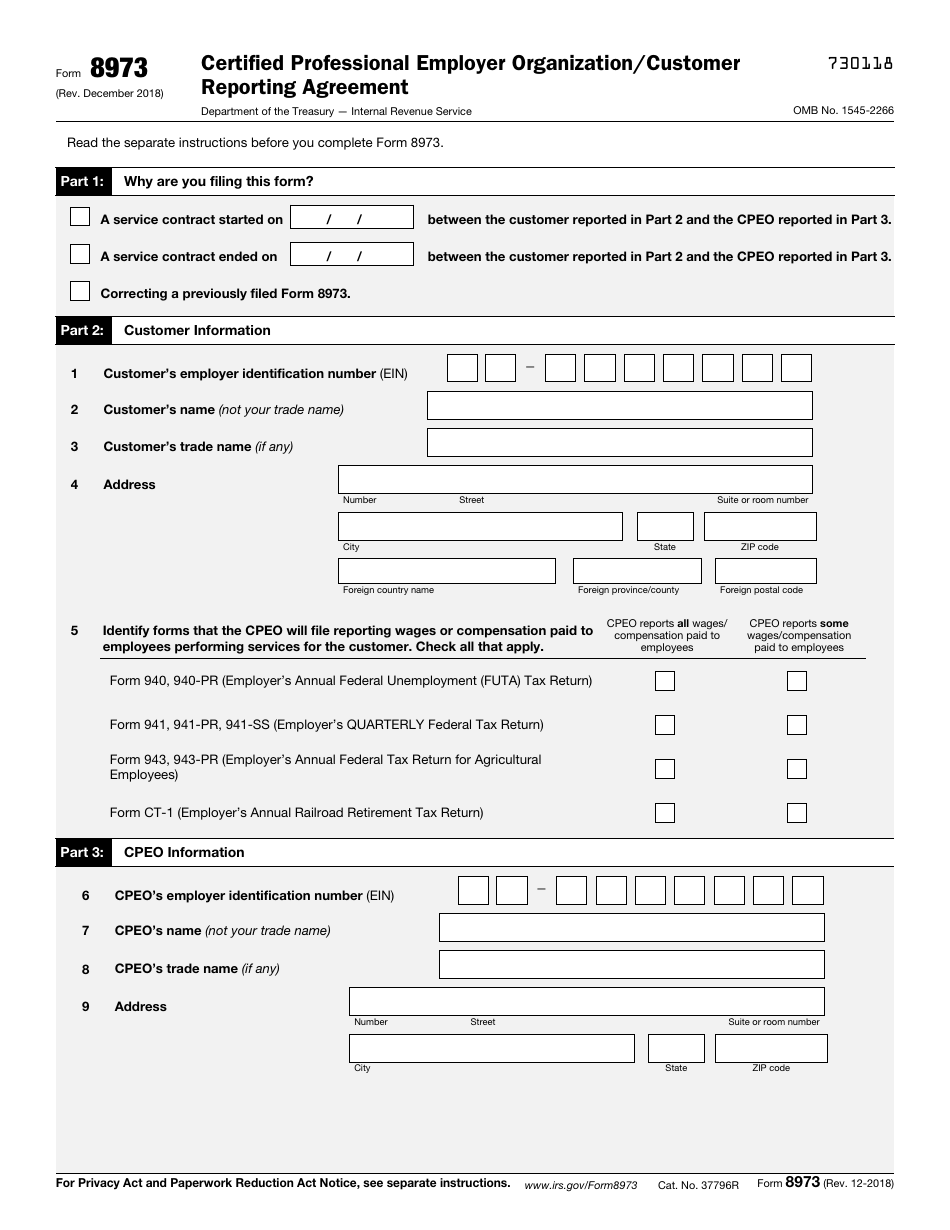

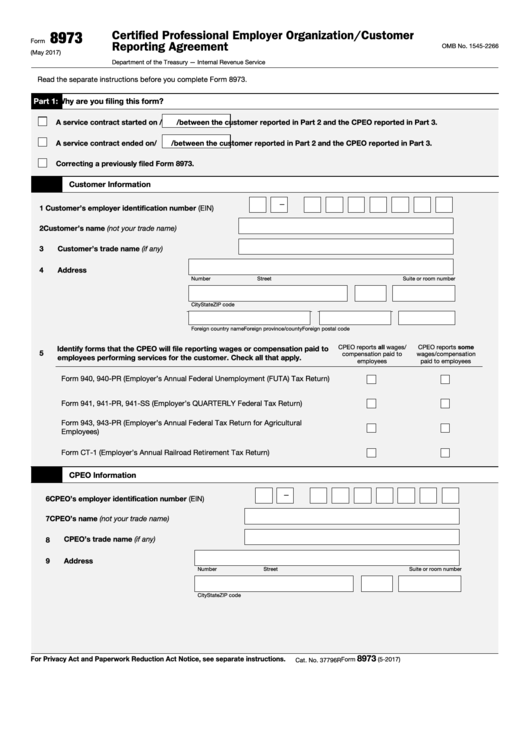

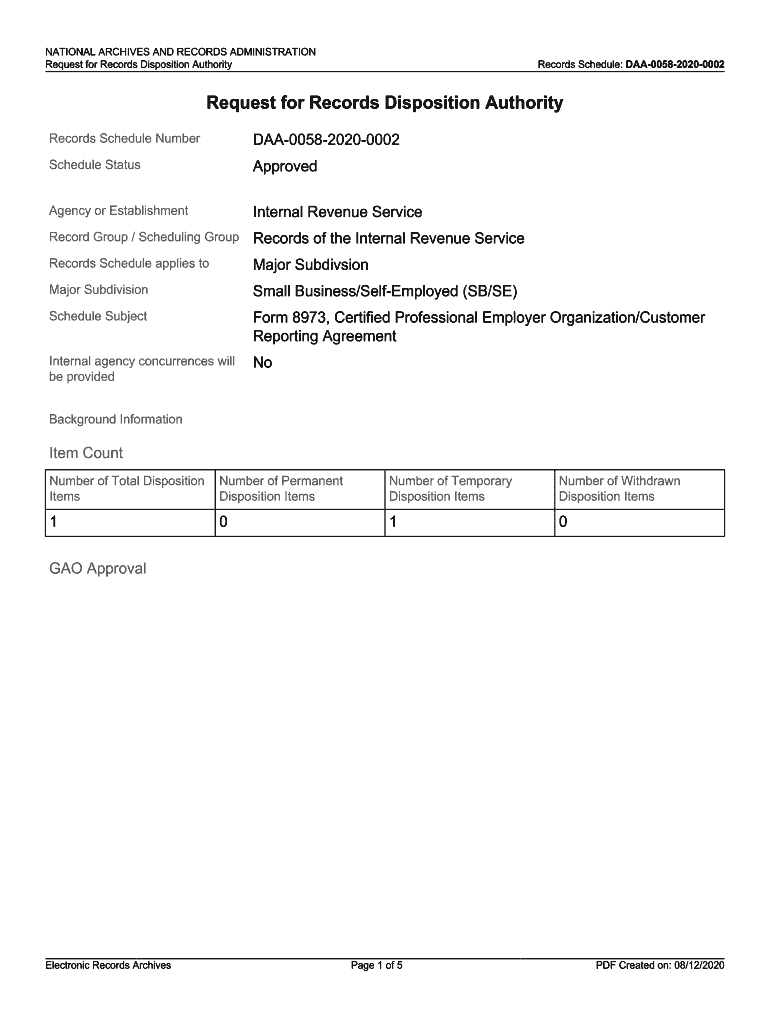

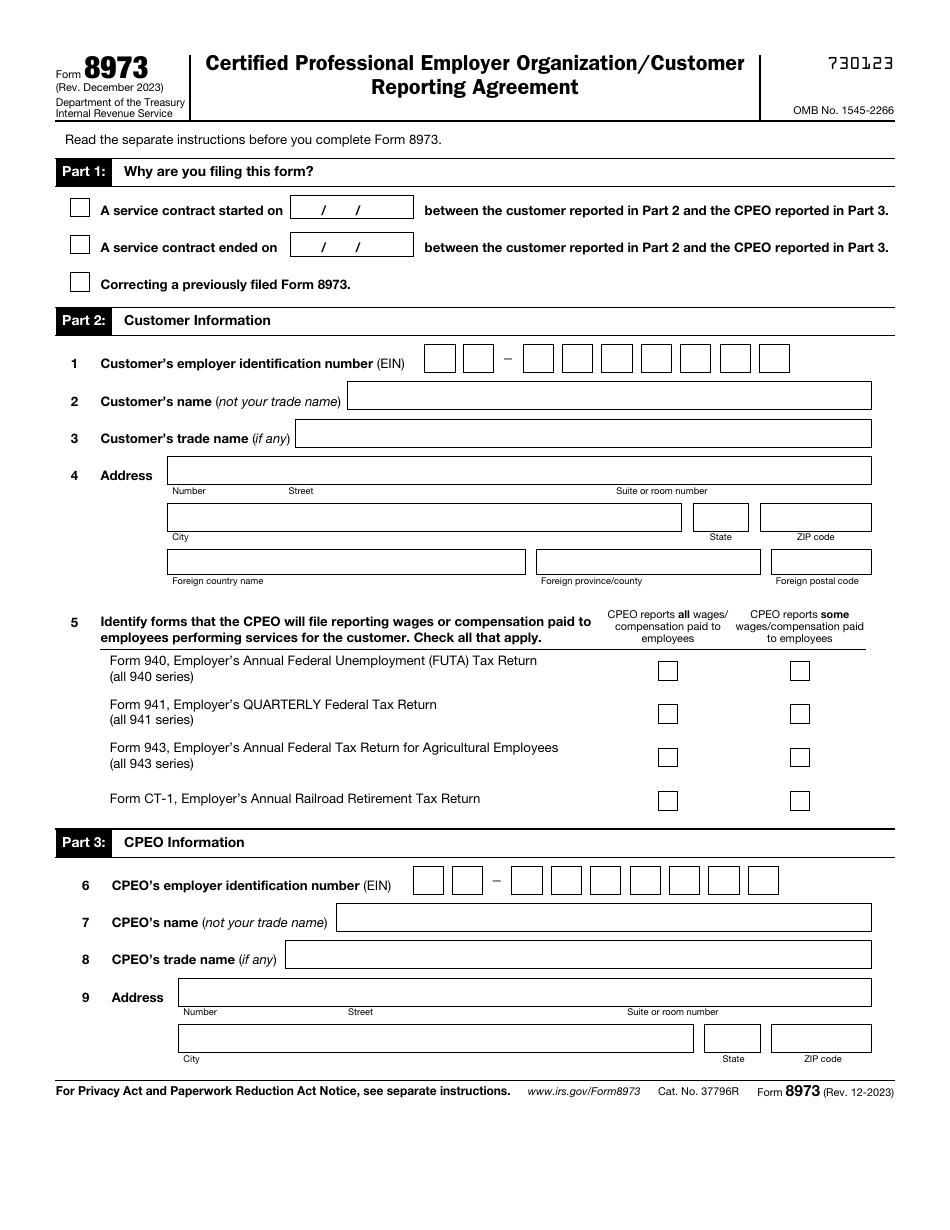

Form 8973 - Certified professional employer organizations (cpeos) use form 8973 to notify the irs that a service contract between a cpeo and a customer. In addition, though not required, the customer may also. The cpeo is required to file form 8973 to notify the irs that a service contract has ended. To maintain certification, a certified professional employer organization (cpeo) must complete this consent to disclose tax information to the. Information about form 8973, certified professional employer organization/customer reporting agreement, including recent updates,. If the cpeo does not file a combined form 8973 reporting both the start and the end of a service contract, the cpeo must timely file two separate.

Information about form 8973, certified professional employer organization/customer reporting agreement, including recent updates,. The cpeo is required to file form 8973 to notify the irs that a service contract has ended. Certified professional employer organizations (cpeos) use form 8973 to notify the irs that a service contract between a cpeo and a customer. If the cpeo does not file a combined form 8973 reporting both the start and the end of a service contract, the cpeo must timely file two separate. To maintain certification, a certified professional employer organization (cpeo) must complete this consent to disclose tax information to the. In addition, though not required, the customer may also.

In addition, though not required, the customer may also. The cpeo is required to file form 8973 to notify the irs that a service contract has ended. If the cpeo does not file a combined form 8973 reporting both the start and the end of a service contract, the cpeo must timely file two separate. To maintain certification, a certified professional employer organization (cpeo) must complete this consent to disclose tax information to the. Information about form 8973, certified professional employer organization/customer reporting agreement, including recent updates,. Certified professional employer organizations (cpeos) use form 8973 to notify the irs that a service contract between a cpeo and a customer.

Download Instructions for IRS Form 8973 Certified Professional Employer

Information about form 8973, certified professional employer organization/customer reporting agreement, including recent updates,. Certified professional employer organizations (cpeos) use form 8973 to notify the irs that a service contract between a cpeo and a customer. The cpeo is required to file form 8973 to notify the irs that a service contract has ended. To maintain certification, a certified professional employer.

Oakland County, Michigan Professional Standards Review Organization

To maintain certification, a certified professional employer organization (cpeo) must complete this consent to disclose tax information to the. If the cpeo does not file a combined form 8973 reporting both the start and the end of a service contract, the cpeo must timely file two separate. Information about form 8973, certified professional employer organization/customer reporting agreement, including recent updates,..

NOTICENINJA PrismHR

In addition, though not required, the customer may also. The cpeo is required to file form 8973 to notify the irs that a service contract has ended. To maintain certification, a certified professional employer organization (cpeo) must complete this consent to disclose tax information to the. Information about form 8973, certified professional employer organization/customer reporting agreement, including recent updates,. Certified.

IRS Form 8973 Fill Out, Sign Online and Download Fillable PDF

If the cpeo does not file a combined form 8973 reporting both the start and the end of a service contract, the cpeo must timely file two separate. Certified professional employer organizations (cpeos) use form 8973 to notify the irs that a service contract between a cpeo and a customer. Information about form 8973, certified professional employer organization/customer reporting agreement,.

Navigating Form 8973 Certified Professional Employer Organization

To maintain certification, a certified professional employer organization (cpeo) must complete this consent to disclose tax information to the. If the cpeo does not file a combined form 8973 reporting both the start and the end of a service contract, the cpeo must timely file two separate. Information about form 8973, certified professional employer organization/customer reporting agreement, including recent updates,..

Navigating Form 8973 Certified Professional Employer Organization

Certified professional employer organizations (cpeos) use form 8973 to notify the irs that a service contract between a cpeo and a customer. To maintain certification, a certified professional employer organization (cpeo) must complete this consent to disclose tax information to the. The cpeo is required to file form 8973 to notify the irs that a service contract has ended. If.

IRS Form 8973 Fill Out, Sign Online and Download Fillable PDF

If the cpeo does not file a combined form 8973 reporting both the start and the end of a service contract, the cpeo must timely file two separate. In addition, though not required, the customer may also. Certified professional employer organizations (cpeos) use form 8973 to notify the irs that a service contract between a cpeo and a customer. To.

Certified Professional Employer Organization Customer Reporting

The cpeo is required to file form 8973 to notify the irs that a service contract has ended. To maintain certification, a certified professional employer organization (cpeo) must complete this consent to disclose tax information to the. If the cpeo does not file a combined form 8973 reporting both the start and the end of a service contract, the cpeo.

napeo2024 noticeninja form8973 orlandoevents

Certified professional employer organizations (cpeos) use form 8973 to notify the irs that a service contract between a cpeo and a customer. If the cpeo does not file a combined form 8973 reporting both the start and the end of a service contract, the cpeo must timely file two separate. In addition, though not required, the customer may also. Information.

Fillable Online Form 8973, Certified Professional Employer Organization

If the cpeo does not file a combined form 8973 reporting both the start and the end of a service contract, the cpeo must timely file two separate. To maintain certification, a certified professional employer organization (cpeo) must complete this consent to disclose tax information to the. Information about form 8973, certified professional employer organization/customer reporting agreement, including recent updates,..

To Maintain Certification, A Certified Professional Employer Organization (Cpeo) Must Complete This Consent To Disclose Tax Information To The.

Information about form 8973, certified professional employer organization/customer reporting agreement, including recent updates,. In addition, though not required, the customer may also. The cpeo is required to file form 8973 to notify the irs that a service contract has ended. If the cpeo does not file a combined form 8973 reporting both the start and the end of a service contract, the cpeo must timely file two separate.

.png?width=1500&name=Amanda Reineke CEO Co-founder (53).png)