Form 8895 - Are these numbers supposed to match? The qbid can can be generated by schedule c, schedule e, schedule f. I don't run a business! Irs form 8995 is used to report the qualified business income deduction. The form 8995 is used to figure your qualified business income (qbi) deduction. Form 8995 line 3 shows a loss carryforward from prior years resulting from schedule c losses. The same form show a loss. Why is my qualified business income on schedule c (line 31) different on form 8895? If you have a business (1099 income), or an amount in. Why did turbotax desktop premier generate form 8895?

Are these numbers supposed to match? Irs form 8995 is used to report the qualified business income deduction. I don't run a business! The form 8995 is used to figure your qualified business income (qbi) deduction. The same form show a loss. Form 8995 line 3 shows a loss carryforward from prior years resulting from schedule c losses. Why is my qualified business income on schedule c (line 31) different on form 8895? Why did turbotax desktop premier generate form 8895? The qbid can can be generated by schedule c, schedule e, schedule f. If you have a business (1099 income), or an amount in.

Irs form 8995 is used to report the qualified business income deduction. The qbid can can be generated by schedule c, schedule e, schedule f. The form 8995 is used to figure your qualified business income (qbi) deduction. Why is my qualified business income on schedule c (line 31) different on form 8895? Form 8995 line 3 shows a loss carryforward from prior years resulting from schedule c losses. Are these numbers supposed to match? If you have a business (1099 income), or an amount in. Why did turbotax desktop premier generate form 8895? The same form show a loss. I don't run a business!

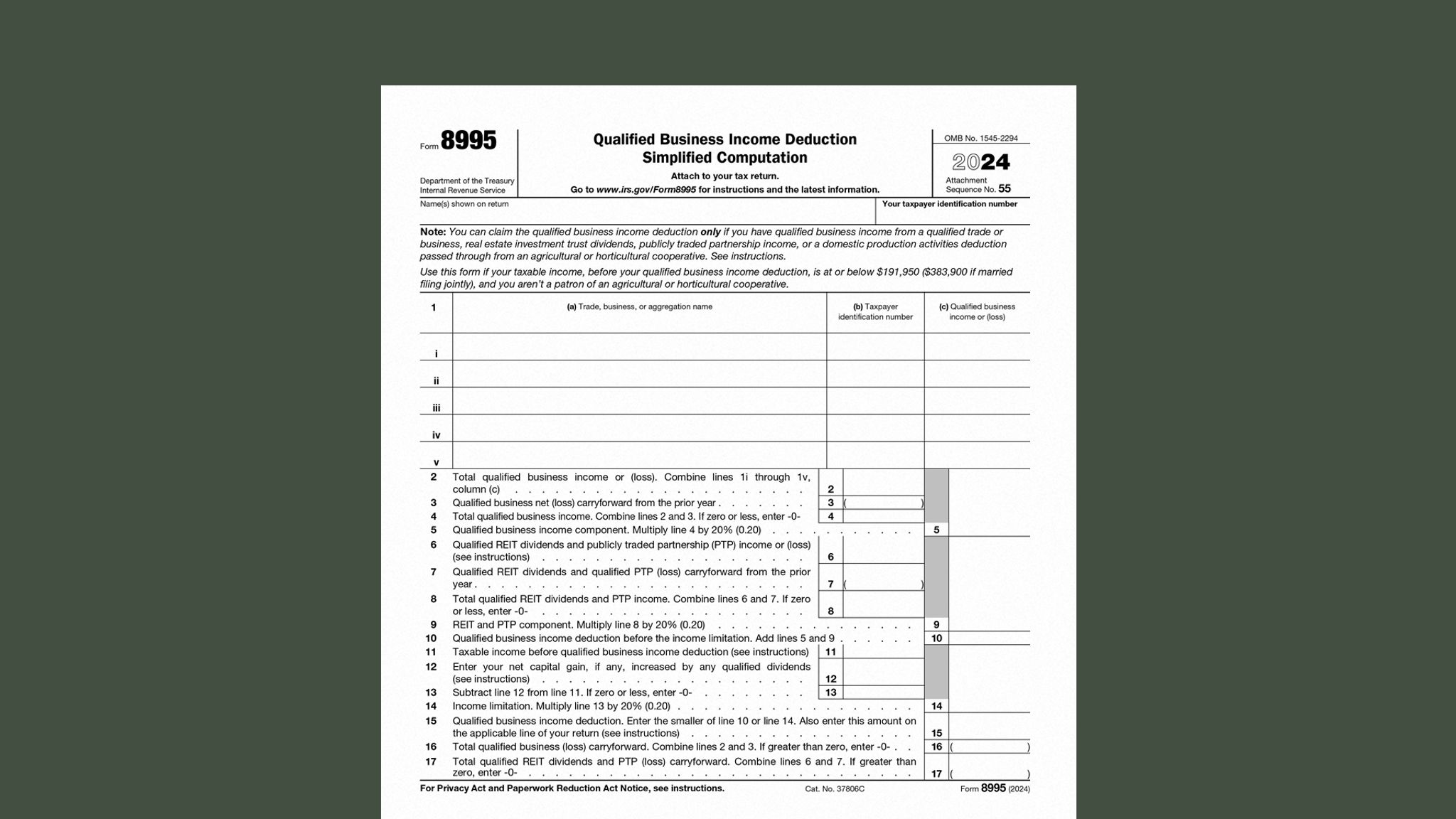

Form 8995 How to Calculate Your Qualified Business (QBI

Form 8995 line 3 shows a loss carryforward from prior years resulting from schedule c losses. The form 8995 is used to figure your qualified business income (qbi) deduction. If you have a business (1099 income), or an amount in. I don't run a business! Are these numbers supposed to match?

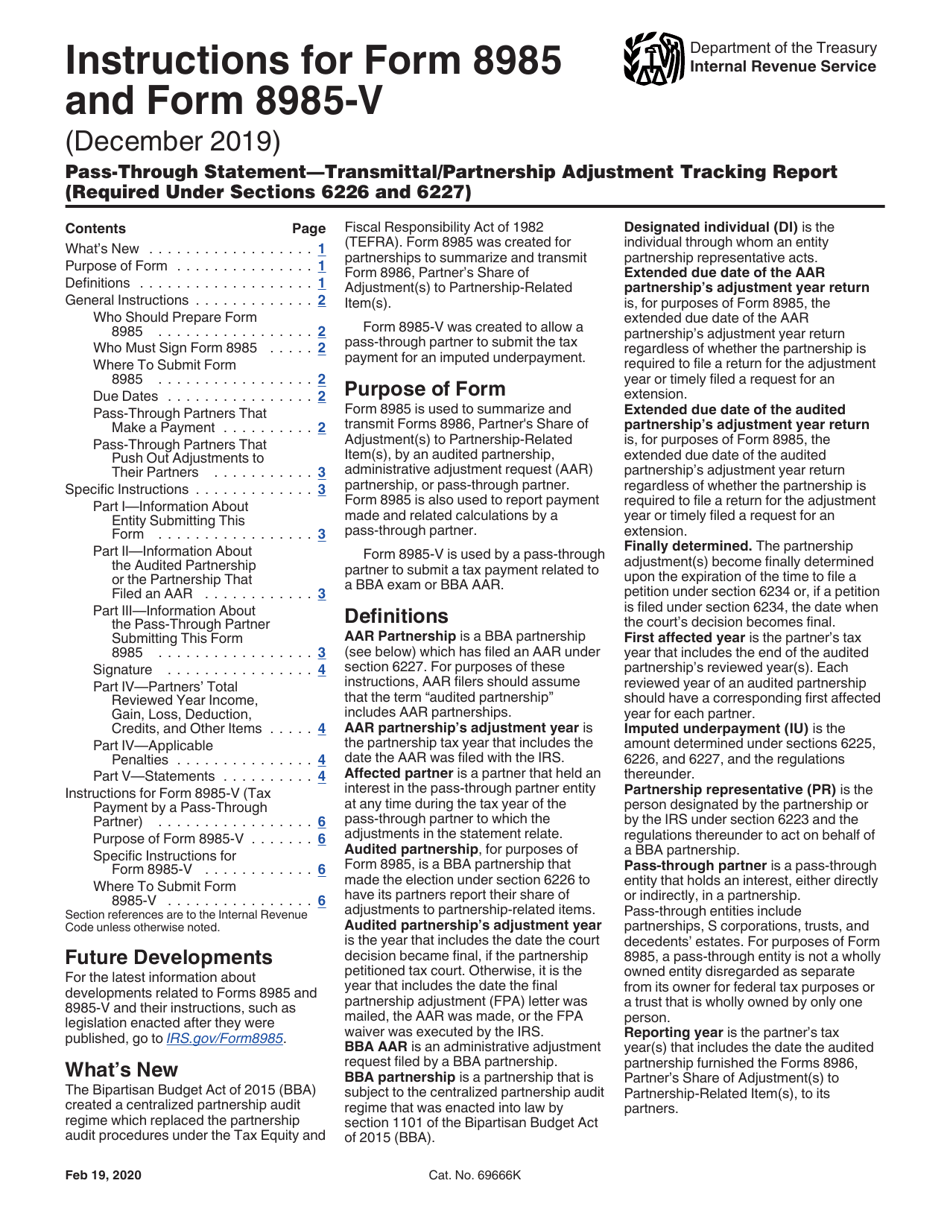

Download Instructions for IRS Form 8985, 8985V PDF Templateroller

If you have a business (1099 income), or an amount in. I don't run a business! The form 8995 is used to figure your qualified business income (qbi) deduction. The qbid can can be generated by schedule c, schedule e, schedule f. Are these numbers supposed to match?

QBI Deduction What It Is, Who Qualifies & How to Take It Hourly, Inc.

Why did turbotax desktop premier generate form 8895? The same form show a loss. Irs form 8995 is used to report the qualified business income deduction. I don't run a business! Why is my qualified business income on schedule c (line 31) different on form 8895?

Form 8895 Fill and sign online with Lumin

Irs form 8995 is used to report the qualified business income deduction. Why did turbotax desktop premier generate form 8895? Why is my qualified business income on schedule c (line 31) different on form 8895? The form 8995 is used to figure your qualified business income (qbi) deduction. Form 8995 line 3 shows a loss carryforward from prior years resulting.

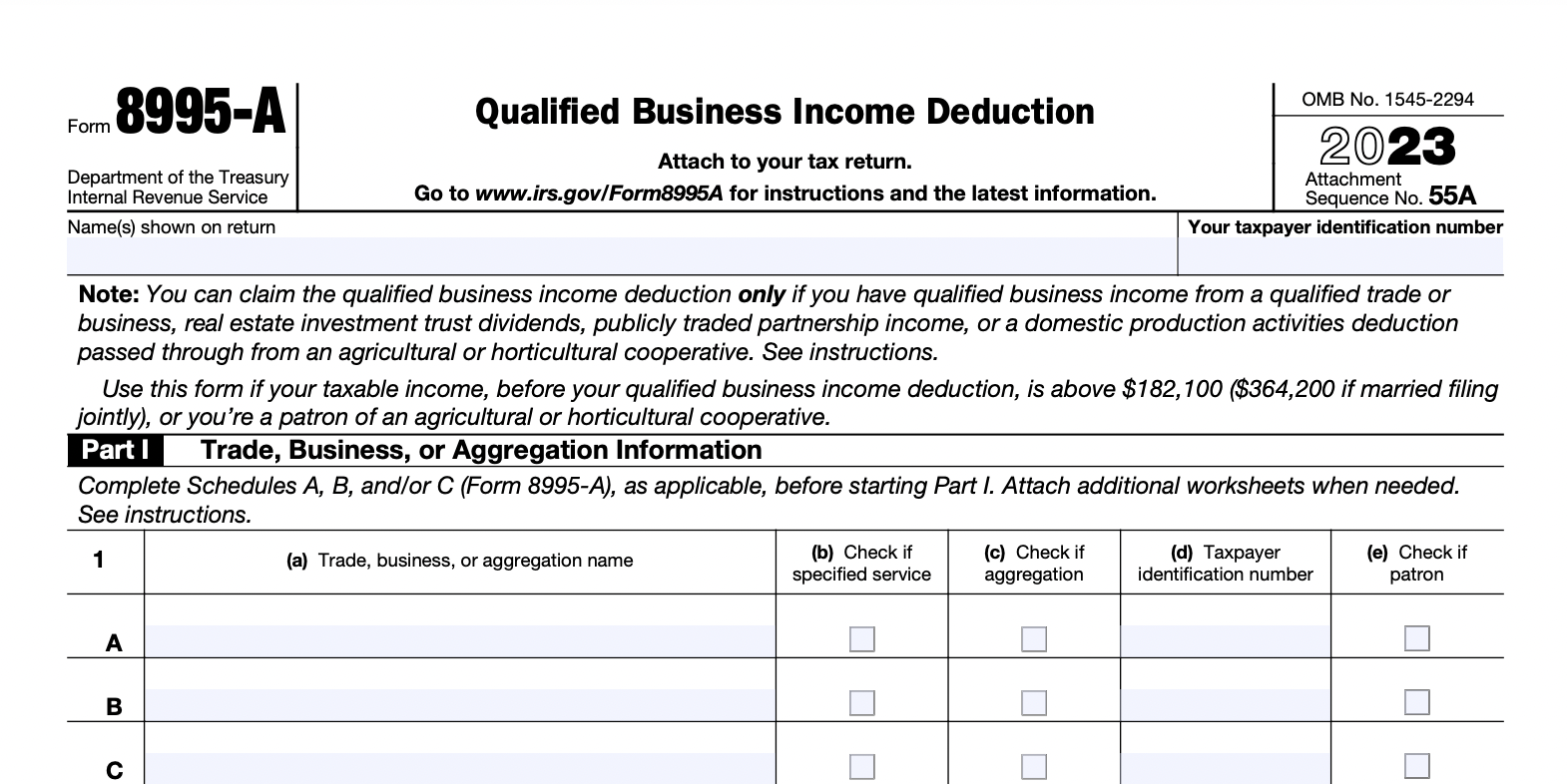

[Solved] Attached is my completed 1040 and 8995, which I am completing

The form 8995 is used to figure your qualified business income (qbi) deduction. If you have a business (1099 income), or an amount in. Are these numbers supposed to match? I don't run a business! The qbid can can be generated by schedule c, schedule e, schedule f.

What Is the QBI Tax Deduction and Who Can Claim It?

The same form show a loss. Why did turbotax desktop premier generate form 8895? If you have a business (1099 income), or an amount in. Why is my qualified business income on schedule c (line 31) different on form 8895? Form 8995 line 3 shows a loss carryforward from prior years resulting from schedule c losses.

Form 8995 How to Calculate Your Qualified Business (QBI

Why is my qualified business income on schedule c (line 31) different on form 8895? Form 8995 line 3 shows a loss carryforward from prior years resulting from schedule c losses. If you have a business (1099 income), or an amount in. The form 8995 is used to figure your qualified business income (qbi) deduction. Irs form 8995 is used.

V VH and SK. ppt download

Irs form 8995 is used to report the qualified business income deduction. Are these numbers supposed to match? The same form show a loss. Form 8995 line 3 shows a loss carryforward from prior years resulting from schedule c losses. The form 8995 is used to figure your qualified business income (qbi) deduction.

V VH and SK. ppt download

Are these numbers supposed to match? Why did turbotax desktop premier generate form 8895? Irs form 8995 is used to report the qualified business income deduction. The form 8995 is used to figure your qualified business income (qbi) deduction. The same form show a loss.

IRS Form 8995 walkthrough (QBI Deduction Simplified Computation) YouTube

The same form show a loss. Form 8995 line 3 shows a loss carryforward from prior years resulting from schedule c losses. I don't run a business! If you have a business (1099 income), or an amount in. Why did turbotax desktop premier generate form 8895?

Why Did Turbotax Desktop Premier Generate Form 8895?

Irs form 8995 is used to report the qualified business income deduction. Are these numbers supposed to match? If you have a business (1099 income), or an amount in. The same form show a loss.

I Don't Run A Business!

The qbid can can be generated by schedule c, schedule e, schedule f. Why is my qualified business income on schedule c (line 31) different on form 8895? Form 8995 line 3 shows a loss carryforward from prior years resulting from schedule c losses. The form 8995 is used to figure your qualified business income (qbi) deduction.

+5-0.jpg)