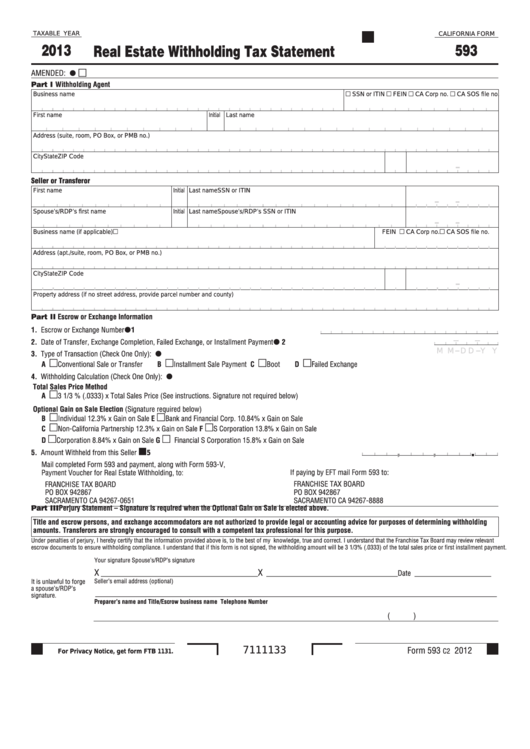

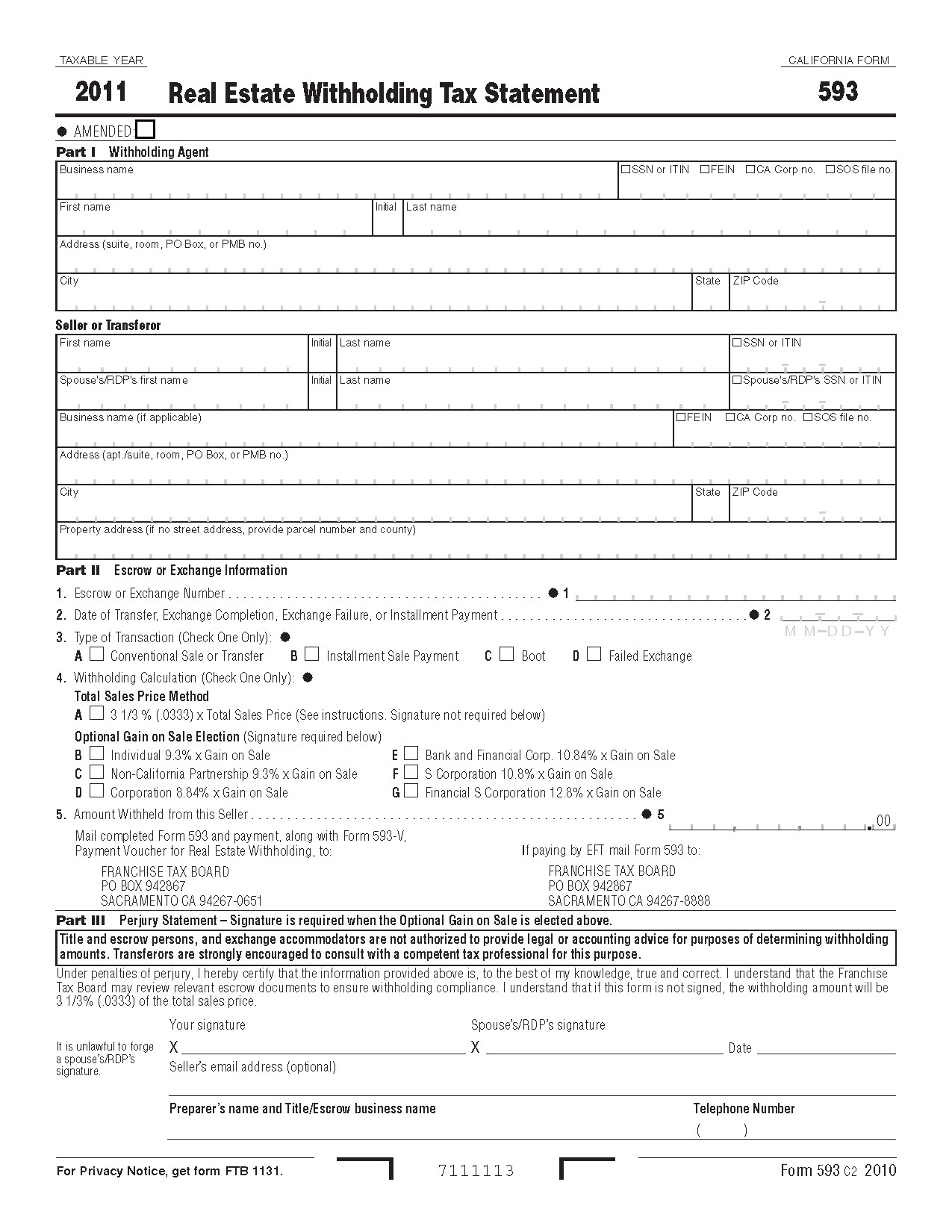

Form 593 - The seller/transferor must submit form 593 before the close of the real estate transaction to prevent withholding on the transaction. Check all boxes that apply to the property being sold or transferred. Learn the essentials of accurately completing ca form 593 for real estate withholding, including key requirements and calculation. In this blog post, we will dive into what form 593 is, its significance in real estate transactions, and answer some frequently asked questions to. Determine whether you qualify for a full withholding exemption.

Check all boxes that apply to the property being sold or transferred. Learn the essentials of accurately completing ca form 593 for real estate withholding, including key requirements and calculation. The seller/transferor must submit form 593 before the close of the real estate transaction to prevent withholding on the transaction. In this blog post, we will dive into what form 593 is, its significance in real estate transactions, and answer some frequently asked questions to. Determine whether you qualify for a full withholding exemption.

In this blog post, we will dive into what form 593 is, its significance in real estate transactions, and answer some frequently asked questions to. The seller/transferor must submit form 593 before the close of the real estate transaction to prevent withholding on the transaction. Learn the essentials of accurately completing ca form 593 for real estate withholding, including key requirements and calculation. Determine whether you qualify for a full withholding exemption. Check all boxes that apply to the property being sold or transferred.

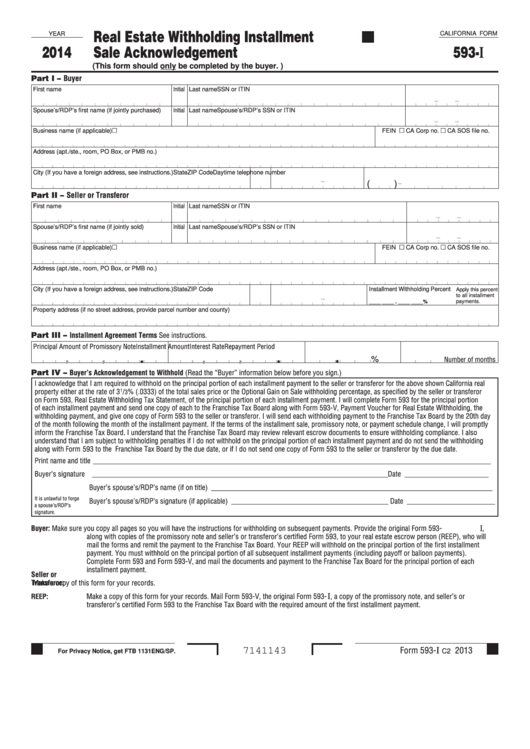

Fillable California Form 593I Real Estate Withholding Installment

Check all boxes that apply to the property being sold or transferred. Determine whether you qualify for a full withholding exemption. Learn the essentials of accurately completing ca form 593 for real estate withholding, including key requirements and calculation. The seller/transferor must submit form 593 before the close of the real estate transaction to prevent withholding on the transaction. In.

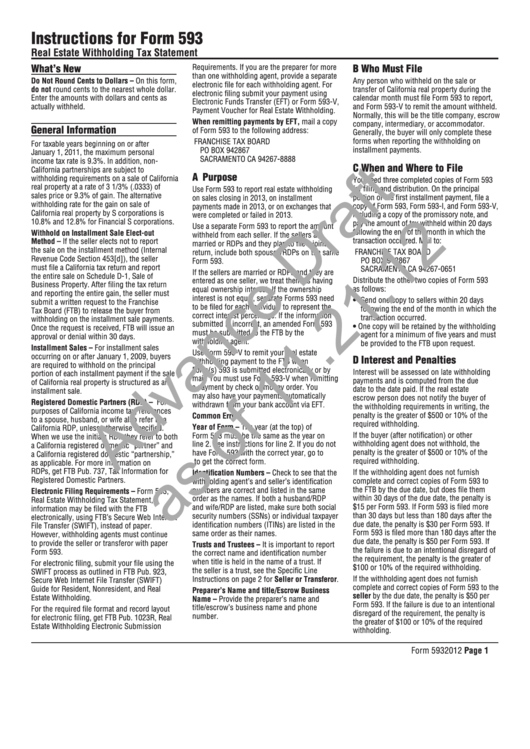

Instructions For Form 593 Advance Draft Real Estate Withholding Tax

The seller/transferor must submit form 593 before the close of the real estate transaction to prevent withholding on the transaction. Learn the essentials of accurately completing ca form 593 for real estate withholding, including key requirements and calculation. In this blog post, we will dive into what form 593 is, its significance in real estate transactions, and answer some frequently.

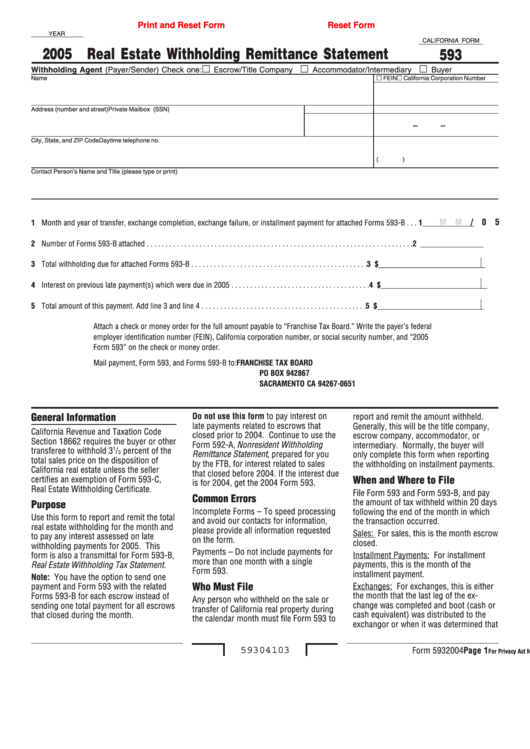

Fillable Form 593 Real Estate Withholding Remittance Statement 2005

The seller/transferor must submit form 593 before the close of the real estate transaction to prevent withholding on the transaction. Check all boxes that apply to the property being sold or transferred. Determine whether you qualify for a full withholding exemption. In this blog post, we will dive into what form 593 is, its significance in real estate transactions, and.

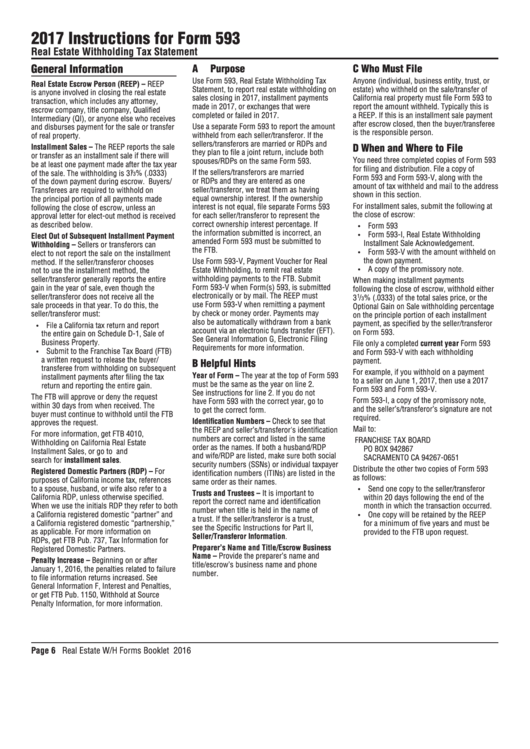

Instructions For Form 593 Real Estate Withholding Tax Statement

The seller/transferor must submit form 593 before the close of the real estate transaction to prevent withholding on the transaction. Check all boxes that apply to the property being sold or transferred. In this blog post, we will dive into what form 593 is, its significance in real estate transactions, and answer some frequently asked questions to. Determine whether you.

Fillable California Form 593 Real Estate Withholding Tax Statement

Learn the essentials of accurately completing ca form 593 for real estate withholding, including key requirements and calculation. Determine whether you qualify for a full withholding exemption. In this blog post, we will dive into what form 593 is, its significance in real estate transactions, and answer some frequently asked questions to. The seller/transferor must submit form 593 before the.

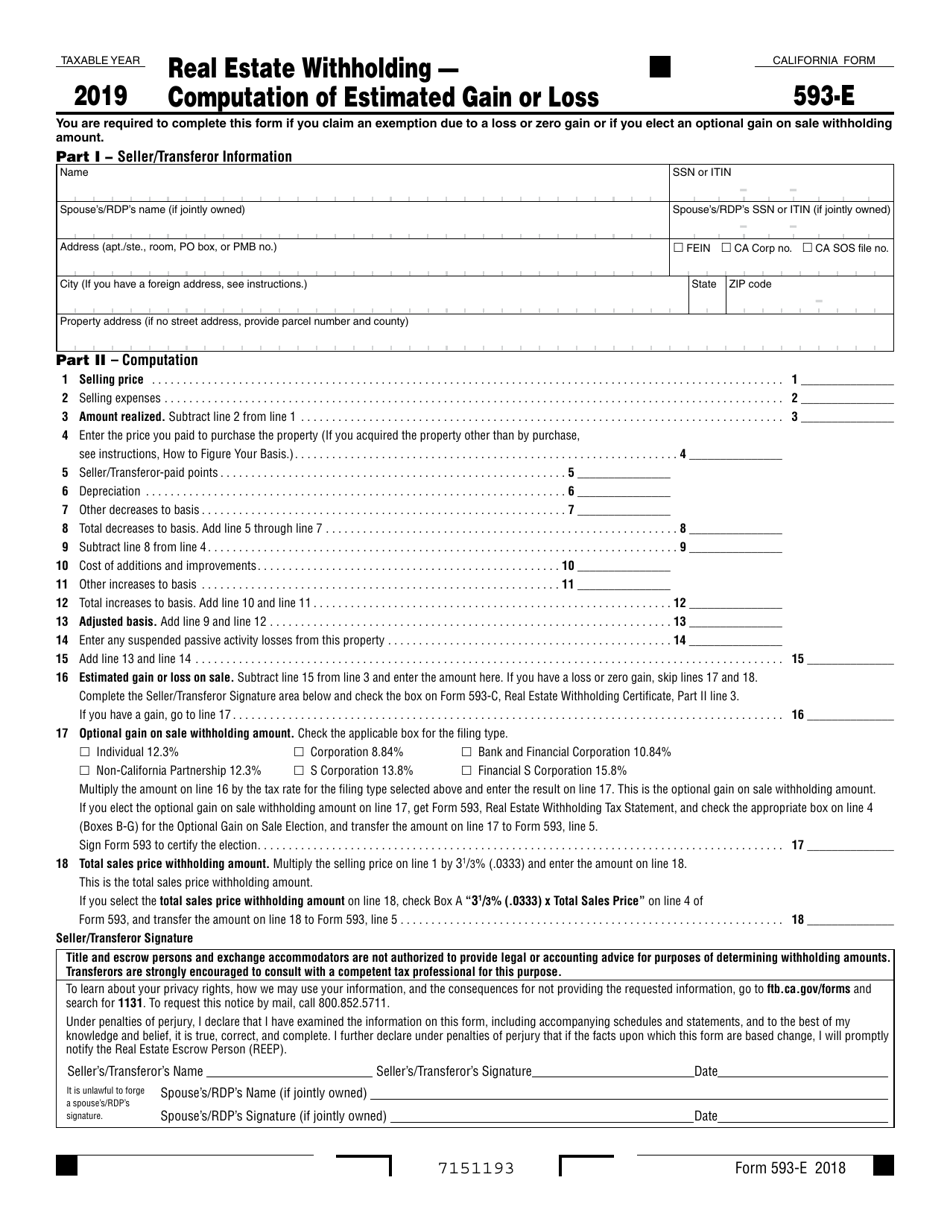

Form 593E Download Fillable PDF or Fill Online Real Estate Withholding

Learn the essentials of accurately completing ca form 593 for real estate withholding, including key requirements and calculation. Check all boxes that apply to the property being sold or transferred. The seller/transferor must submit form 593 before the close of the real estate transaction to prevent withholding on the transaction. Determine whether you qualify for a full withholding exemption. In.

Real Estate Withholding Form Ca Complete with ease airSlate SignNow

The seller/transferor must submit form 593 before the close of the real estate transaction to prevent withholding on the transaction. Learn the essentials of accurately completing ca form 593 for real estate withholding, including key requirements and calculation. In this blog post, we will dive into what form 593 is, its significance in real estate transactions, and answer some frequently.

Real Estate Withholding Form 593 at Maybelle Fitzhugh blog

Learn the essentials of accurately completing ca form 593 for real estate withholding, including key requirements and calculation. The seller/transferor must submit form 593 before the close of the real estate transaction to prevent withholding on the transaction. Check all boxes that apply to the property being sold or transferred. In this blog post, we will dive into what form.

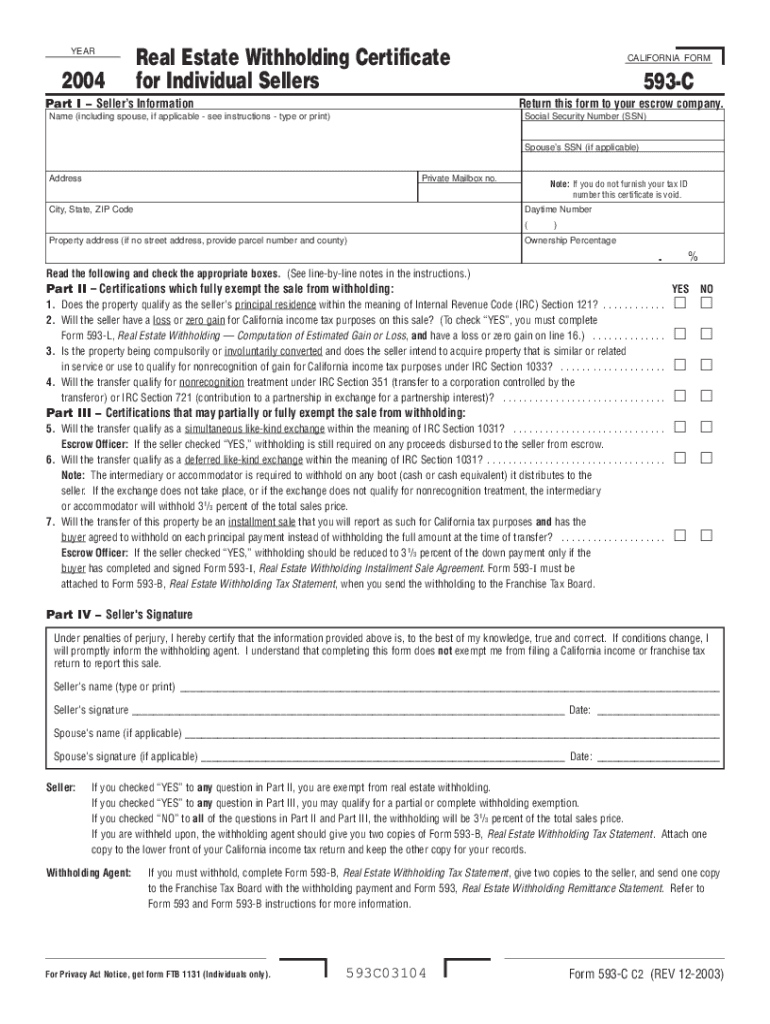

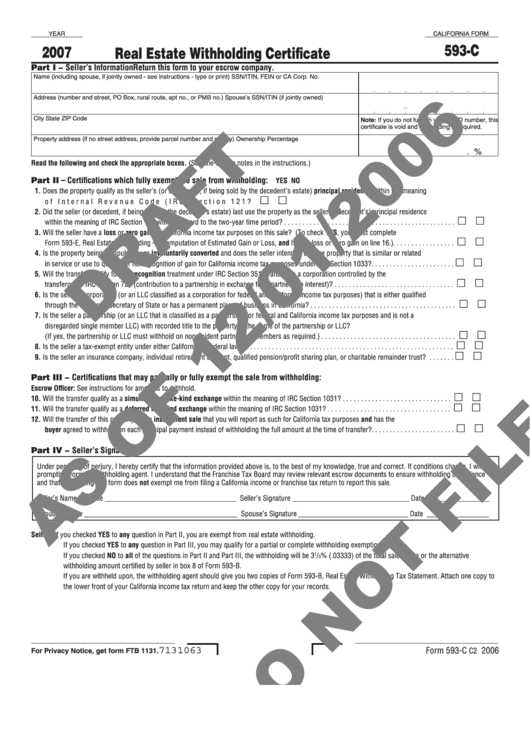

California Form 593C Draft Real Estate Withholding Certificate

In this blog post, we will dive into what form 593 is, its significance in real estate transactions, and answer some frequently asked questions to. The seller/transferor must submit form 593 before the close of the real estate transaction to prevent withholding on the transaction. Learn the essentials of accurately completing ca form 593 for real estate withholding, including key.

Fillable Online The Real Estate Withholding Certificate (Form 593C

Learn the essentials of accurately completing ca form 593 for real estate withholding, including key requirements and calculation. Check all boxes that apply to the property being sold or transferred. Determine whether you qualify for a full withholding exemption. The seller/transferor must submit form 593 before the close of the real estate transaction to prevent withholding on the transaction. In.

Learn The Essentials Of Accurately Completing Ca Form 593 For Real Estate Withholding, Including Key Requirements And Calculation.

Check all boxes that apply to the property being sold or transferred. Determine whether you qualify for a full withholding exemption. The seller/transferor must submit form 593 before the close of the real estate transaction to prevent withholding on the transaction. In this blog post, we will dive into what form 593 is, its significance in real estate transactions, and answer some frequently asked questions to.