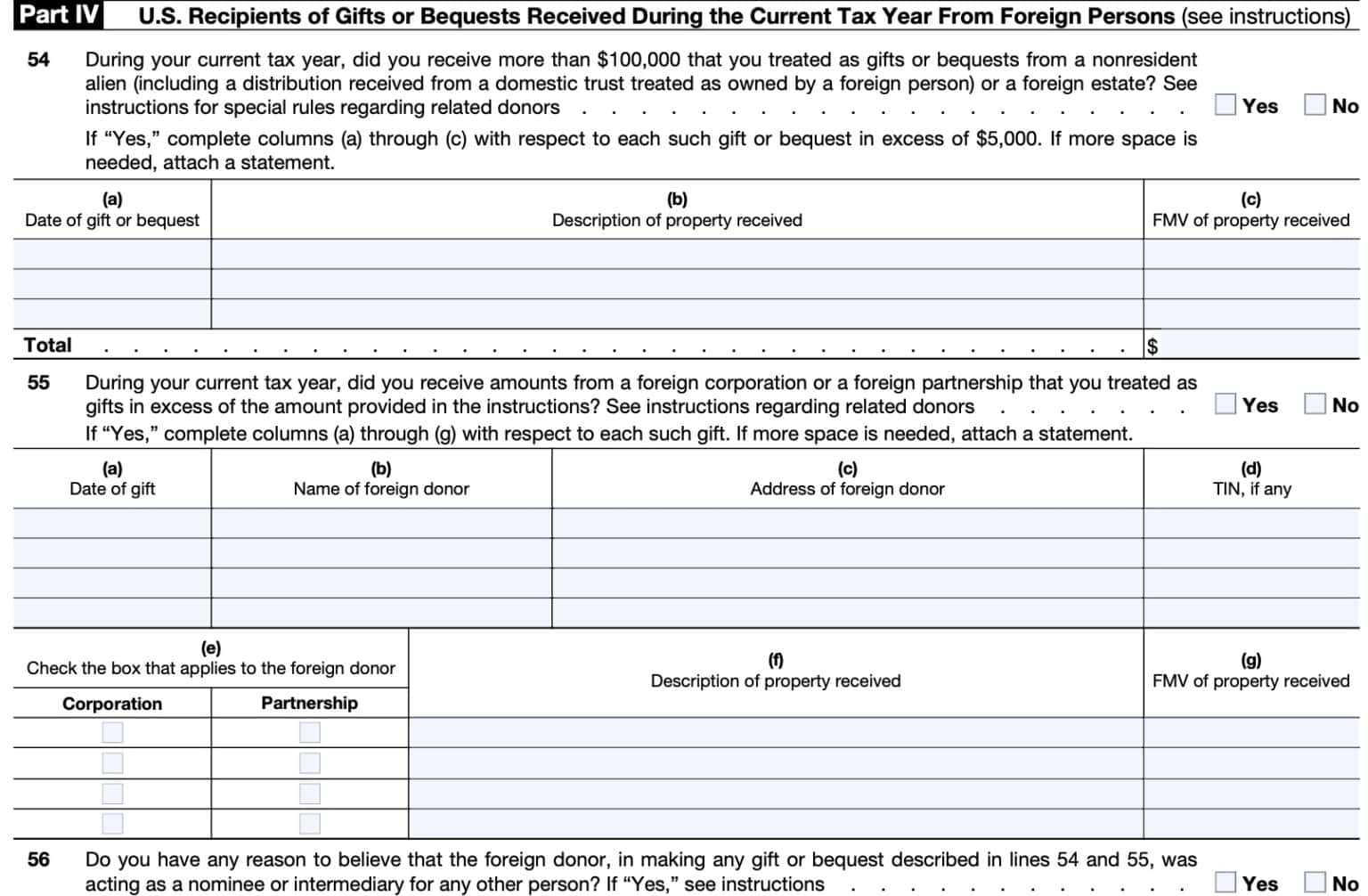

Form 3520 Instructions - You need to print and mail form 3250. If you and your spouse are filing a joint income tax return for tax year 2021,. The deadline is the same (april. It isn't part of your regular tax return. See below the relevant section from form 3520 instructions. If you have to file form 3520 this year (annual return to report transactions with foreign trusts and receipt of certain foreign gifts), you. A penalty applies if form 3520 is not timely filed or if the. According to the instructions for form 3520, you may file jointly if if you and your spouse are filing a joint income tax return for tax year. Form 3520 is not included with your tax return, it is mailed separately to the address in the instructions.

See below the relevant section from form 3520 instructions. A penalty applies if form 3520 is not timely filed or if the. The deadline is the same (april. If you have to file form 3520 this year (annual return to report transactions with foreign trusts and receipt of certain foreign gifts), you. You need to print and mail form 3250. If you and your spouse are filing a joint income tax return for tax year 2021,. Form 3520 is not included with your tax return, it is mailed separately to the address in the instructions. According to the instructions for form 3520, you may file jointly if if you and your spouse are filing a joint income tax return for tax year. It isn't part of your regular tax return.

A penalty applies if form 3520 is not timely filed or if the. You need to print and mail form 3250. If you and your spouse are filing a joint income tax return for tax year 2021,. According to the instructions for form 3520, you may file jointly if if you and your spouse are filing a joint income tax return for tax year. If you have to file form 3520 this year (annual return to report transactions with foreign trusts and receipt of certain foreign gifts), you. It isn't part of your regular tax return. The deadline is the same (april. Form 3520 is not included with your tax return, it is mailed separately to the address in the instructions. See below the relevant section from form 3520 instructions.

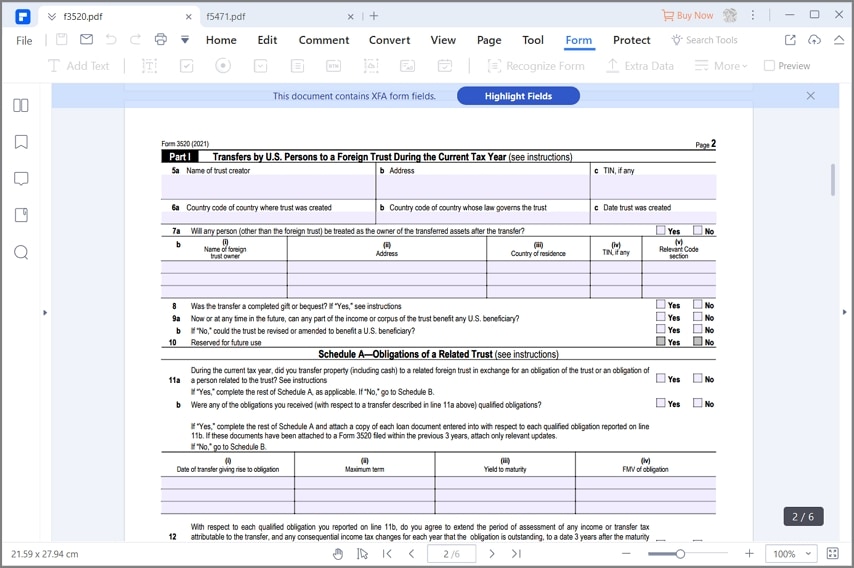

Form 3520 Examples and Guide to Filing fro Expats

Form 3520 is not included with your tax return, it is mailed separately to the address in the instructions. A penalty applies if form 3520 is not timely filed or if the. The deadline is the same (april. You need to print and mail form 3250. If you have to file form 3520 this year (annual return to report transactions.

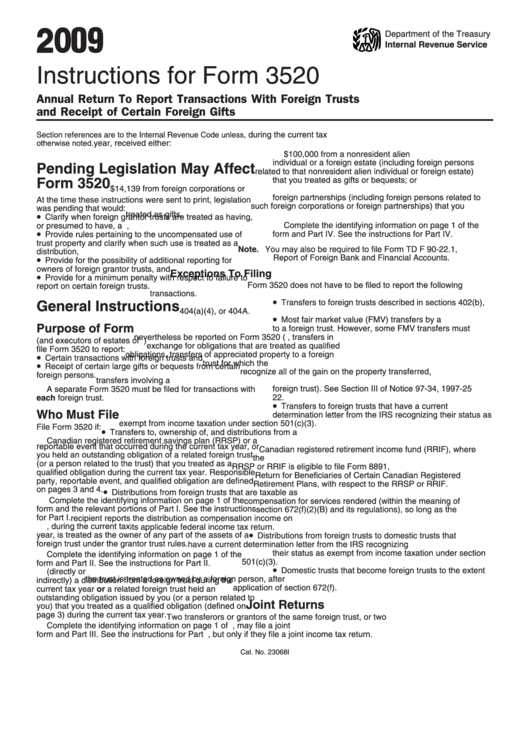

Instructions For Form 3520A Annual Information Return of Foreign

It isn't part of your regular tax return. If you and your spouse are filing a joint income tax return for tax year 2021,. You need to print and mail form 3250. According to the instructions for form 3520, you may file jointly if if you and your spouse are filing a joint income tax return for tax year. If.

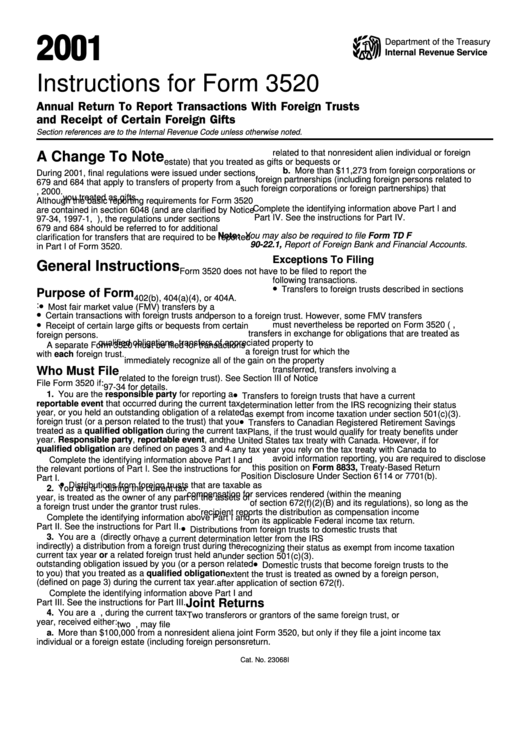

Instructions For Form 3520 Annual Return To Report Transactions With

If you have to file form 3520 this year (annual return to report transactions with foreign trusts and receipt of certain foreign gifts), you. It isn't part of your regular tax return. A penalty applies if form 3520 is not timely filed or if the. According to the instructions for form 3520, you may file jointly if if you and.

IRS Form 3520 Instructions to Fill it Right in 2025

You need to print and mail form 3250. Form 3520 is not included with your tax return, it is mailed separately to the address in the instructions. The deadline is the same (april. According to the instructions for form 3520, you may file jointly if if you and your spouse are filing a joint income tax return for tax year..

IRS Form 3520 Instructions

See below the relevant section from form 3520 instructions. A penalty applies if form 3520 is not timely filed or if the. You need to print and mail form 3250. The deadline is the same (april. It isn't part of your regular tax return.

Instructions For Form 3520 Annual Return To Report Transactions With

You need to print and mail form 3250. It isn't part of your regular tax return. If you have to file form 3520 this year (annual return to report transactions with foreign trusts and receipt of certain foreign gifts), you. See below the relevant section from form 3520 instructions. Form 3520 is not included with your tax return, it is.

Download Instructions for IRS Form 3520 Annual Return to Report

If you have to file form 3520 this year (annual return to report transactions with foreign trusts and receipt of certain foreign gifts), you. The deadline is the same (april. You need to print and mail form 3250. Form 3520 is not included with your tax return, it is mailed separately to the address in the instructions. If you and.

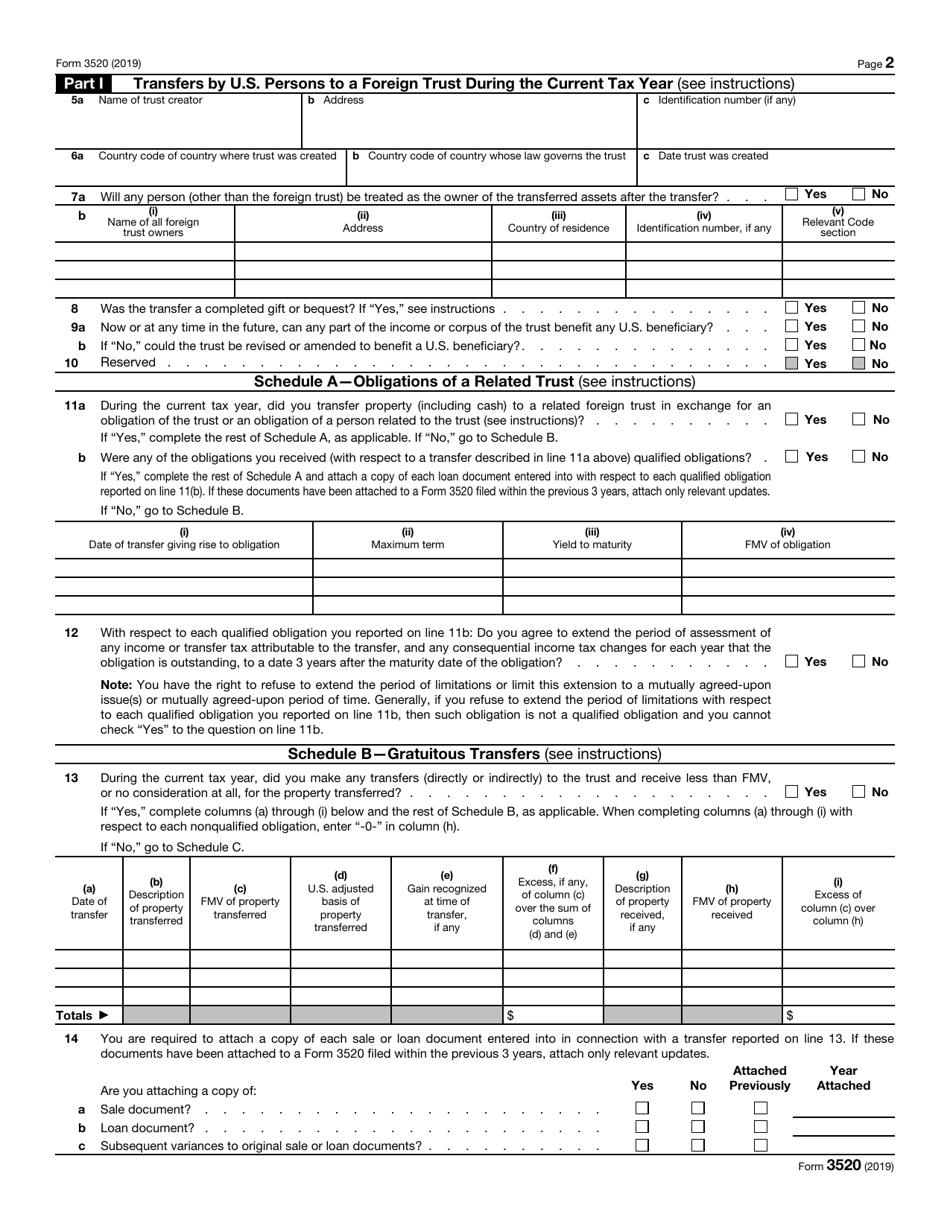

IRS Form 3520 2019 Fill Out, Sign Online and Download Fillable PDF

A penalty applies if form 3520 is not timely filed or if the. It isn't part of your regular tax return. The deadline is the same (april. If you have to file form 3520 this year (annual return to report transactions with foreign trusts and receipt of certain foreign gifts), you. See below the relevant section from form 3520 instructions.

IRS Form 3520Reporting Transactions With Foreign Trusts

According to the instructions for form 3520, you may file jointly if if you and your spouse are filing a joint income tax return for tax year. A penalty applies if form 3520 is not timely filed or if the. See below the relevant section from form 3520 instructions. If you and your spouse are filing a joint income tax.

Instructions For Form 3520 Annual Return To Report Transactions With

According to the instructions for form 3520, you may file jointly if if you and your spouse are filing a joint income tax return for tax year. If you have to file form 3520 this year (annual return to report transactions with foreign trusts and receipt of certain foreign gifts), you. The deadline is the same (april. See below the.

It Isn't Part Of Your Regular Tax Return.

If you and your spouse are filing a joint income tax return for tax year 2021,. See below the relevant section from form 3520 instructions. You need to print and mail form 3250. If you have to file form 3520 this year (annual return to report transactions with foreign trusts and receipt of certain foreign gifts), you.

A Penalty Applies If Form 3520 Is Not Timely Filed Or If The.

The deadline is the same (april. According to the instructions for form 3520, you may file jointly if if you and your spouse are filing a joint income tax return for tax year. Form 3520 is not included with your tax return, it is mailed separately to the address in the instructions.