Form 2441 Provider Amount Paid - The screen that shows you the message. The form 2441 is used to report qualified childcare expenses paid to an individual or organization. If you paid to an individual, you. The following link will provide more information: You should enter the amount you paid the provider for childcare. It's the amount you paid for child or dependent care to the 7th care provider that you entered. What is the provider amount paid on my form 2441?what do i put in the provider amount paid box if i paid out of pocket around 1,200 and. There are a number of eligibility requirements you must satisfy first, so it’s a good idea to familiarize yourself with the rules before.

If you paid to an individual, you. The screen that shows you the message. You should enter the amount you paid the provider for childcare. What is the provider amount paid on my form 2441?what do i put in the provider amount paid box if i paid out of pocket around 1,200 and. The following link will provide more information: There are a number of eligibility requirements you must satisfy first, so it’s a good idea to familiarize yourself with the rules before. It's the amount you paid for child or dependent care to the 7th care provider that you entered. The form 2441 is used to report qualified childcare expenses paid to an individual or organization.

You should enter the amount you paid the provider for childcare. The screen that shows you the message. The form 2441 is used to report qualified childcare expenses paid to an individual or organization. It's the amount you paid for child or dependent care to the 7th care provider that you entered. If you paid to an individual, you. There are a number of eligibility requirements you must satisfy first, so it’s a good idea to familiarize yourself with the rules before. The following link will provide more information: What is the provider amount paid on my form 2441?what do i put in the provider amount paid box if i paid out of pocket around 1,200 and.

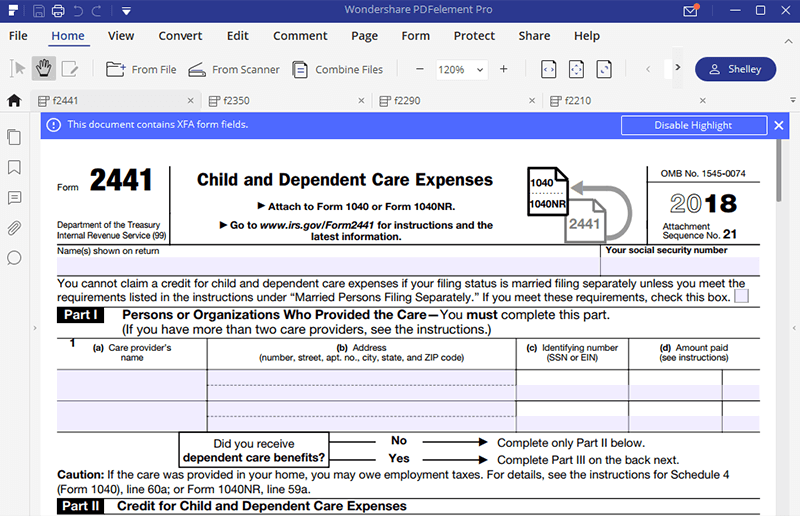

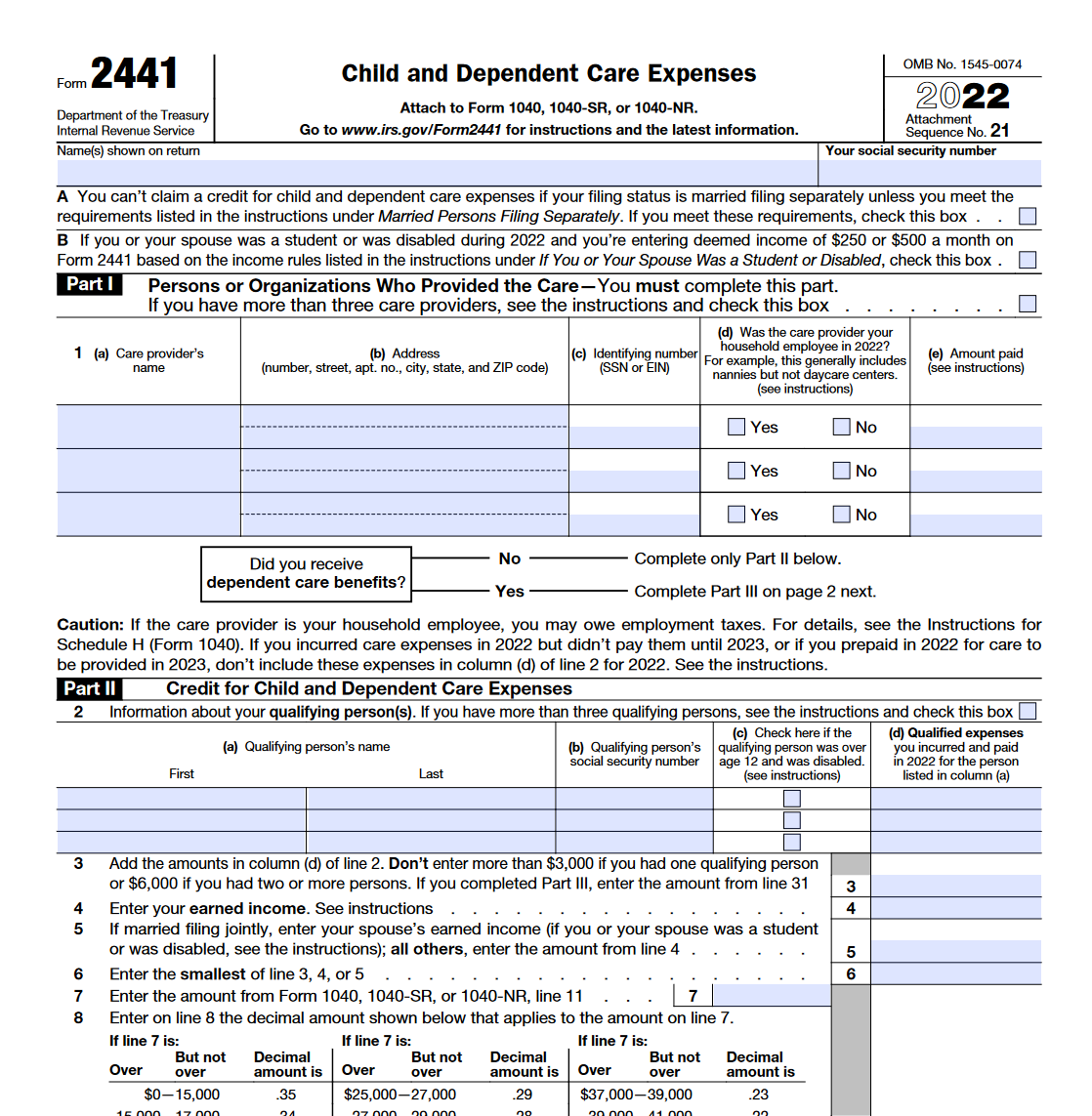

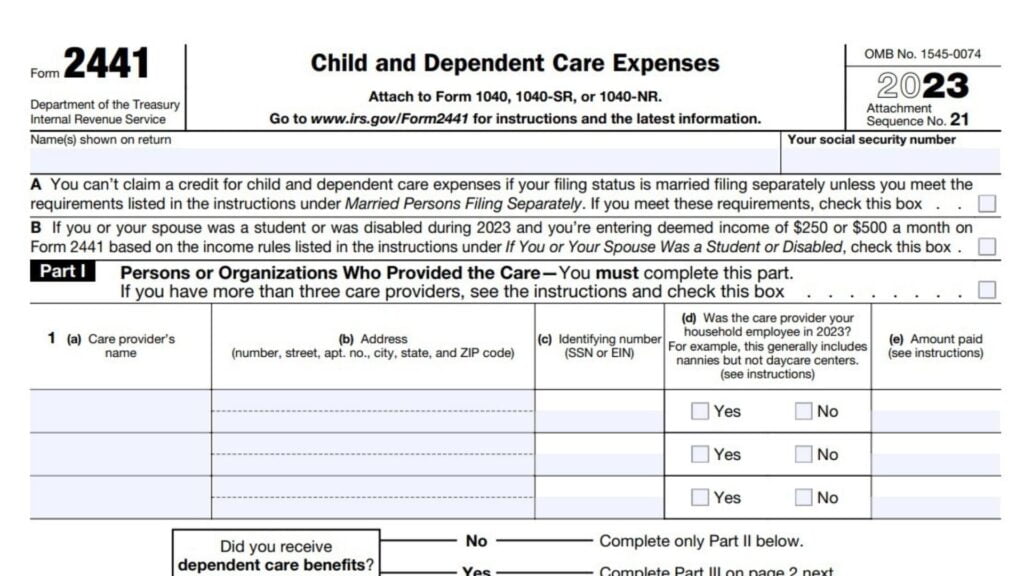

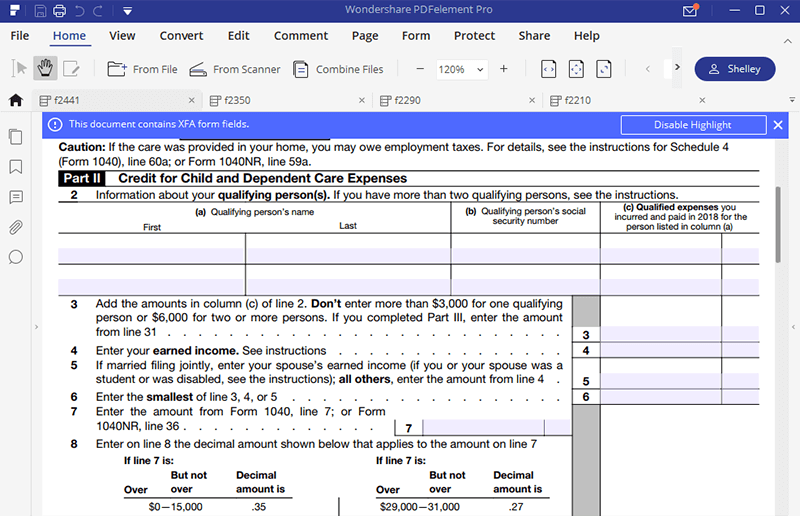

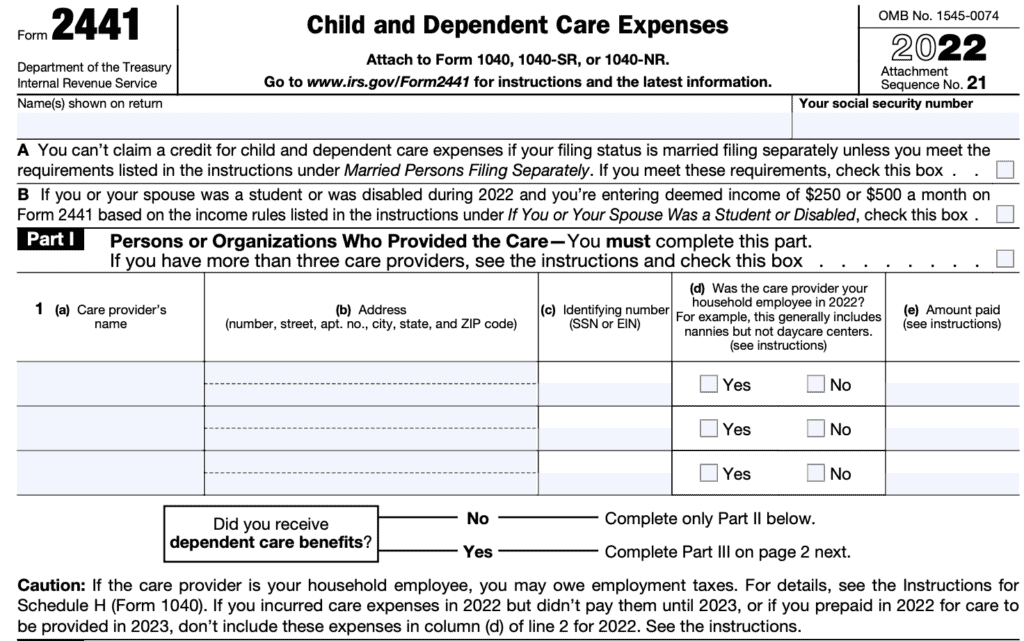

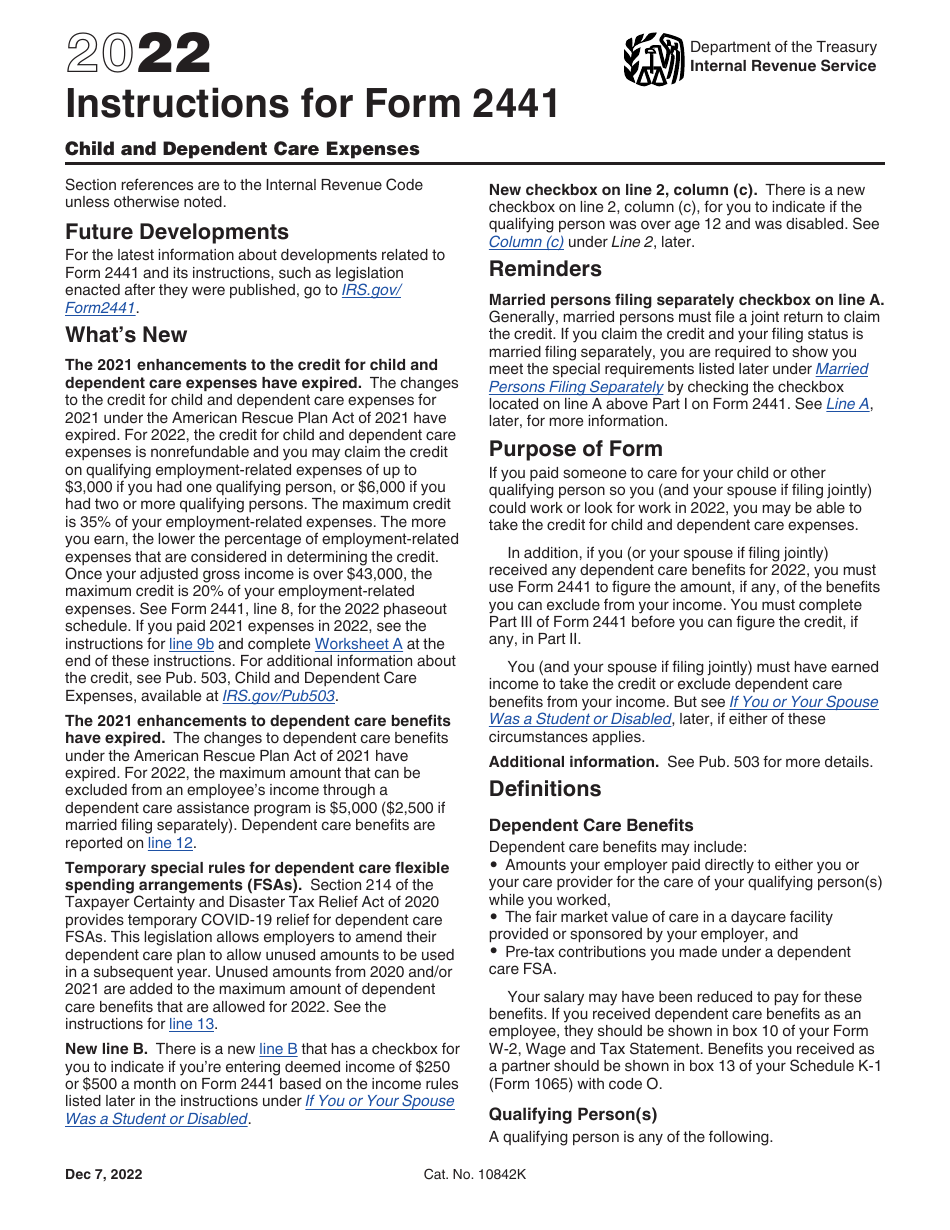

IRS Form 2441 Instructions Child and Dependent Care Expenses

There are a number of eligibility requirements you must satisfy first, so it’s a good idea to familiarize yourself with the rules before. It's the amount you paid for child or dependent care to the 7th care provider that you entered. If you paid to an individual, you. The screen that shows you the message. What is the provider amount.

Download Instructions for IRS Form 2441 Child and Dependent Care

If you paid to an individual, you. There are a number of eligibility requirements you must satisfy first, so it’s a good idea to familiarize yourself with the rules before. The screen that shows you the message. It's the amount you paid for child or dependent care to the 7th care provider that you entered. The following link will provide.

IRS Form 2441 What It Is, Who Can File, and How to Fill It Out

You should enter the amount you paid the provider for childcare. It's the amount you paid for child or dependent care to the 7th care provider that you entered. The following link will provide more information: The form 2441 is used to report qualified childcare expenses paid to an individual or organization. There are a number of eligibility requirements you.

IRS Form 2441 What It Is, Who Can File, and How to Fill It Out

The following link will provide more information: There are a number of eligibility requirements you must satisfy first, so it’s a good idea to familiarize yourself with the rules before. The form 2441 is used to report qualified childcare expenses paid to an individual or organization. What is the provider amount paid on my form 2441?what do i put in.

Instructions for How to Fill in IRS Form 2441

The following link will provide more information: If you paid to an individual, you. What is the provider amount paid on my form 2441?what do i put in the provider amount paid box if i paid out of pocket around 1,200 and. It's the amount you paid for child or dependent care to the 7th care provider that you entered..

IRS Form 2441. Child and Dependent Care Expenses Forms Docs 2023

There are a number of eligibility requirements you must satisfy first, so it’s a good idea to familiarize yourself with the rules before. If you paid to an individual, you. What is the provider amount paid on my form 2441?what do i put in the provider amount paid box if i paid out of pocket around 1,200 and. The form.

Form 2441 Instructions 2024 2025

There are a number of eligibility requirements you must satisfy first, so it’s a good idea to familiarize yourself with the rules before. If you paid to an individual, you. What is the provider amount paid on my form 2441?what do i put in the provider amount paid box if i paid out of pocket around 1,200 and. The screen.

Instructions for How to Fill in IRS Form 2441

The following link will provide more information: There are a number of eligibility requirements you must satisfy first, so it’s a good idea to familiarize yourself with the rules before. The screen that shows you the message. You should enter the amount you paid the provider for childcare. The form 2441 is used to report qualified childcare expenses paid to.

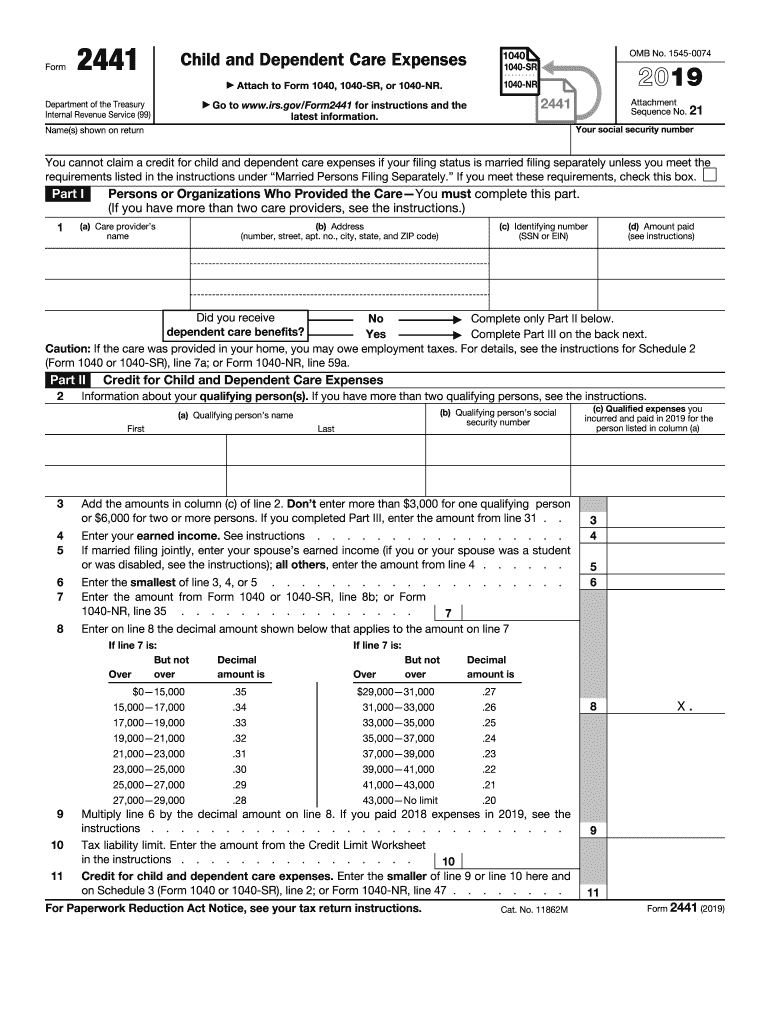

Form 2441 Child and Dependent Care Expenses

What is the provider amount paid on my form 2441?what do i put in the provider amount paid box if i paid out of pocket around 1,200 and. The following link will provide more information: The screen that shows you the message. The form 2441 is used to report qualified childcare expenses paid to an individual or organization. If you.

Form 2441 Complete with ease airSlate SignNow

If you paid to an individual, you. The form 2441 is used to report qualified childcare expenses paid to an individual or organization. The screen that shows you the message. You should enter the amount you paid the provider for childcare. There are a number of eligibility requirements you must satisfy first, so it’s a good idea to familiarize yourself.

What Is The Provider Amount Paid On My Form 2441?What Do I Put In The Provider Amount Paid Box If I Paid Out Of Pocket Around 1,200 And.

The screen that shows you the message. If you paid to an individual, you. You should enter the amount you paid the provider for childcare. It's the amount you paid for child or dependent care to the 7th care provider that you entered.

The Form 2441 Is Used To Report Qualified Childcare Expenses Paid To An Individual Or Organization.

The following link will provide more information: There are a number of eligibility requirements you must satisfy first, so it’s a good idea to familiarize yourself with the rules before.

:max_bytes(150000):strip_icc()/f2441Pg2-ed5dcc6424ff40989a5c5263c8b62c15.jpg)

:max_bytes(150000):strip_icc()/f2441Pg1-386902f42b8a4e61b03a246af9d9b0e2.jpg)