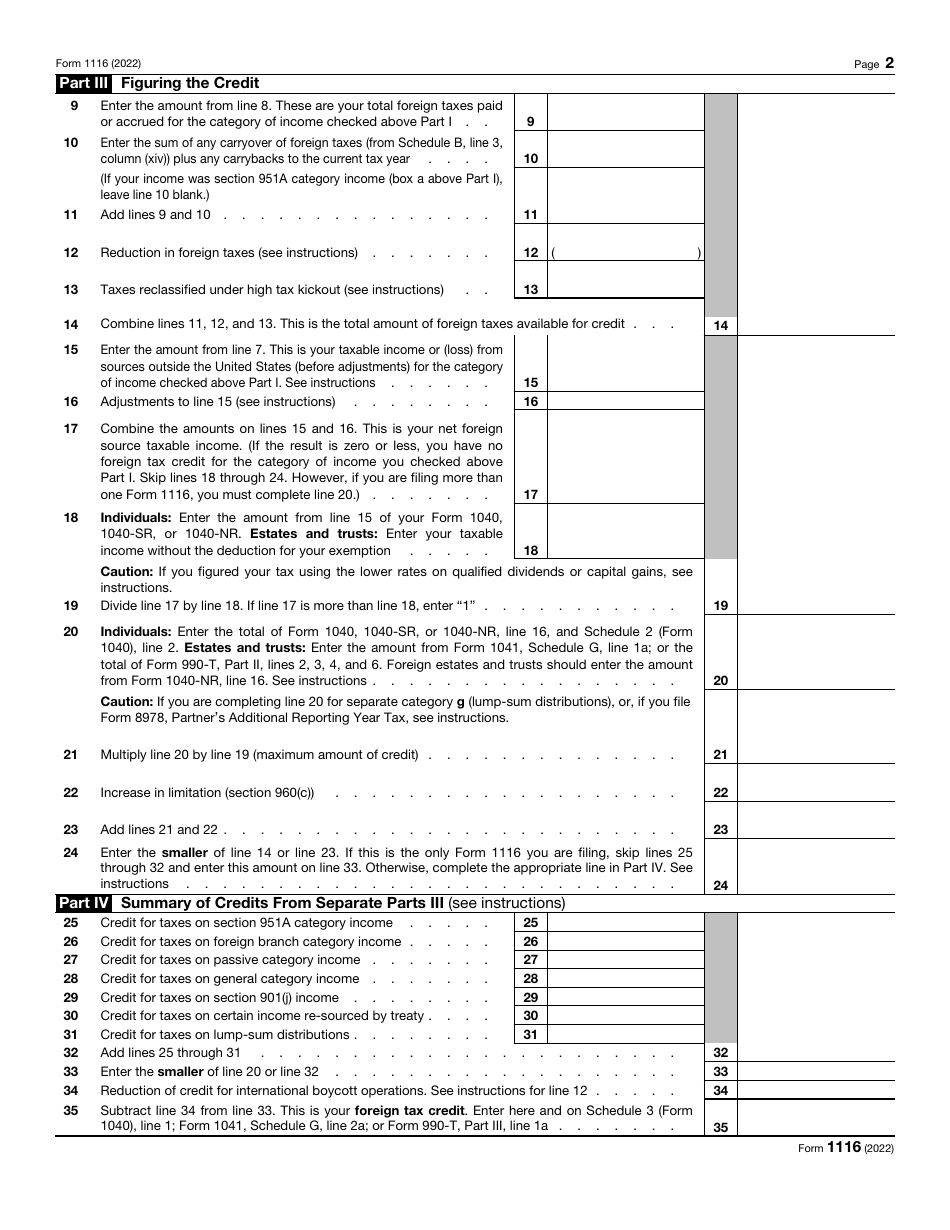

Foreign Tax Credit Form 1116 - Form 1116, officially known as the foreign tax credit (individual, estate, or trust), is an irs form that u.s. Taxpayers claim the foreign tax. Taxpayers use to claim a credit. Check if you qualify, claim the foreign tax credit, and avoid paying taxes twice on your foreign income. Learn how form 1116 helps u.s. Guide to irs form 1116: What is form 1116 used for and how to claim the foreign tax credit? Instructions for form 1116 (2024) foreign tax credit (individual, estate, or trust) section references are to the internal revenue. Depending on the type of foreign income you've earned and how much foreign tax you've paid, you may need to take different steps.

Taxpayers claim the foreign tax. Instructions for form 1116 (2024) foreign tax credit (individual, estate, or trust) section references are to the internal revenue. What is form 1116 used for and how to claim the foreign tax credit? Check if you qualify, claim the foreign tax credit, and avoid paying taxes twice on your foreign income. Form 1116, officially known as the foreign tax credit (individual, estate, or trust), is an irs form that u.s. Taxpayers use to claim a credit. Depending on the type of foreign income you've earned and how much foreign tax you've paid, you may need to take different steps. Learn how form 1116 helps u.s. Guide to irs form 1116:

Instructions for form 1116 (2024) foreign tax credit (individual, estate, or trust) section references are to the internal revenue. Taxpayers use to claim a credit. Taxpayers claim the foreign tax. What is form 1116 used for and how to claim the foreign tax credit? Learn how form 1116 helps u.s. Form 1116, officially known as the foreign tax credit (individual, estate, or trust), is an irs form that u.s. Guide to irs form 1116: Depending on the type of foreign income you've earned and how much foreign tax you've paid, you may need to take different steps. Check if you qualify, claim the foreign tax credit, and avoid paying taxes twice on your foreign income.

Foreign Tax Credit Your Guide to the Form 1116 SDG Accountant

Learn how form 1116 helps u.s. Guide to irs form 1116: Instructions for form 1116 (2024) foreign tax credit (individual, estate, or trust) section references are to the internal revenue. Depending on the type of foreign income you've earned and how much foreign tax you've paid, you may need to take different steps. Check if you qualify, claim the foreign.

The Expat's Guide to Form 1116 Foreign Tax Credit

Taxpayers claim the foreign tax. Depending on the type of foreign income you've earned and how much foreign tax you've paid, you may need to take different steps. Form 1116, officially known as the foreign tax credit (individual, estate, or trust), is an irs form that u.s. Learn how form 1116 helps u.s. Taxpayers use to claim a credit.

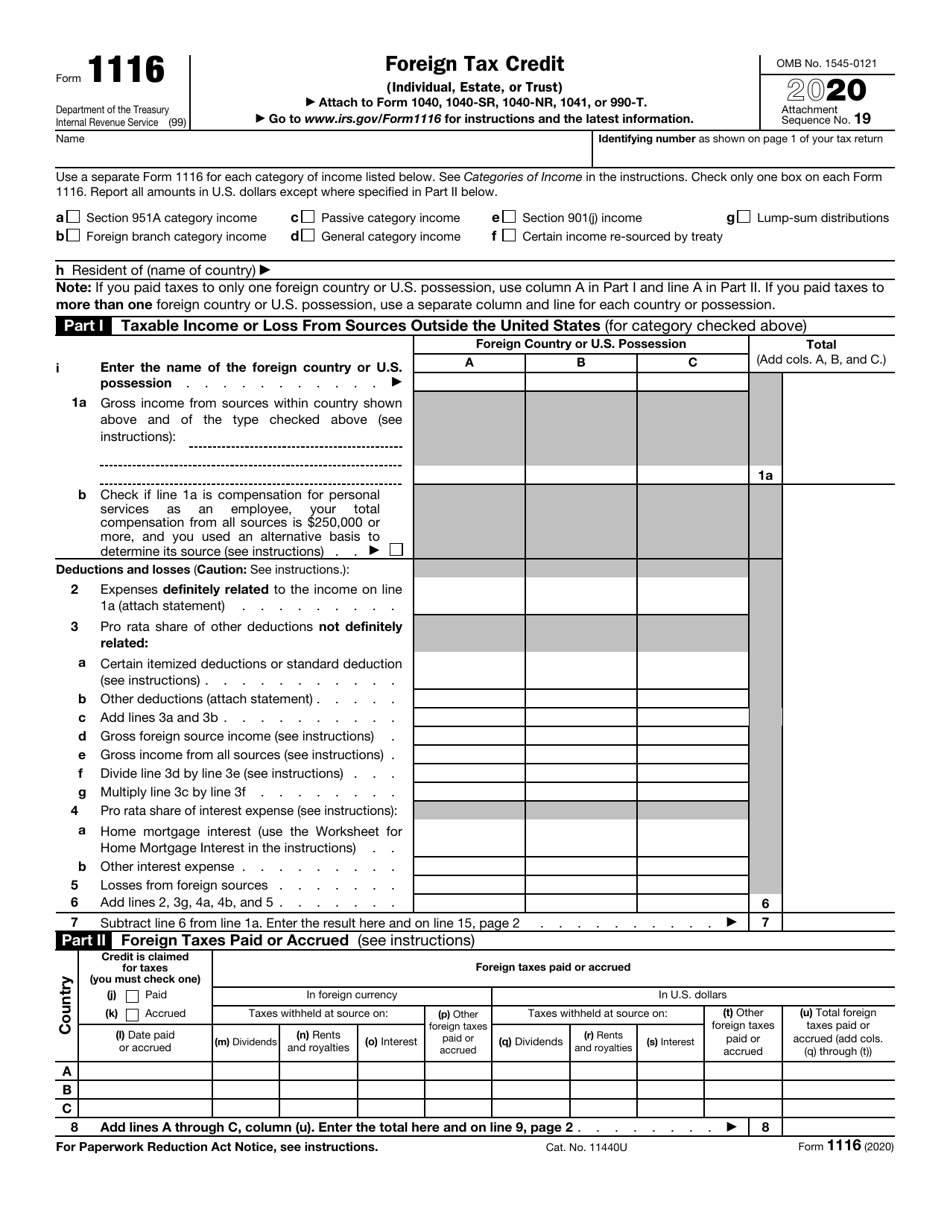

IRS Form 1116 Download Fillable PDF or Fill Online Foreign Tax Credit

What is form 1116 used for and how to claim the foreign tax credit? Taxpayers use to claim a credit. Guide to irs form 1116: Form 1116, officially known as the foreign tax credit (individual, estate, or trust), is an irs form that u.s. Taxpayers claim the foreign tax.

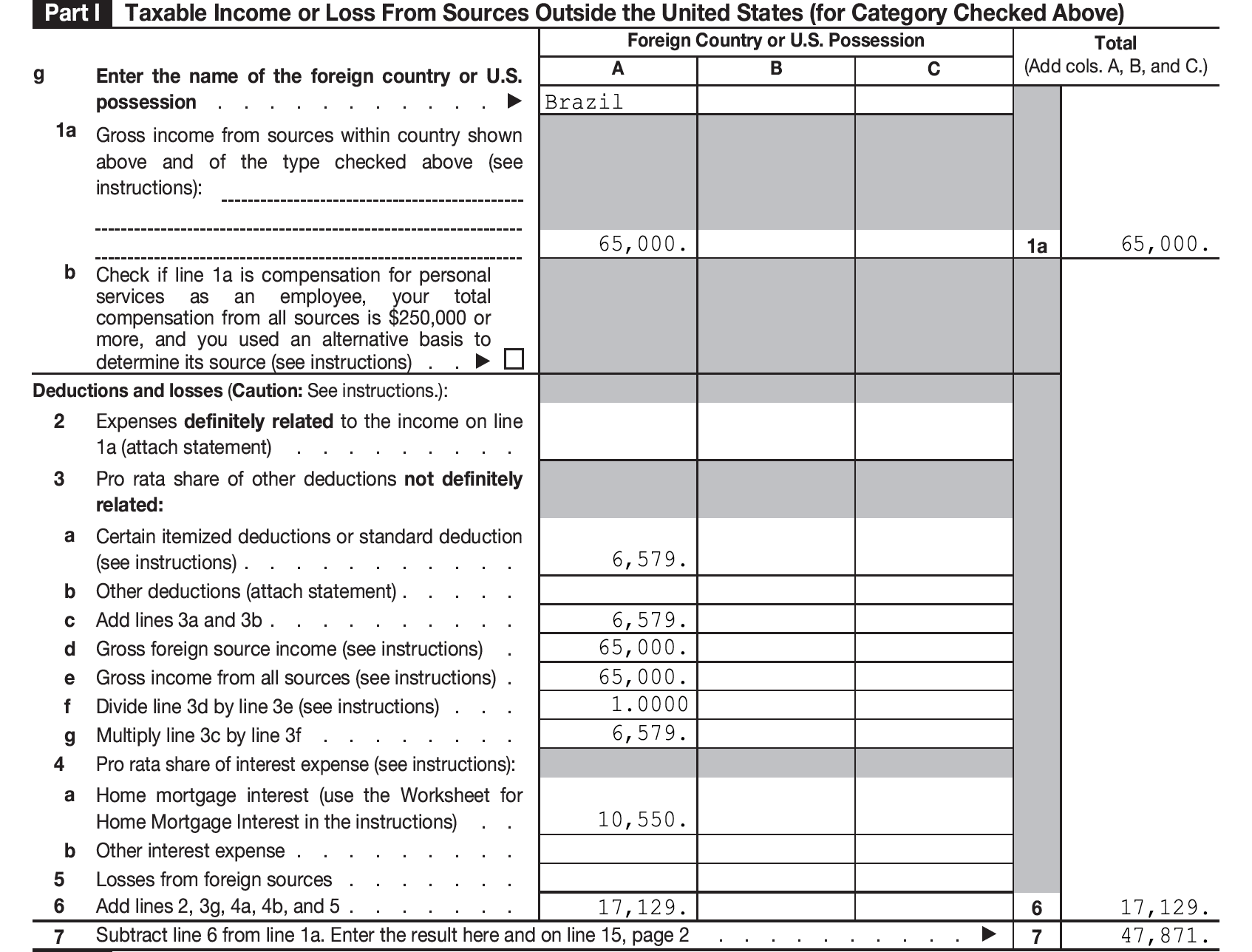

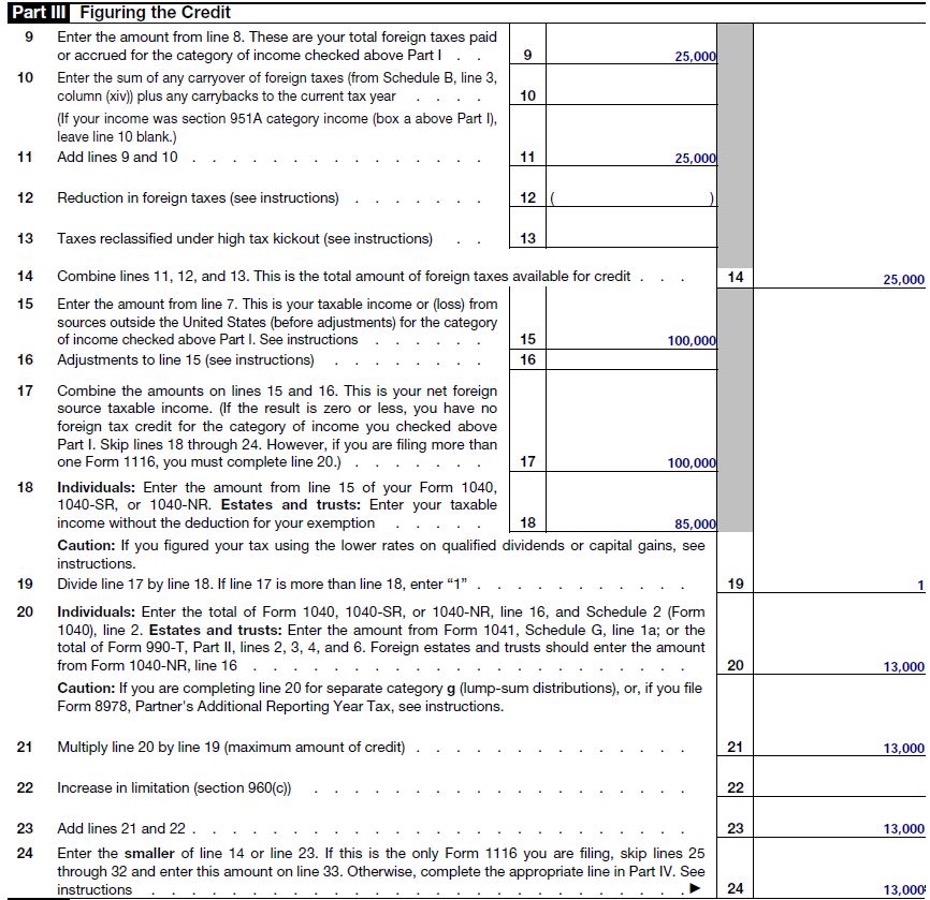

Filing Form 1116 Foreign Tax Credit (With Examples) TaxConnections

Taxpayers claim the foreign tax. Guide to irs form 1116: What is form 1116 used for and how to claim the foreign tax credit? Form 1116, officially known as the foreign tax credit (individual, estate, or trust), is an irs form that u.s. Instructions for form 1116 (2024) foreign tax credit (individual, estate, or trust) section references are to the.

Form 1116 Claiming the Foreign Tax Credit

Check if you qualify, claim the foreign tax credit, and avoid paying taxes twice on your foreign income. Form 1116, officially known as the foreign tax credit (individual, estate, or trust), is an irs form that u.s. Taxpayers claim the foreign tax. What is form 1116 used for and how to claim the foreign tax credit? Depending on the type.

Form 1116 Instructions for Expats Claiming the Foreign Tax Credit

Check if you qualify, claim the foreign tax credit, and avoid paying taxes twice on your foreign income. Depending on the type of foreign income you've earned and how much foreign tax you've paid, you may need to take different steps. Taxpayers use to claim a credit. What is form 1116 used for and how to claim the foreign tax.

How to File IRS Form 1116 for a Foreign Tax Credit on Compensation

Taxpayers claim the foreign tax. Check if you qualify, claim the foreign tax credit, and avoid paying taxes twice on your foreign income. What is form 1116 used for and how to claim the foreign tax credit? Instructions for form 1116 (2024) foreign tax credit (individual, estate, or trust) section references are to the internal revenue. Learn how form 1116.

IRS Form 1116 walkthrough (Foreign Tax Credit) YouTube

Instructions for form 1116 (2024) foreign tax credit (individual, estate, or trust) section references are to the internal revenue. Depending on the type of foreign income you've earned and how much foreign tax you've paid, you may need to take different steps. Taxpayers use to claim a credit. Learn how form 1116 helps u.s. Guide to irs form 1116:

Filing Form 1116 Foreign Tax Credit (With Examples) TaxConnections

Instructions for form 1116 (2024) foreign tax credit (individual, estate, or trust) section references are to the internal revenue. Guide to irs form 1116: Taxpayers use to claim a credit. Taxpayers claim the foreign tax. Depending on the type of foreign income you've earned and how much foreign tax you've paid, you may need to take different steps.

IRS Form 1116 Download Fillable PDF or Fill Online Foreign Tax Credit

Taxpayers claim the foreign tax. Instructions for form 1116 (2024) foreign tax credit (individual, estate, or trust) section references are to the internal revenue. What is form 1116 used for and how to claim the foreign tax credit? Form 1116, officially known as the foreign tax credit (individual, estate, or trust), is an irs form that u.s. Taxpayers use to.

Taxpayers Use To Claim A Credit.

Learn how form 1116 helps u.s. Taxpayers claim the foreign tax. Guide to irs form 1116: What is form 1116 used for and how to claim the foreign tax credit?

Check If You Qualify, Claim The Foreign Tax Credit, And Avoid Paying Taxes Twice On Your Foreign Income.

Form 1116, officially known as the foreign tax credit (individual, estate, or trust), is an irs form that u.s. Instructions for form 1116 (2024) foreign tax credit (individual, estate, or trust) section references are to the internal revenue. Depending on the type of foreign income you've earned and how much foreign tax you've paid, you may need to take different steps.