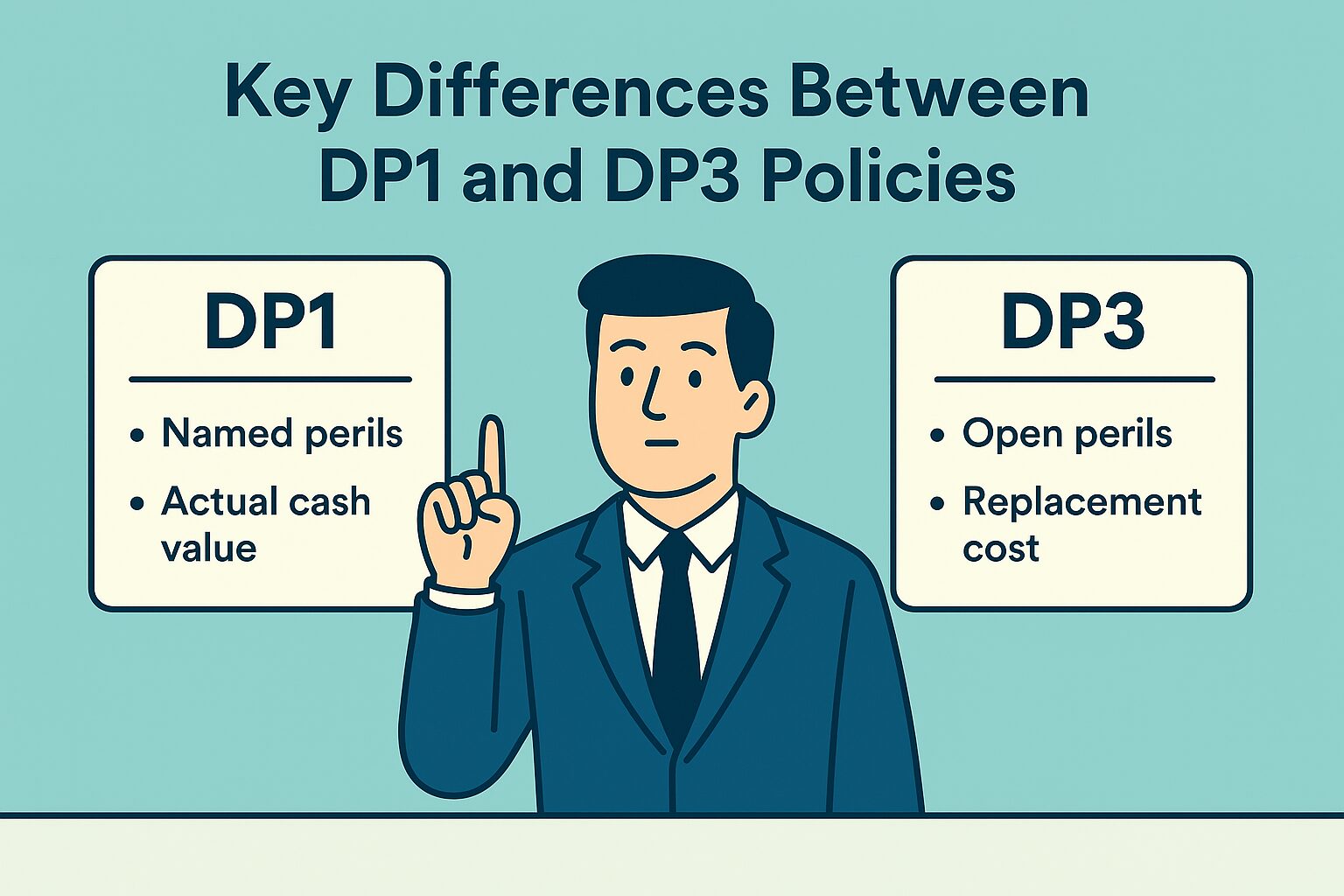

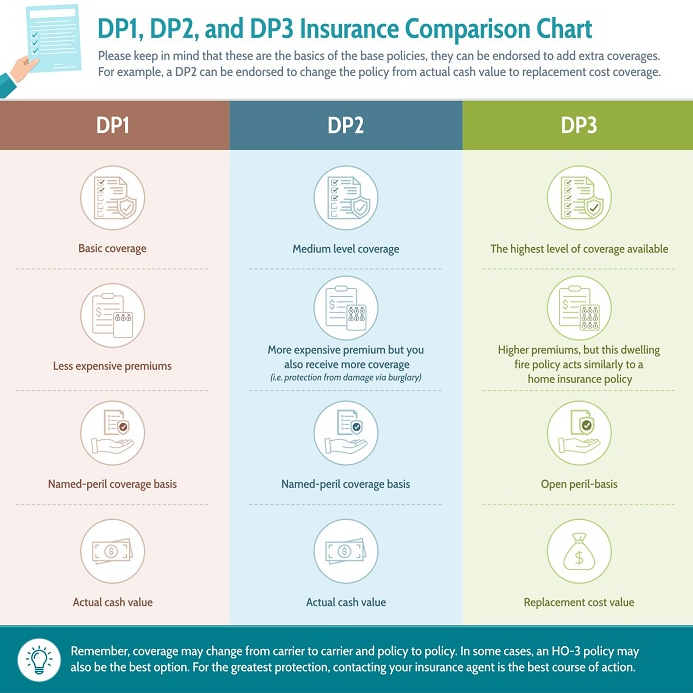

Dp1 Form - A dp1 policy, also called a dwelling fire form 1, is a named peril policy that provides coverage only for the specific risks or perils listed in the policy. A dp1 insurance policy is a type of dwelling fire insurance designed for properties that may not qualify for standard homeowners. It provides very basic insurance. This policy is often referred to as dwelling fire or property form 1, or dp1 insurance or basic coverage. Dp3 insurance policies and find the right coverage for you. Discover the key differences between dp1 vs.

This policy is often referred to as dwelling fire or property form 1, or dp1 insurance or basic coverage. It provides very basic insurance. Discover the key differences between dp1 vs. A dp1 insurance policy is a type of dwelling fire insurance designed for properties that may not qualify for standard homeowners. Dp3 insurance policies and find the right coverage for you. A dp1 policy, also called a dwelling fire form 1, is a named peril policy that provides coverage only for the specific risks or perils listed in the policy.

Discover the key differences between dp1 vs. A dp1 insurance policy is a type of dwelling fire insurance designed for properties that may not qualify for standard homeowners. Dp3 insurance policies and find the right coverage for you. This policy is often referred to as dwelling fire or property form 1, or dp1 insurance or basic coverage. It provides very basic insurance. A dp1 policy, also called a dwelling fire form 1, is a named peril policy that provides coverage only for the specific risks or perils listed in the policy.

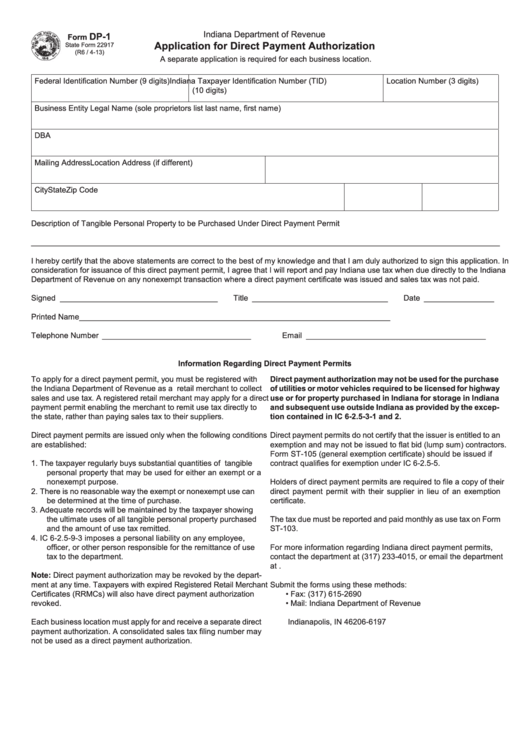

Fillable Form Dp1 Application For Direct Payment Authorization

It provides very basic insurance. A dp1 insurance policy is a type of dwelling fire insurance designed for properties that may not qualify for standard homeowners. This policy is often referred to as dwelling fire or property form 1, or dp1 insurance or basic coverage. A dp1 policy, also called a dwelling fire form 1, is a named peril policy.

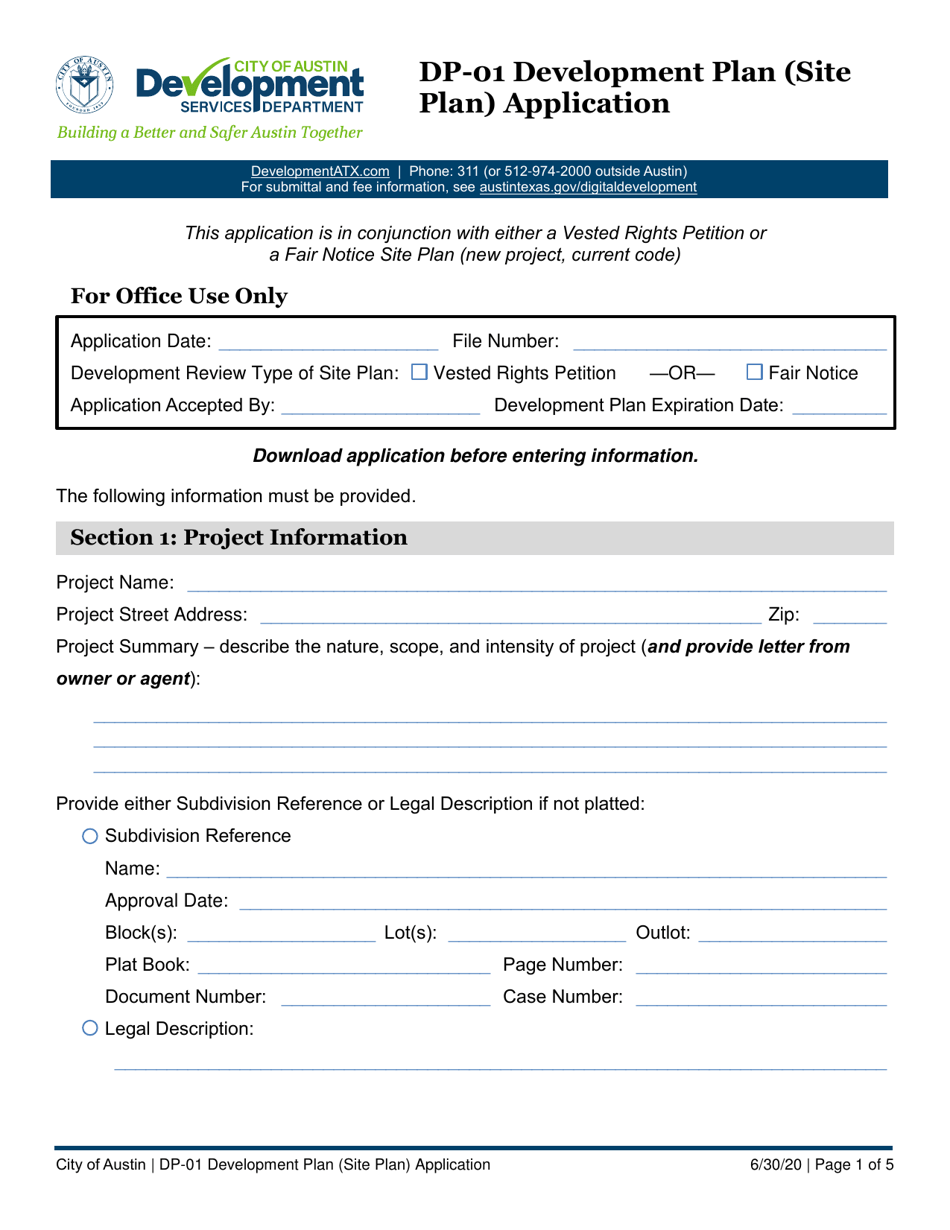

Form DP01 Fill Out, Sign Online and Download Fillable PDF, City of

It provides very basic insurance. A dp1 insurance policy is a type of dwelling fire insurance designed for properties that may not qualify for standard homeowners. A dp1 policy, also called a dwelling fire form 1, is a named peril policy that provides coverage only for the specific risks or perils listed in the policy. Dp3 insurance policies and find.

What Is Not Covered On A Dp1 at Leonard Richey blog

A dp1 policy, also called a dwelling fire form 1, is a named peril policy that provides coverage only for the specific risks or perils listed in the policy. This policy is often referred to as dwelling fire or property form 1, or dp1 insurance or basic coverage. It provides very basic insurance. Discover the key differences between dp1 vs..

What's the Difference Between DP1 vs DP3 Policies?

Discover the key differences between dp1 vs. Dp3 insurance policies and find the right coverage for you. A dp1 policy, also called a dwelling fire form 1, is a named peril policy that provides coverage only for the specific risks or perils listed in the policy. It provides very basic insurance. This policy is often referred to as dwelling fire.

Residential Property Insurance Coverages ppt download

A dp1 insurance policy is a type of dwelling fire insurance designed for properties that may not qualify for standard homeowners. Dp3 insurance policies and find the right coverage for you. A dp1 policy, also called a dwelling fire form 1, is a named peril policy that provides coverage only for the specific risks or perils listed in the policy..

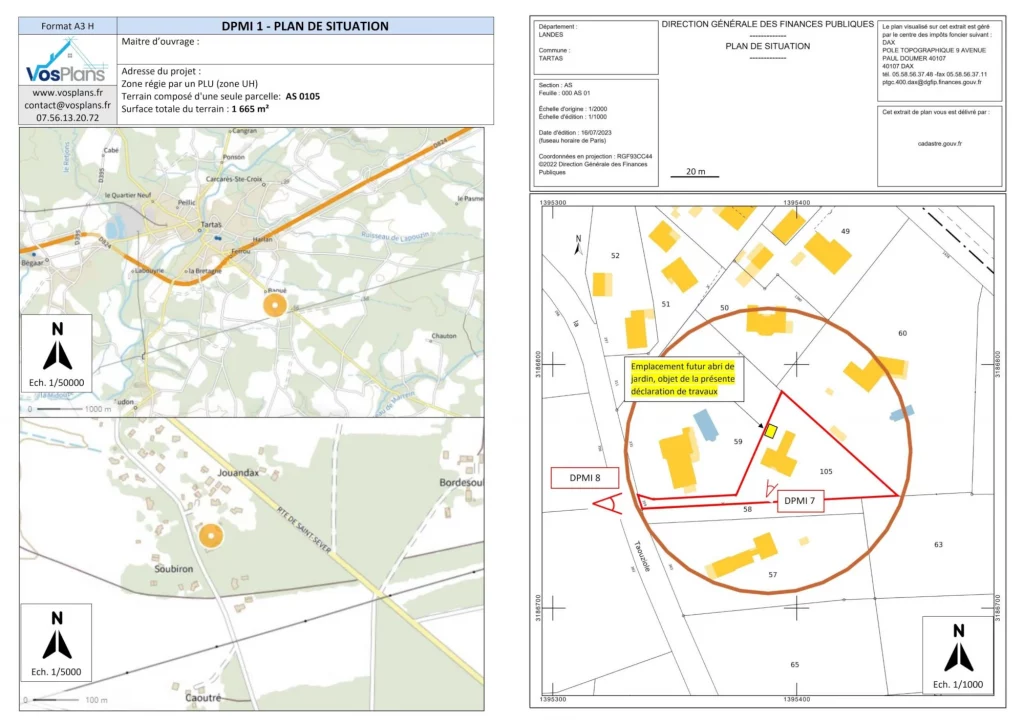

Plan de situation DPC1 un document INDISPENSABLE

This policy is often referred to as dwelling fire or property form 1, or dp1 insurance or basic coverage. A dp1 insurance policy is a type of dwelling fire insurance designed for properties that may not qualify for standard homeowners. It provides very basic insurance. Discover the key differences between dp1 vs. A dp1 policy, also called a dwelling fire.

Form DP1 Fill Out, Sign Online and Download Fillable PDF, California

Dp3 insurance policies and find the right coverage for you. A dp1 policy, also called a dwelling fire form 1, is a named peril policy that provides coverage only for the specific risks or perils listed in the policy. It provides very basic insurance. This policy is often referred to as dwelling fire or property form 1, or dp1 insurance.

Dwelling Fire Insurance vs. Homeowners Insurance

It provides very basic insurance. This policy is often referred to as dwelling fire or property form 1, or dp1 insurance or basic coverage. Discover the key differences between dp1 vs. Dp3 insurance policies and find the right coverage for you. A dp1 policy, also called a dwelling fire form 1, is a named peril policy that provides coverage only.

Fillable Online LLOYDS OF LONDON DWELLING PROGRAM (DP1 FORM) Fax Email

Discover the key differences between dp1 vs. A dp1 insurance policy is a type of dwelling fire insurance designed for properties that may not qualify for standard homeowners. This policy is often referred to as dwelling fire or property form 1, or dp1 insurance or basic coverage. Dp3 insurance policies and find the right coverage for you. It provides very.

DP1 vs DP3 What Dwelling Policy Do You Need?

A dp1 policy, also called a dwelling fire form 1, is a named peril policy that provides coverage only for the specific risks or perils listed in the policy. This policy is often referred to as dwelling fire or property form 1, or dp1 insurance or basic coverage. A dp1 insurance policy is a type of dwelling fire insurance designed.

It Provides Very Basic Insurance.

Discover the key differences between dp1 vs. A dp1 policy, also called a dwelling fire form 1, is a named peril policy that provides coverage only for the specific risks or perils listed in the policy. This policy is often referred to as dwelling fire or property form 1, or dp1 insurance or basic coverage. Dp3 insurance policies and find the right coverage for you.