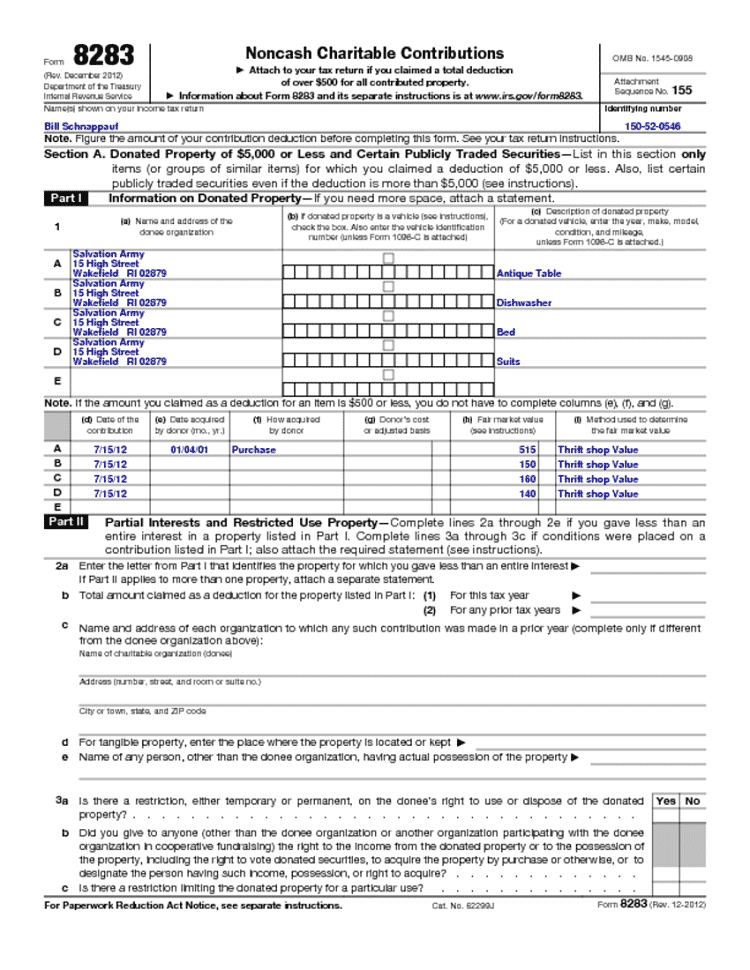

Charitable Contributions Form - Form 8283 is used to report noncash charitable contributions of $500 or more. The irs provides comprehensive instructions for form 8283, which includes a thorough explanation of each section and the. Generally, to deduct a charitable contribution, you must itemize deductions on schedule a (form 1040). Many individuals and businesses choose to make noncash charitable. Charitable donations are not just limited to cash contributions. Business entities and individual taxpayers who donate over $500 worth of noncash charitable contributions to qualifying. Irs form 8283, noncash charitable contributions, is a document that taxpayers must complete to report noncash donations valued over $500 made within. It provides important information about the donated items,. The amount of your deduction may be limited if. Information about form 8283, noncash charitable contributions, including recent updates, related forms and instructions on how to file.

Form 8283 is used to report noncash charitable contributions of $500 or more. Information about form 8283, noncash charitable contributions, including recent updates, related forms and instructions on how to file. Many individuals and businesses choose to make noncash charitable. Generally, to deduct a charitable contribution, you must itemize deductions on schedule a (form 1040). It provides important information about the donated items,. Irs form 8283, noncash charitable contributions, is a document that taxpayers must complete to report noncash donations valued over $500 made within. Charitable donations are not just limited to cash contributions. Business entities and individual taxpayers who donate over $500 worth of noncash charitable contributions to qualifying. The amount of your deduction may be limited if. The irs provides comprehensive instructions for form 8283, which includes a thorough explanation of each section and the.

Irs form 8283, noncash charitable contributions, is a document that taxpayers must complete to report noncash donations valued over $500 made within. Information about form 8283, noncash charitable contributions, including recent updates, related forms and instructions on how to file. Form 8283 is used to report noncash charitable contributions of $500 or more. Irs form 8283, noncash charitable contributions, is required when an individual, partnership, or corporation donates property. Many individuals and businesses choose to make noncash charitable. It provides important information about the donated items,. Business entities and individual taxpayers who donate over $500 worth of noncash charitable contributions to qualifying. Generally, to deduct a charitable contribution, you must itemize deductions on schedule a (form 1040). The irs provides comprehensive instructions for form 8283, which includes a thorough explanation of each section and the. The amount of your deduction may be limited if.

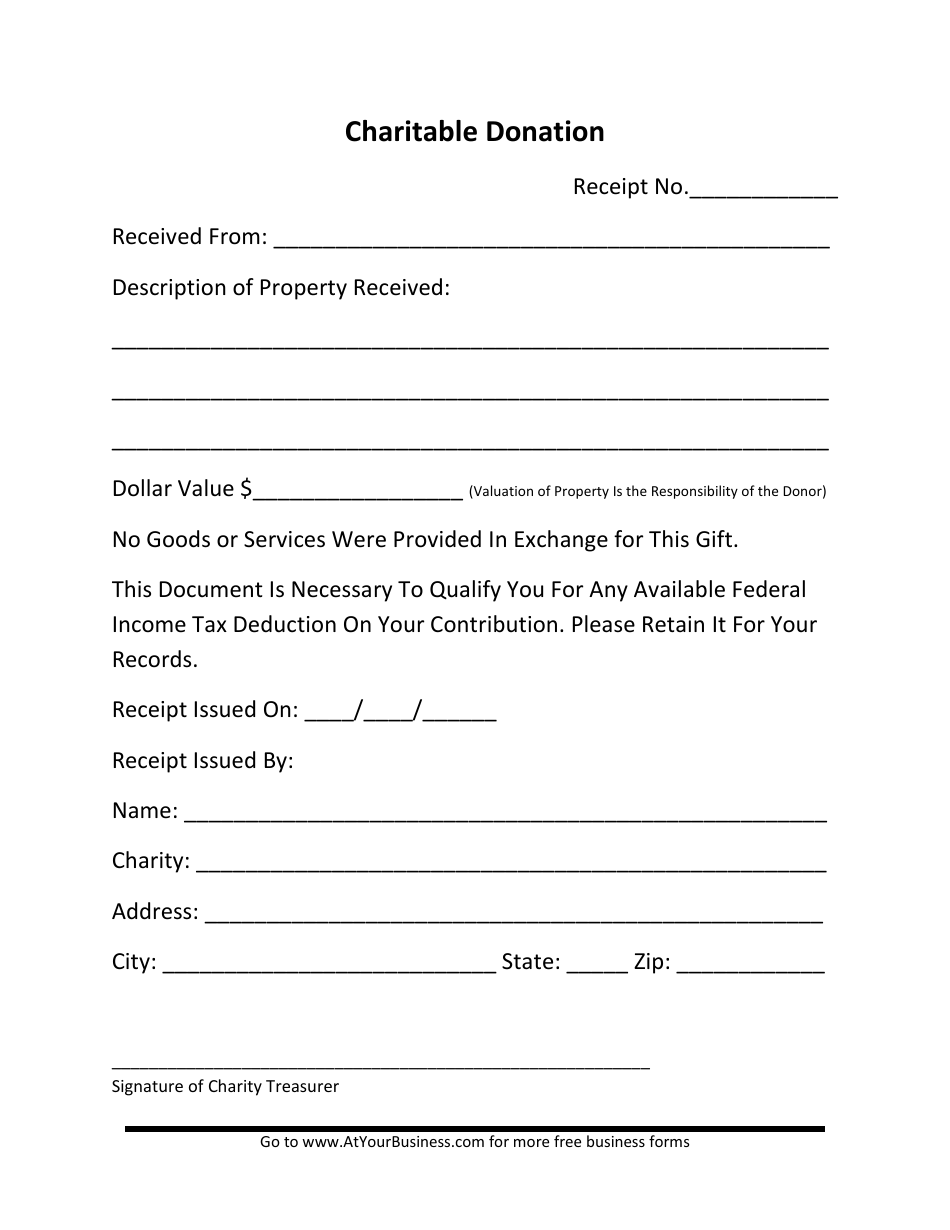

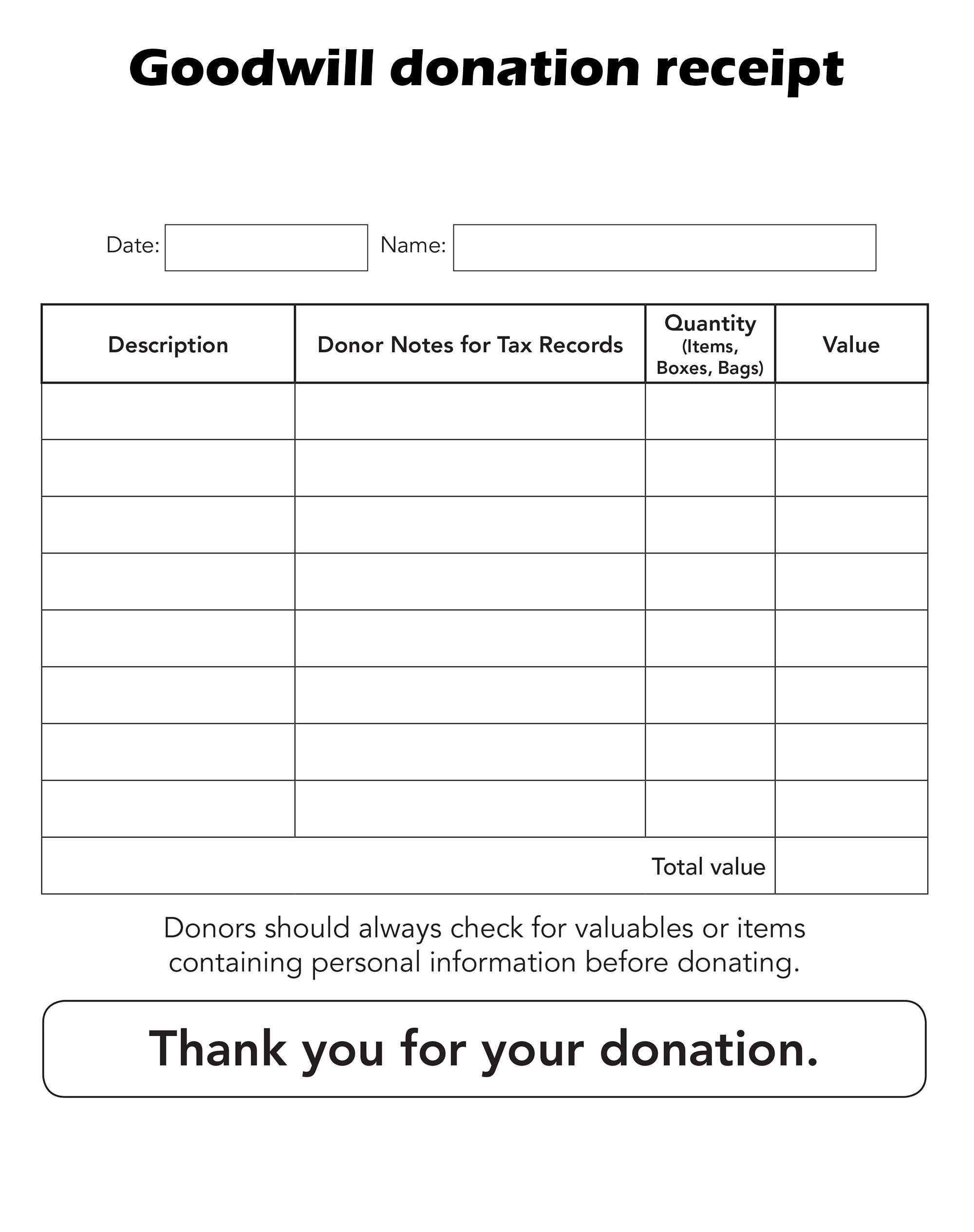

Charitable Donation Form Fill Out, Sign Online and Download PDF

Business entities and individual taxpayers who donate over $500 worth of noncash charitable contributions to qualifying. Irs form 8283, noncash charitable contributions, is required when an individual, partnership, or corporation donates property. The amount of your deduction may be limited if. The irs provides comprehensive instructions for form 8283, which includes a thorough explanation of each section and the. Charitable.

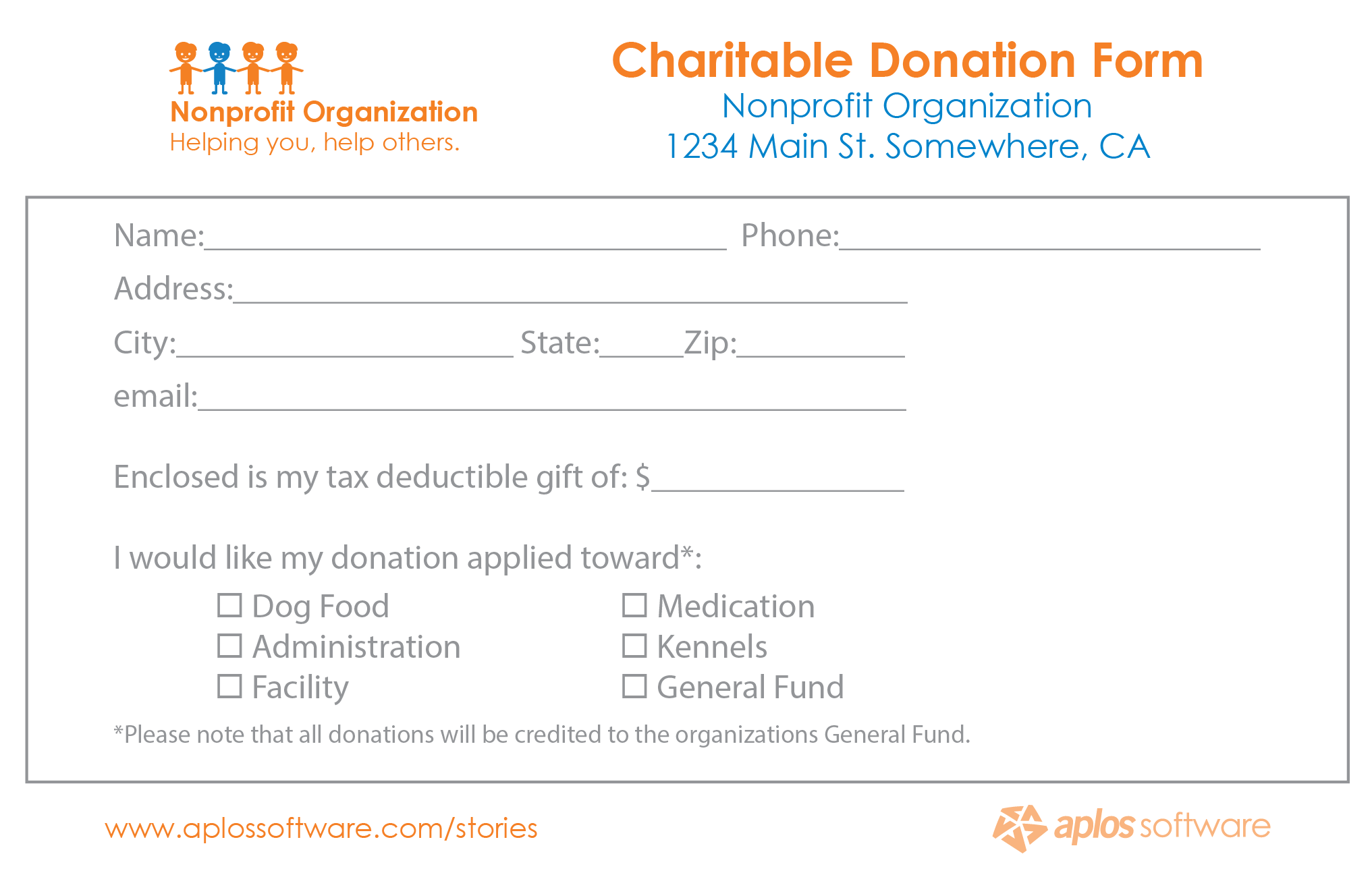

Charity Donation Template

Generally, to deduct a charitable contribution, you must itemize deductions on schedule a (form 1040). Irs form 8283, noncash charitable contributions, is a document that taxpayers must complete to report noncash donations valued over $500 made within. It provides important information about the donated items,. Information about form 8283, noncash charitable contributions, including recent updates, related forms and instructions on.

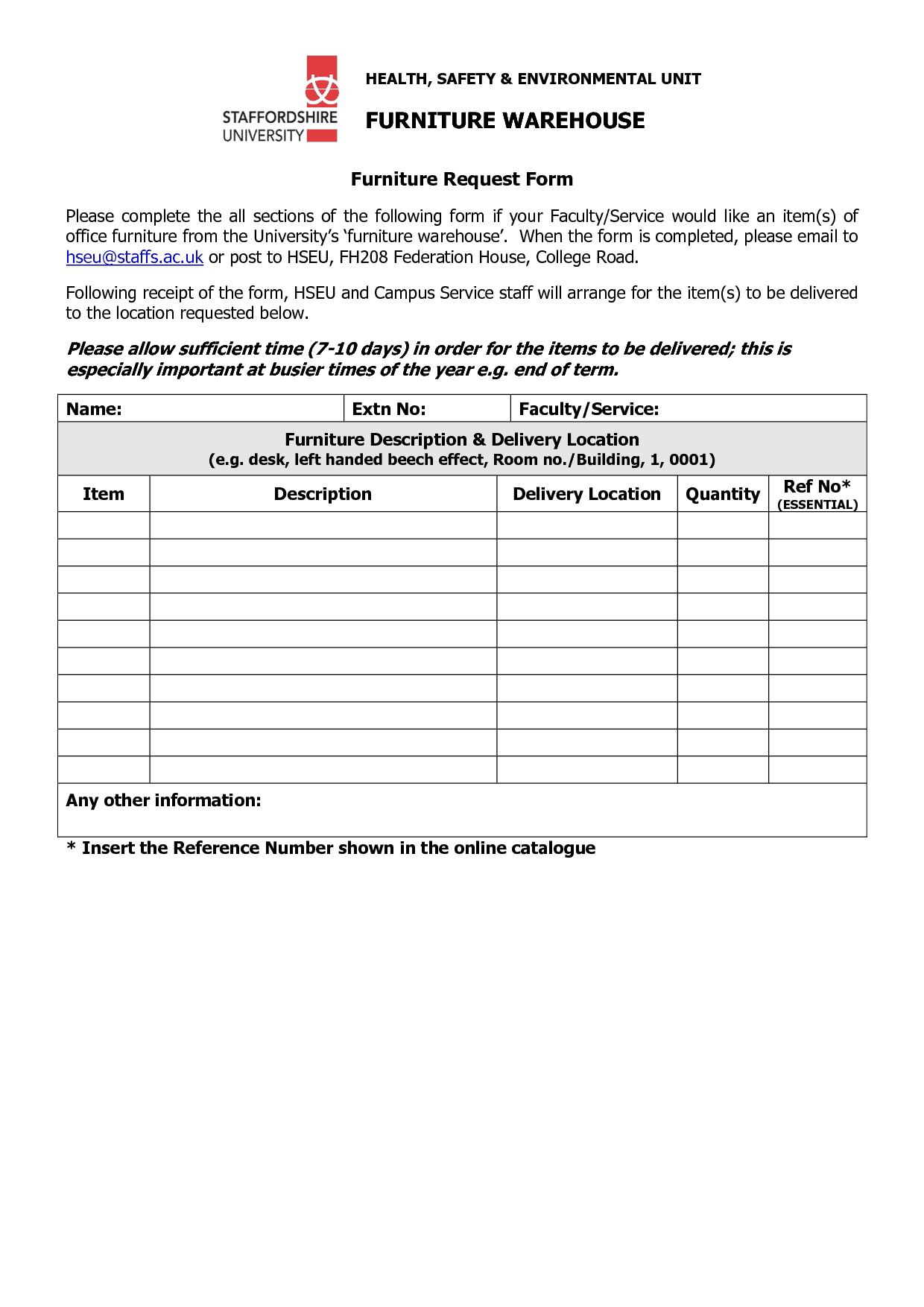

36+ Free Donation Form Templates in Word Excel PDF

The irs provides comprehensive instructions for form 8283, which includes a thorough explanation of each section and the. Information about form 8283, noncash charitable contributions, including recent updates, related forms and instructions on how to file. It provides important information about the donated items,. Many individuals and businesses choose to make noncash charitable. Irs form 8283, noncash charitable contributions, is.

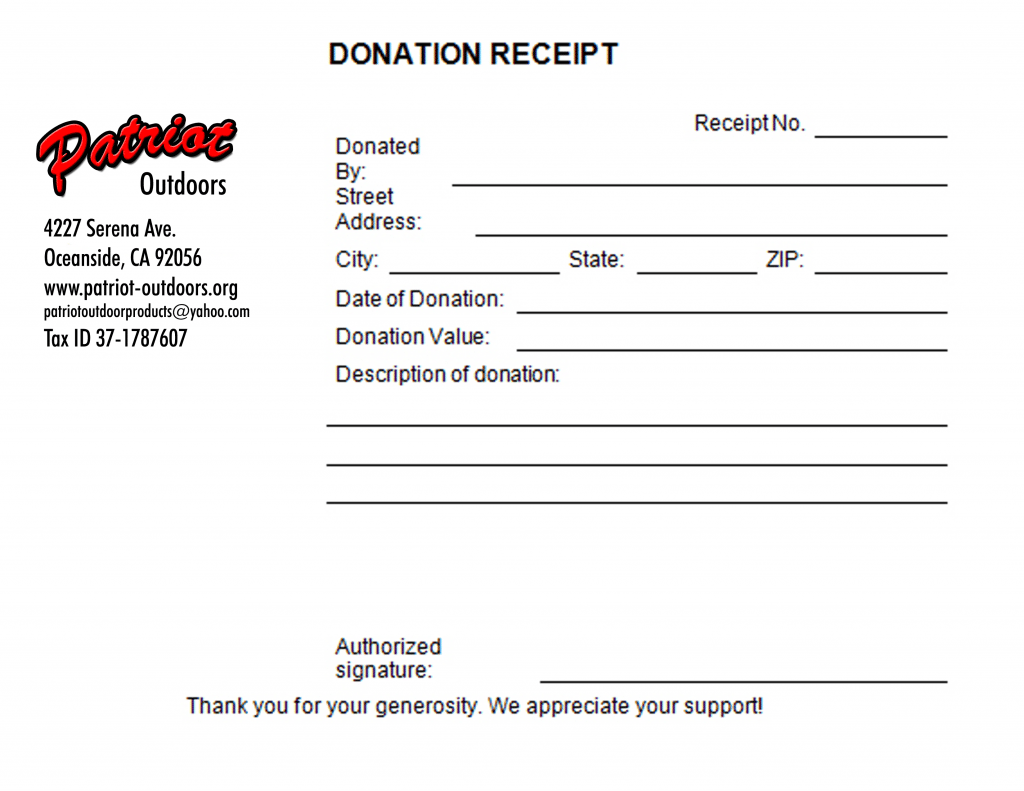

Charitable Donation Receipt Template Excel Templates

Generally, to deduct a charitable contribution, you must itemize deductions on schedule a (form 1040). Information about form 8283, noncash charitable contributions, including recent updates, related forms and instructions on how to file. Irs form 8283, noncash charitable contributions, is required when an individual, partnership, or corporation donates property. The irs provides comprehensive instructions for form 8283, which includes a.

Goodwill Donation Form Template Word PDF Google Docs Highfile

Generally, to deduct a charitable contribution, you must itemize deductions on schedule a (form 1040). Irs form 8283, noncash charitable contributions, is a document that taxpayers must complete to report noncash donations valued over $500 made within. It provides important information about the donated items,. Information about form 8283, noncash charitable contributions, including recent updates, related forms and instructions on.

Printable Donation List Template

Business entities and individual taxpayers who donate over $500 worth of noncash charitable contributions to qualifying. It provides important information about the donated items,. Information about form 8283, noncash charitable contributions, including recent updates, related forms and instructions on how to file. Irs form 8283, noncash charitable contributions, is a document that taxpayers must complete to report noncash donations valued.

Free Charitable Donation Request Form Template

Business entities and individual taxpayers who donate over $500 worth of noncash charitable contributions to qualifying. The amount of your deduction may be limited if. Generally, to deduct a charitable contribution, you must itemize deductions on schedule a (form 1040). Irs form 8283, noncash charitable contributions, is required when an individual, partnership, or corporation donates property. Many individuals and businesses.

Charitable Donations Tax Deduction Worksheet

Irs form 8283, noncash charitable contributions, is a document that taxpayers must complete to report noncash donations valued over $500 made within. Generally, to deduct a charitable contribution, you must itemize deductions on schedule a (form 1040). The amount of your deduction may be limited if. Irs form 8283, noncash charitable contributions, is required when an individual, partnership, or corporation.

Charitable Contribution Carryover Worksheets

Irs form 8283, noncash charitable contributions, is a document that taxpayers must complete to report noncash donations valued over $500 made within. Charitable donations are not just limited to cash contributions. Many individuals and businesses choose to make noncash charitable. Generally, to deduct a charitable contribution, you must itemize deductions on schedule a (form 1040). Information about form 8283, noncash.

Charitable Contributions and How to Handle the Tax Deductions

Charitable donations are not just limited to cash contributions. Irs form 8283, noncash charitable contributions, is required when an individual, partnership, or corporation donates property. The irs provides comprehensive instructions for form 8283, which includes a thorough explanation of each section and the. It provides important information about the donated items,. Information about form 8283, noncash charitable contributions, including recent.

It Provides Important Information About The Donated Items,.

Irs form 8283, noncash charitable contributions, is required when an individual, partnership, or corporation donates property. Irs form 8283, noncash charitable contributions, is a document that taxpayers must complete to report noncash donations valued over $500 made within. The amount of your deduction may be limited if. Generally, to deduct a charitable contribution, you must itemize deductions on schedule a (form 1040).

Many Individuals And Businesses Choose To Make Noncash Charitable.

Business entities and individual taxpayers who donate over $500 worth of noncash charitable contributions to qualifying. Charitable donations are not just limited to cash contributions. Form 8283 is used to report noncash charitable contributions of $500 or more. The irs provides comprehensive instructions for form 8283, which includes a thorough explanation of each section and the.