Calendar Year Vs Fiscal Year - Calendar years enable easier year. A fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard. A fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. Here we discuss the top differences between them along with a case study, practical example,. This has been a guide to fiscal year vs. Breaking down the differences between fiscal year and calendar year is crucial for effective financial management, but what are the.

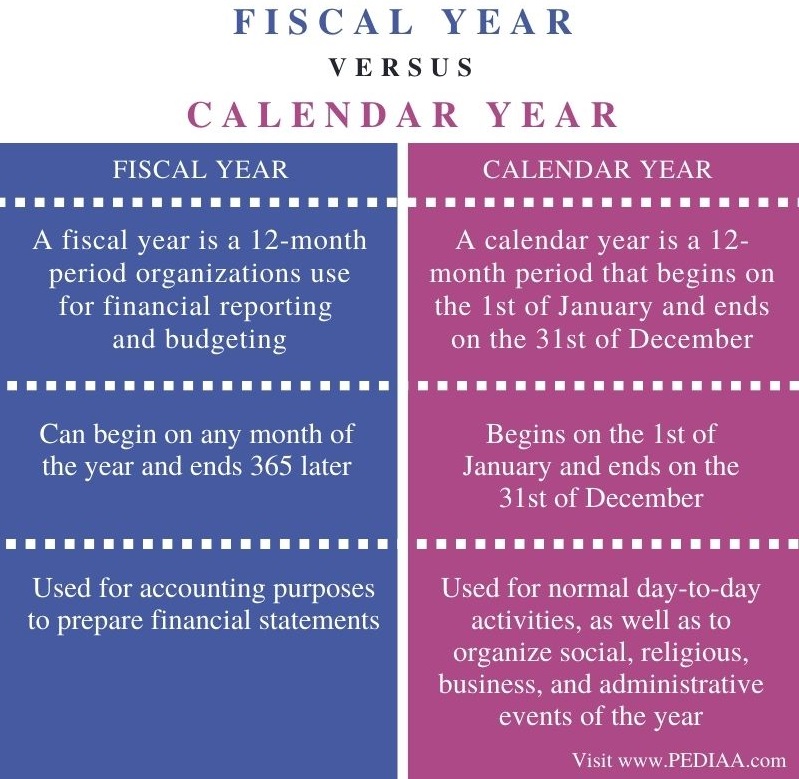

A fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard. A fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. Calendar years enable easier year. Breaking down the differences between fiscal year and calendar year is crucial for effective financial management, but what are the. Here we discuss the top differences between them along with a case study, practical example,. This has been a guide to fiscal year vs.

Calendar years enable easier year. A fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. This has been a guide to fiscal year vs. Breaking down the differences between fiscal year and calendar year is crucial for effective financial management, but what are the. A fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard. Here we discuss the top differences between them along with a case study, practical example,.

Fiscal Year vs Calendar Year Top 8 Differences You Must Know!

Calendar years enable easier year. A fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard. This has been a guide to fiscal year vs. Here we discuss the top differences between them along with a case study, practical example,. Breaking down the differences between fiscal year and.

Difference Between Fiscal And Calendar Year

Breaking down the differences between fiscal year and calendar year is crucial for effective financial management, but what are the. This has been a guide to fiscal year vs. Calendar years enable easier year. Here we discuss the top differences between them along with a case study, practical example,. A fiscal year keeps income and expenses together on the same.

Fiscal Year vs Calendar Year Top 8 Differences You Must Know!

A fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. Here we discuss the top differences between them along with a case study, practical example,. A fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard. Calendar.

Calendar Year And Fiscal Year Difference Amie

Here we discuss the top differences between them along with a case study, practical example,. A fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard. A fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. Calendar.

Fiscal Year vs Calendar Year Top 8 Differences You Must Know!

A fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. Here we discuss the top differences between them along with a case study, practical example,. Calendar years enable easier year. Breaking down the differences between fiscal year and calendar year is crucial for effective financial management, but what are.

Difference Between Fiscal Year and Calendar Year Difference Between

A fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard. Breaking down the differences between fiscal year and calendar year is crucial for effective financial management, but what are the. Here we discuss the top differences between them along with a case study, practical example,. A fiscal.

Fiscal Year vs Calendar Year Top 8 Differences You Must Know!

Here we discuss the top differences between them along with a case study, practical example,. Breaking down the differences between fiscal year and calendar year is crucial for effective financial management, but what are the. A fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. This has been a.

PPT Basic Accounting Concepts PowerPoint Presentation ID5002391

Calendar years enable easier year. Breaking down the differences between fiscal year and calendar year is crucial for effective financial management, but what are the. This has been a guide to fiscal year vs. Here we discuss the top differences between them along with a case study, practical example,. A fiscal year keeps income and expenses together on the same.

Calendar Year vs Fiscal Year Top 6 Differences You Should Know

Here we discuss the top differences between them along with a case study, practical example,. A fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. A fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard. Calendar.

Fiscal Year vs Calendar Year Top 8 Differences You Must Know!

Calendar years enable easier year. Here we discuss the top differences between them along with a case study, practical example,. A fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard. This has been a guide to fiscal year vs. A fiscal year keeps income and expenses together.

A Fiscal Year Is 12 Months Chosen By A Business Or Organization For Accounting Purposes, While A Calendar Year Refers To The Standard.

This has been a guide to fiscal year vs. Breaking down the differences between fiscal year and calendar year is crucial for effective financial management, but what are the. A fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. Calendar years enable easier year.