Calendar Spreads - Calendar spreads are options strategies that require one long and short position at the same strike price with different expiration dates. A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same. Options calendar spreads are a versatile strategy for capturing opportunities created by volatility, time decay, and the underlying asset’s lack of or. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the.

Calendar spreads are options strategies that require one long and short position at the same strike price with different expiration dates. A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same. A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. Options calendar spreads are a versatile strategy for capturing opportunities created by volatility, time decay, and the underlying asset’s lack of or. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the.

A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same. Options calendar spreads are a versatile strategy for capturing opportunities created by volatility, time decay, and the underlying asset’s lack of or. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the. Calendar spreads are options strategies that require one long and short position at the same strike price with different expiration dates. A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias.

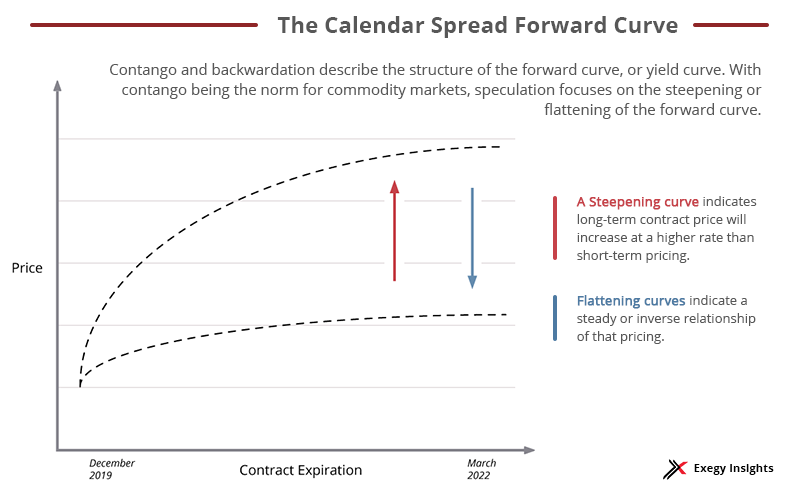

Getting Started with Calendar Spreads in Futures Exegy

Options calendar spreads are a versatile strategy for capturing opportunities created by volatility, time decay, and the underlying asset’s lack of or. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the. Calendar spreads are options strategies that require one long and short position at the same.

The Calendar Spread Options Strategy (and How to Build with Alpaca)

A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the. Calendar spreads are options strategies that require one long and short position at the same strike price with different expiration dates. Options calendar spreads are a versatile strategy for capturing opportunities created by volatility, time decay, and.

Calendar Spread Options Kelsy Mellisa

Options calendar spreads are a versatile strategy for capturing opportunities created by volatility, time decay, and the underlying asset’s lack of or. Calendar spreads are options strategies that require one long and short position at the same strike price with different expiration dates. A calendar spread, also known as a time spread, is an options trading strategy that involves buying.

Calendar Spread Definition, Option Strategy, Types, Examples

A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the. A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. Calendar spreads are options strategies that require one long and short position at the same strike.

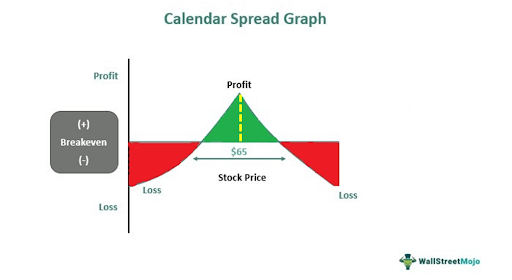

How to Trade Options Calendar Spreads (Visuals and Examples)

Calendar spreads are options strategies that require one long and short position at the same strike price with different expiration dates. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the. A calendar spread allows option traders to take advantage of elevated premium in near term options.

What is a Calendar Spread?

Calendar spreads are options strategies that require one long and short position at the same strike price with different expiration dates. A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. Options calendar spreads are a versatile strategy for capturing opportunities created by volatility, time decay, and the underlying.

How Calendar Spreads Work (Best Explanation) projectoption

A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. Options calendar spreads are a versatile strategy for capturing opportunities created by volatility, time decay, and the underlying asset’s lack of or. A calendar spread is an options or futures strategy where an investor simultaneously enters long and short.

Calendar Spreads Option Trading Strategies Beginner's Guide to the

A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. Calendar spreads are options strategies that require one long and short position at the same strike price with different expiration dates. A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions.

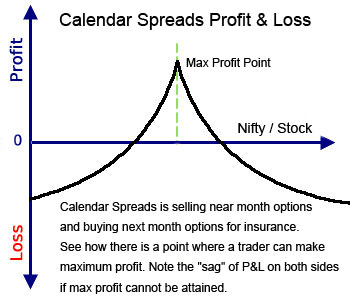

How To Trade Neutral Calendar Spreads 3 Nifty Option Strategies

A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. Options calendar spreads are a versatile strategy for capturing opportunities created by volatility, time decay, and the underlying asset’s lack of or. A calendar spread, also known as a time spread, is an options trading strategy that involves buying.

Everything You Need to Know About Calendar Spreads SoFi

Calendar spreads are options strategies that require one long and short position at the same strike price with different expiration dates. A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and.

Calendar Spreads Are Options Strategies That Require One Long And Short Position At The Same Strike Price With Different Expiration Dates.

A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the. Options calendar spreads are a versatile strategy for capturing opportunities created by volatility, time decay, and the underlying asset’s lack of or.