Acrolon 100 Data Sheet - In essence, we can write custom automated market makers (amms) that are highly composable with onchain exchanges (e.g. The first thing to understand before deep diving into uniswap is the mechanics of an amm and the differences with the traditional. For example, suppose a liquidity provider deposits 100 units of token a and 50. This formula is used in uniswap, one of the most popular amms. With the launch of uniswap v3, the protocol introduced the ability to provide liquidity within a specific and concentrated price range. Uniswap v3's concentrated liquidity and flexible fees contrast balancer's dynamic pools and automated portfolio management.

Uniswap v3's concentrated liquidity and flexible fees contrast balancer's dynamic pools and automated portfolio management. This formula is used in uniswap, one of the most popular amms. With the launch of uniswap v3, the protocol introduced the ability to provide liquidity within a specific and concentrated price range. For example, suppose a liquidity provider deposits 100 units of token a and 50. In essence, we can write custom automated market makers (amms) that are highly composable with onchain exchanges (e.g. The first thing to understand before deep diving into uniswap is the mechanics of an amm and the differences with the traditional.

Uniswap v3's concentrated liquidity and flexible fees contrast balancer's dynamic pools and automated portfolio management. For example, suppose a liquidity provider deposits 100 units of token a and 50. In essence, we can write custom automated market makers (amms) that are highly composable with onchain exchanges (e.g. With the launch of uniswap v3, the protocol introduced the ability to provide liquidity within a specific and concentrated price range. This formula is used in uniswap, one of the most popular amms. The first thing to understand before deep diving into uniswap is the mechanics of an amm and the differences with the traditional.

ACROLON PDF

Uniswap v3's concentrated liquidity and flexible fees contrast balancer's dynamic pools and automated portfolio management. This formula is used in uniswap, one of the most popular amms. The first thing to understand before deep diving into uniswap is the mechanics of an amm and the differences with the traditional. With the launch of uniswap v3, the protocol introduced the ability.

(PDF) Data sheet Temperature controller type EKC 100 Kosim Data Sheet

For example, suppose a liquidity provider deposits 100 units of token a and 50. This formula is used in uniswap, one of the most popular amms. Uniswap v3's concentrated liquidity and flexible fees contrast balancer's dynamic pools and automated portfolio management. In essence, we can write custom automated market makers (amms) that are highly composable with onchain exchanges (e.g. The.

Home page

This formula is used in uniswap, one of the most popular amms. In essence, we can write custom automated market makers (amms) that are highly composable with onchain exchanges (e.g. Uniswap v3's concentrated liquidity and flexible fees contrast balancer's dynamic pools and automated portfolio management. The first thing to understand before deep diving into uniswap is the mechanics of an.

Dymonic 100 Data Sheet PDF Concrete Civil Engineering

In essence, we can write custom automated market makers (amms) that are highly composable with onchain exchanges (e.g. This formula is used in uniswap, one of the most popular amms. For example, suppose a liquidity provider deposits 100 units of token a and 50. Uniswap v3's concentrated liquidity and flexible fees contrast balancer's dynamic pools and automated portfolio management. The.

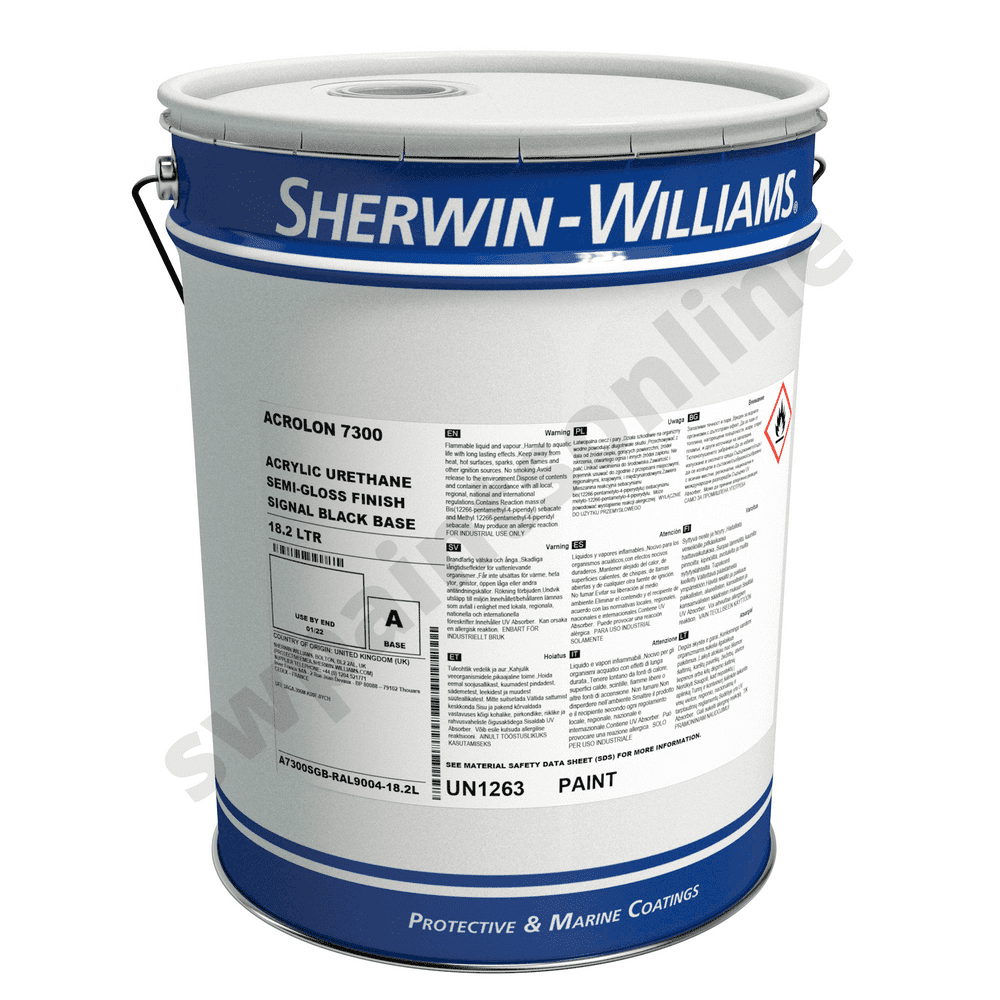

Sherwin Williams Acrolon 7300 Finish Standard Colours

For example, suppose a liquidity provider deposits 100 units of token a and 50. The first thing to understand before deep diving into uniswap is the mechanics of an amm and the differences with the traditional. With the launch of uniswap v3, the protocol introduced the ability to provide liquidity within a specific and concentrated price range. In essence, we.

ACROLON_25 Nandrolone Decanoate 25mg Acrowell Labs

For example, suppose a liquidity provider deposits 100 units of token a and 50. With the launch of uniswap v3, the protocol introduced the ability to provide liquidity within a specific and concentrated price range. In essence, we can write custom automated market makers (amms) that are highly composable with onchain exchanges (e.g. Uniswap v3's concentrated liquidity and flexible fees.

Acrolon 7300 Acrylic Urethane Gloss Finish PDF Varnish Chemistry

Uniswap v3's concentrated liquidity and flexible fees contrast balancer's dynamic pools and automated portfolio management. For example, suppose a liquidity provider deposits 100 units of token a and 50. This formula is used in uniswap, one of the most popular amms. With the launch of uniswap v3, the protocol introduced the ability to provide liquidity within a specific and concentrated.

U01355 Acrolon 355 PDF Pintura acrilica Tecnicas artisticas

With the launch of uniswap v3, the protocol introduced the ability to provide liquidity within a specific and concentrated price range. The first thing to understand before deep diving into uniswap is the mechanics of an amm and the differences with the traditional. Uniswap v3's concentrated liquidity and flexible fees contrast balancer's dynamic pools and automated portfolio management. In essence,.

Acrolon 7300 PDS PDF

Uniswap v3's concentrated liquidity and flexible fees contrast balancer's dynamic pools and automated portfolio management. In essence, we can write custom automated market makers (amms) that are highly composable with onchain exchanges (e.g. For example, suppose a liquidity provider deposits 100 units of token a and 50. The first thing to understand before deep diving into uniswap is the mechanics.

58 Acrolon 355 Cinza PDF

In essence, we can write custom automated market makers (amms) that are highly composable with onchain exchanges (e.g. With the launch of uniswap v3, the protocol introduced the ability to provide liquidity within a specific and concentrated price range. This formula is used in uniswap, one of the most popular amms. For example, suppose a liquidity provider deposits 100 units.

Uniswap V3'S Concentrated Liquidity And Flexible Fees Contrast Balancer's Dynamic Pools And Automated Portfolio Management.

In essence, we can write custom automated market makers (amms) that are highly composable with onchain exchanges (e.g. With the launch of uniswap v3, the protocol introduced the ability to provide liquidity within a specific and concentrated price range. For example, suppose a liquidity provider deposits 100 units of token a and 50. This formula is used in uniswap, one of the most popular amms.