943 Form - An employer generally files form 943 if they meet certain wage thresholds for agricultural labor as defined by the irs. Information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and. If you have an agricultural business, you need to understand irs form 943 for tax purposes. Form 943 is an annual federal tax return used by agricultural employers who pay taxable wages to their employees for farm labor. Below, we’re breaking down everything.

Below, we’re breaking down everything. Form 943 is an annual federal tax return used by agricultural employers who pay taxable wages to their employees for farm labor. If you have an agricultural business, you need to understand irs form 943 for tax purposes. Information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and. An employer generally files form 943 if they meet certain wage thresholds for agricultural labor as defined by the irs.

If you have an agricultural business, you need to understand irs form 943 for tax purposes. Below, we’re breaking down everything. Form 943 is an annual federal tax return used by agricultural employers who pay taxable wages to their employees for farm labor. An employer generally files form 943 if they meet certain wage thresholds for agricultural labor as defined by the irs. Information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and.

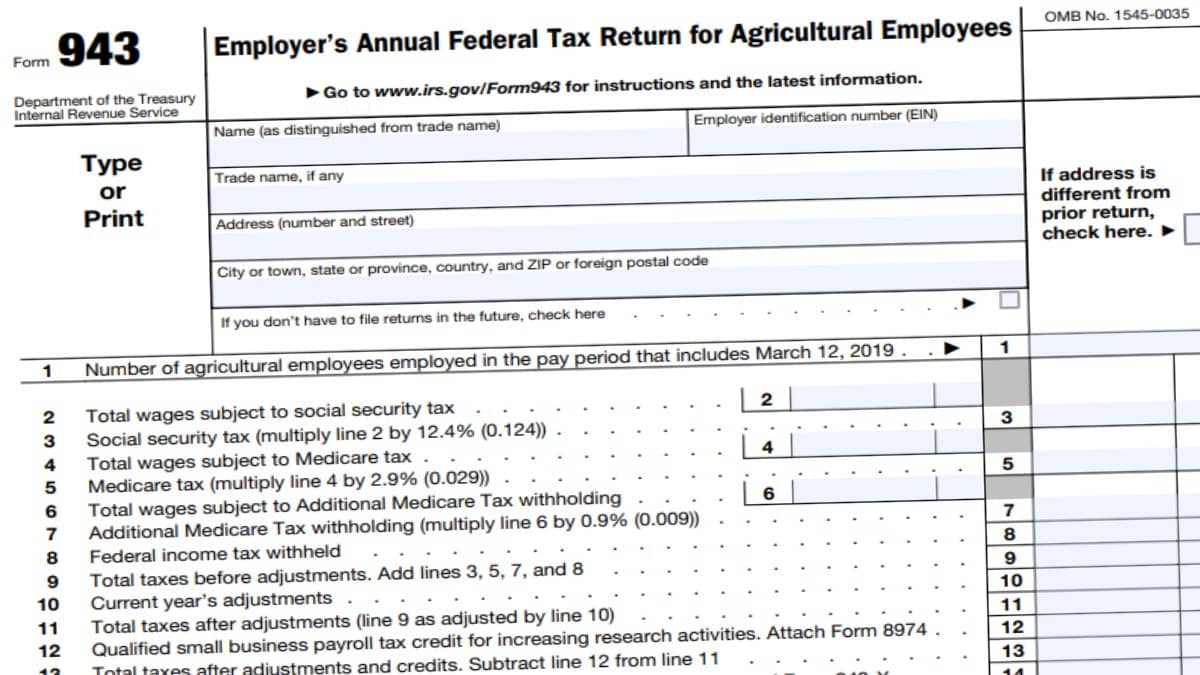

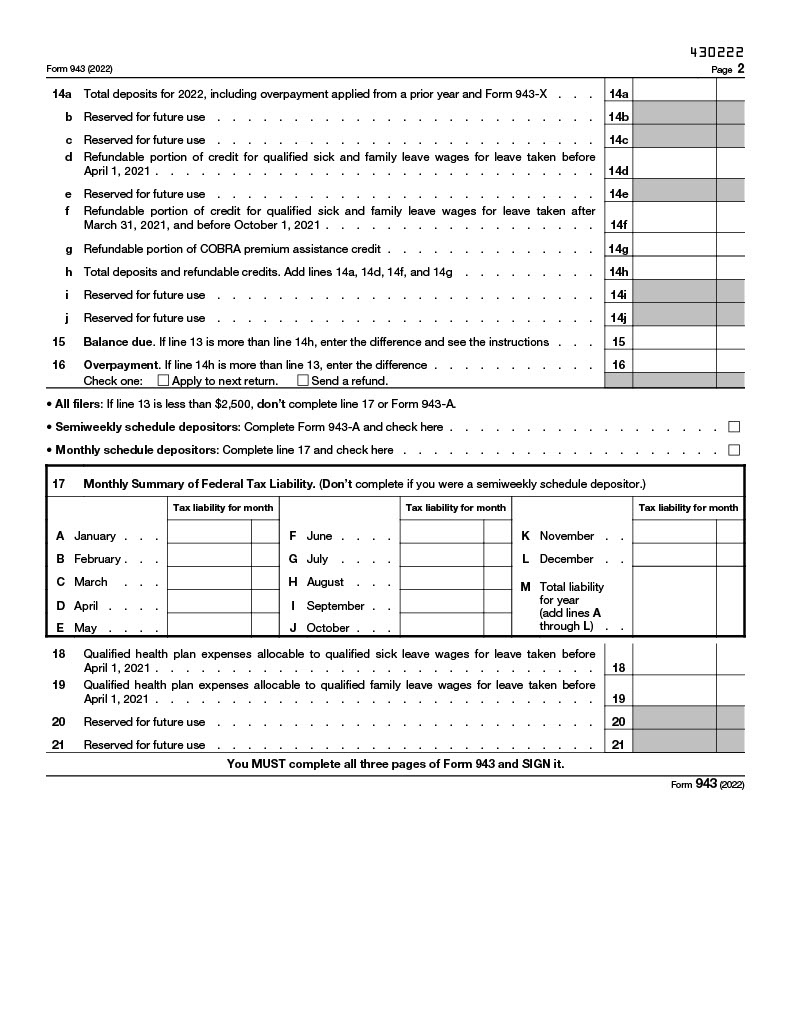

Form 943 Employer`s Annual Federal Tax Return for Agricultural

If you have an agricultural business, you need to understand irs form 943 for tax purposes. Form 943 is an annual federal tax return used by agricultural employers who pay taxable wages to their employees for farm labor. Below, we’re breaking down everything. Information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms.

Efile Form 943 for Agricultural Employers TaxZerone®

An employer generally files form 943 if they meet certain wage thresholds for agricultural labor as defined by the irs. If you have an agricultural business, you need to understand irs form 943 for tax purposes. Information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and. Form 943 is an annual federal.

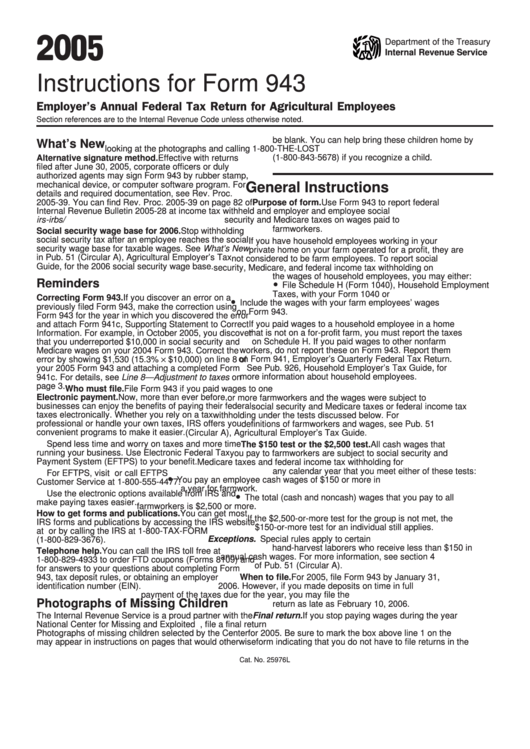

Instructions For Form 943 Employer'S Annual Federal Tax Return For

Form 943 is an annual federal tax return used by agricultural employers who pay taxable wages to their employees for farm labor. An employer generally files form 943 if they meet certain wage thresholds for agricultural labor as defined by the irs. Below, we’re breaking down everything. If you have an agricultural business, you need to understand irs form 943.

Instructions For Form 943 Employer's Annual Tax Return For

Information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and. If you have an agricultural business, you need to understand irs form 943 for tax purposes. Form 943 is an annual federal tax return used by agricultural employers who pay taxable wages to their employees for farm labor. An employer generally files.

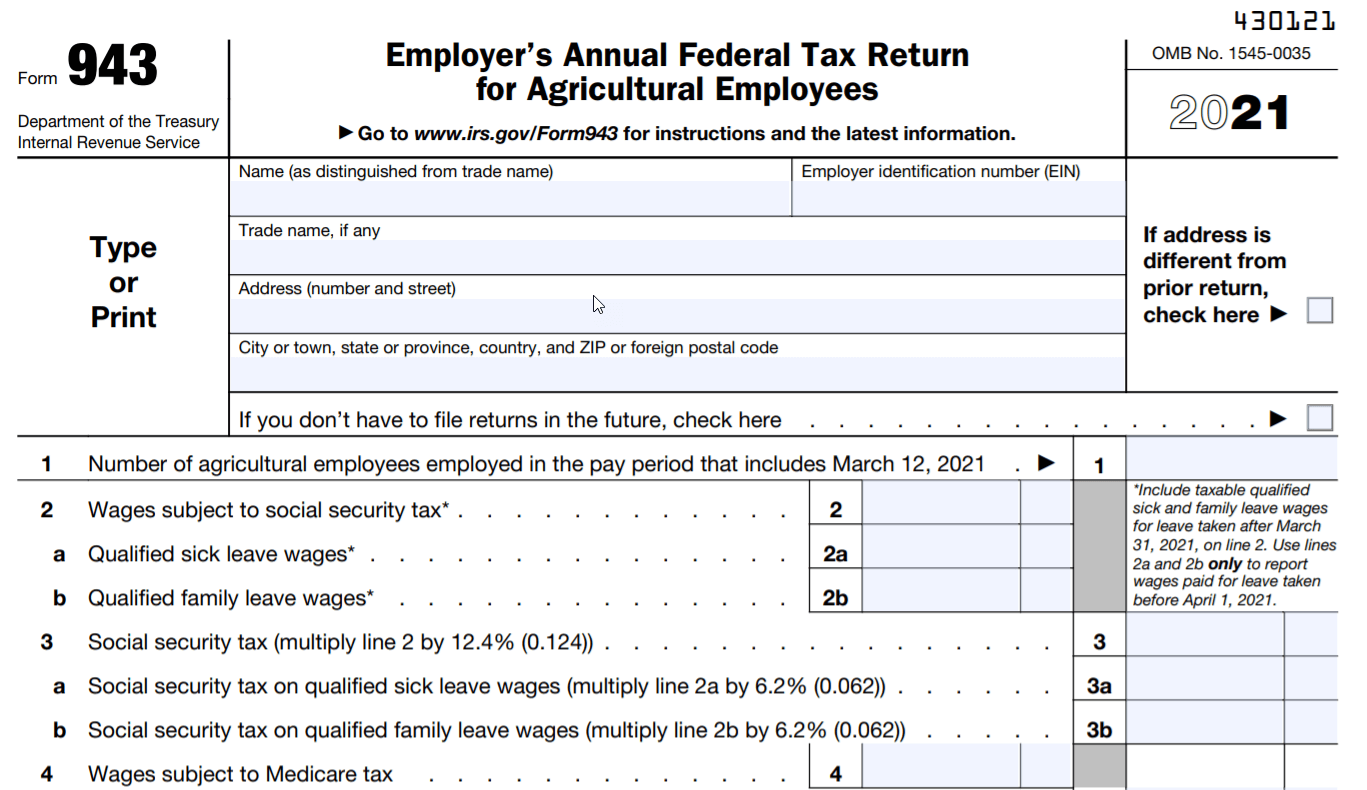

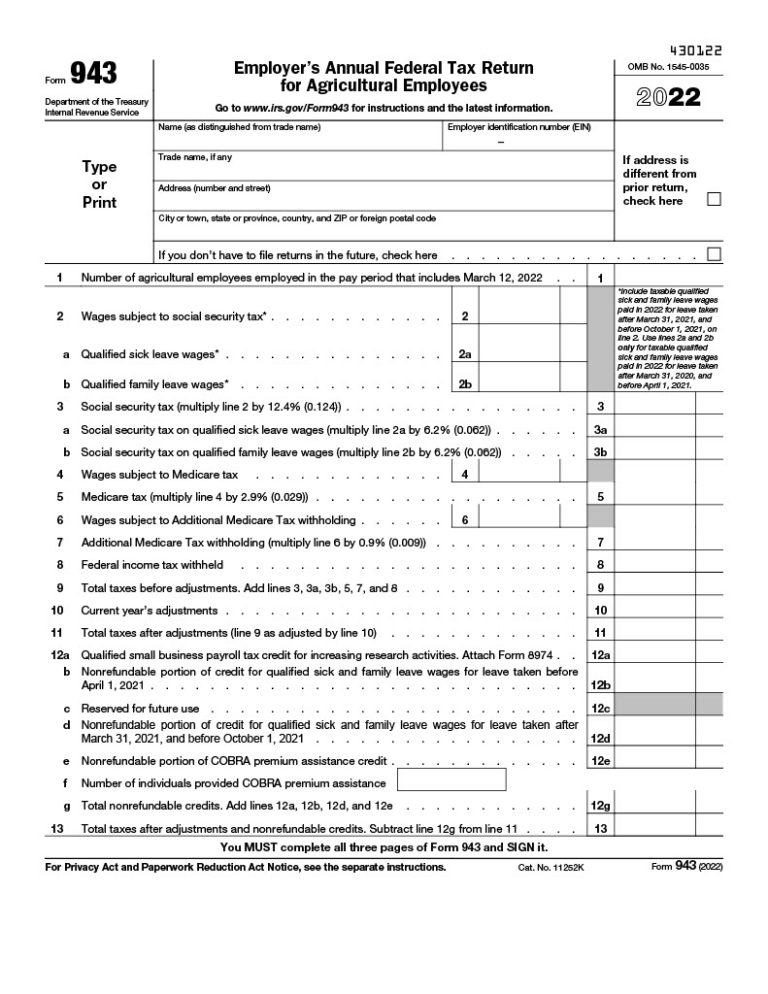

IRS Form 943 for 2022 Employer's Annual Federal Tax Return for

Information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and. Form 943 is an annual federal tax return used by agricultural employers who pay taxable wages to their employees for farm labor. An employer generally files form 943 if they meet certain wage thresholds for agricultural labor as defined by the irs..

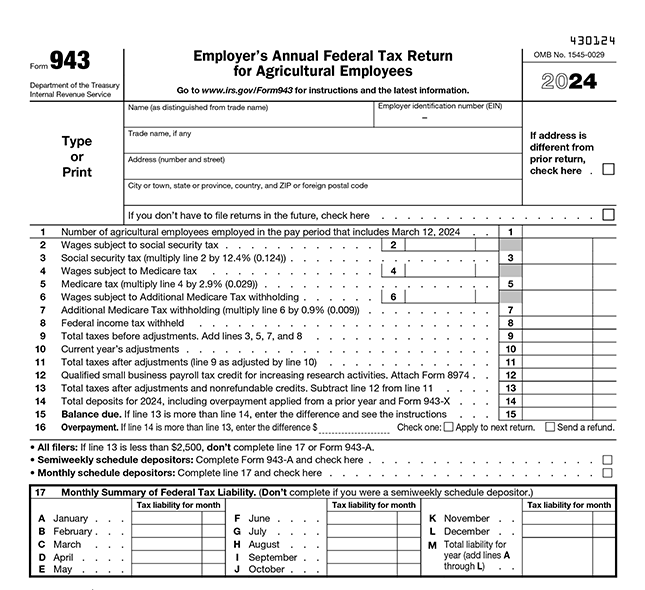

943 Form 2024 2025

An employer generally files form 943 if they meet certain wage thresholds for agricultural labor as defined by the irs. Form 943 is an annual federal tax return used by agricultural employers who pay taxable wages to their employees for farm labor. Information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and..

943 Form 2023, Employer’s Annual Federal Tax Return for Agricultural

Form 943 is an annual federal tax return used by agricultural employers who pay taxable wages to their employees for farm labor. If you have an agricultural business, you need to understand irs form 943 for tax purposes. An employer generally files form 943 if they meet certain wage thresholds for agricultural labor as defined by the irs. Below, we’re.

943 Form 2023, Employer’s Annual Federal Tax Return for Agricultural

Form 943 is an annual federal tax return used by agricultural employers who pay taxable wages to their employees for farm labor. If you have an agricultural business, you need to understand irs form 943 for tax purposes. Information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and. Below, we’re breaking down.

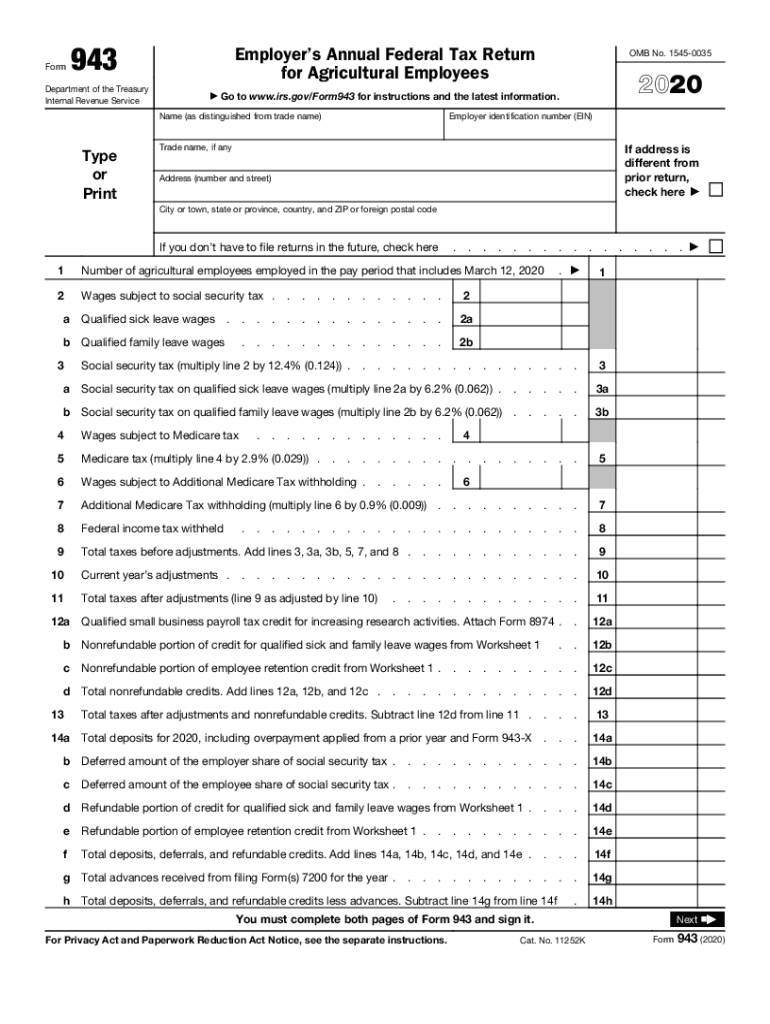

943 20202025 Form Fill Out and Sign Printable PDF Template

Information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and. Form 943 is an annual federal tax return used by agricultural employers who pay taxable wages to their employees for farm labor. An employer generally files form 943 if they meet certain wage thresholds for agricultural labor as defined by the irs..

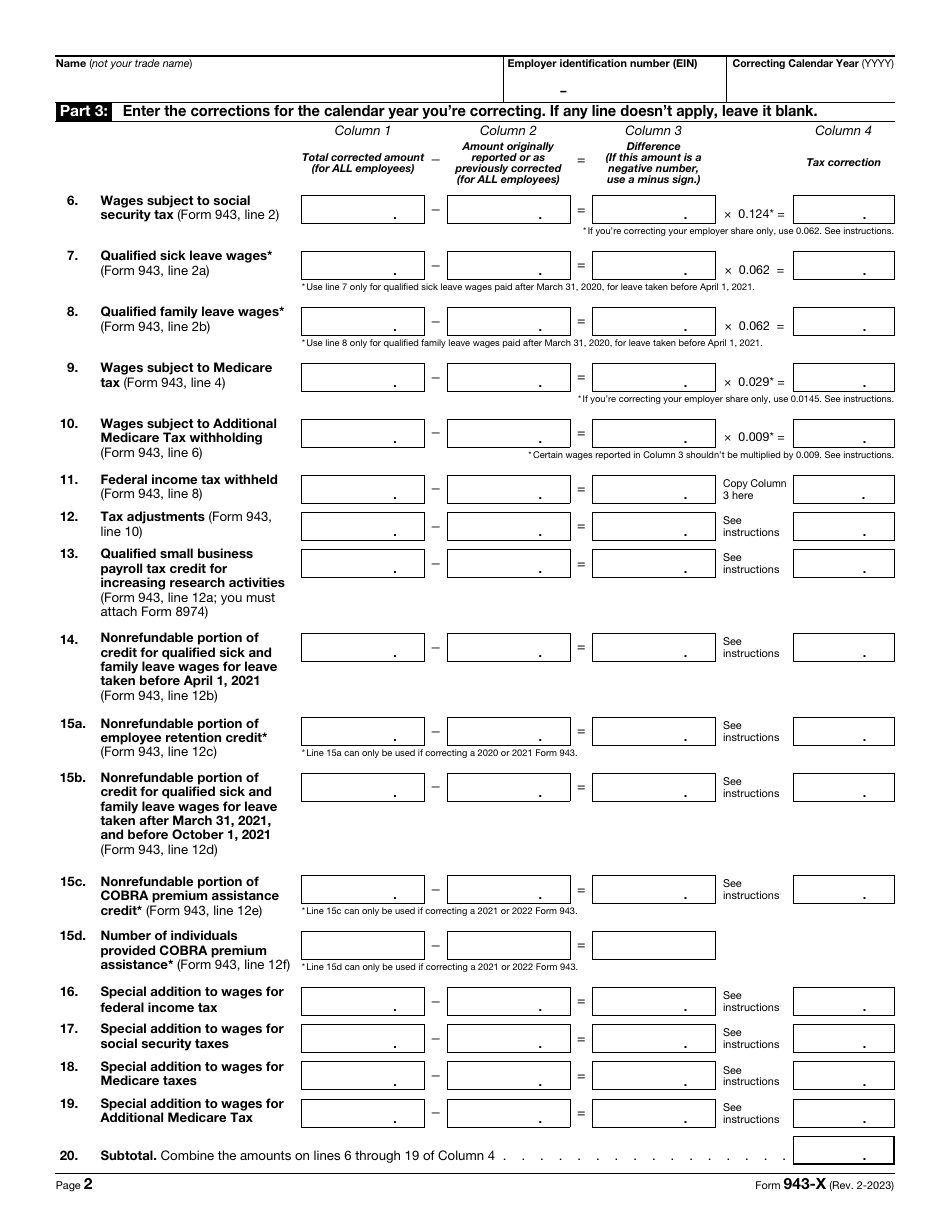

IRS Form 943X Download Fillable PDF or Fill Online Adjusted Employer's

An employer generally files form 943 if they meet certain wage thresholds for agricultural labor as defined by the irs. Below, we’re breaking down everything. Information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and. If you have an agricultural business, you need to understand irs form 943 for tax purposes. Form.

Below, We’re Breaking Down Everything.

If you have an agricultural business, you need to understand irs form 943 for tax purposes. Information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and. Form 943 is an annual federal tax return used by agricultural employers who pay taxable wages to their employees for farm labor. An employer generally files form 943 if they meet certain wage thresholds for agricultural labor as defined by the irs.