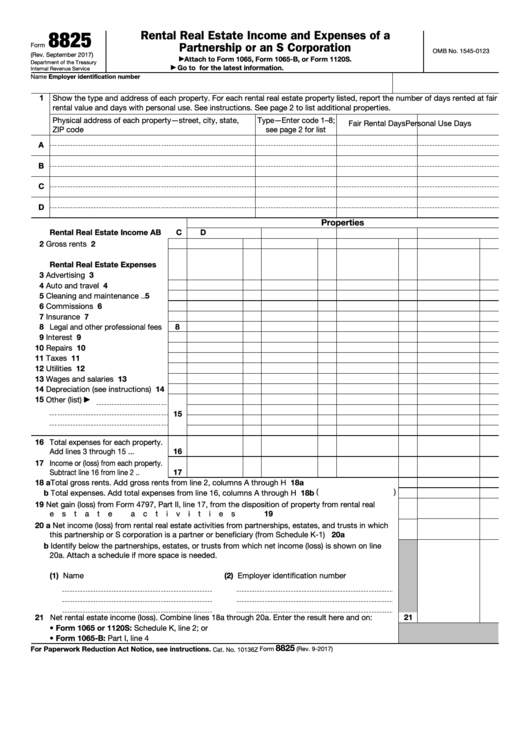

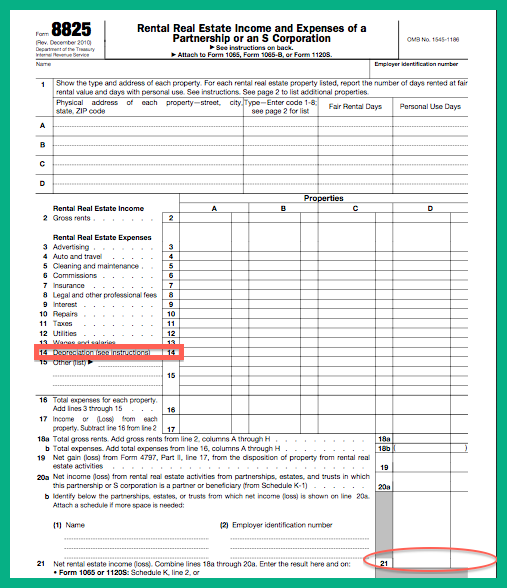

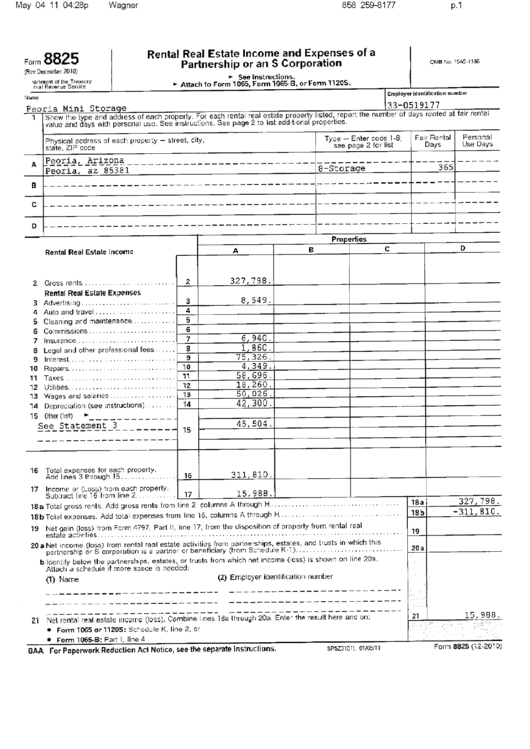

8825 Form - Partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss). Information about form 8825, rental real estate income and expenses of a partnership or an s corporation, including recent updates, related. This article is a comprehensive guide to irs form 8825, titled rental real estate income and expenses of a partnership or an s corporation and. The steps described below should be followed: Partnerships and s corporations use form 8825 to report business income and deductible expenses from rental real estate activities. Obtain the borrower’s business tax returns, including irs form 8825 for the most recent year.

Information about form 8825, rental real estate income and expenses of a partnership or an s corporation, including recent updates, related. This article is a comprehensive guide to irs form 8825, titled rental real estate income and expenses of a partnership or an s corporation and. Partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss). Partnerships and s corporations use form 8825 to report business income and deductible expenses from rental real estate activities. Obtain the borrower’s business tax returns, including irs form 8825 for the most recent year. The steps described below should be followed:

This article is a comprehensive guide to irs form 8825, titled rental real estate income and expenses of a partnership or an s corporation and. Partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss). Obtain the borrower’s business tax returns, including irs form 8825 for the most recent year. Information about form 8825, rental real estate income and expenses of a partnership or an s corporation, including recent updates, related. Partnerships and s corporations use form 8825 to report business income and deductible expenses from rental real estate activities. The steps described below should be followed:

IRS 8825 Rental Real Estate and Expenses of a Partnership or

This article is a comprehensive guide to irs form 8825, titled rental real estate income and expenses of a partnership or an s corporation and. Obtain the borrower’s business tax returns, including irs form 8825 for the most recent year. Information about form 8825, rental real estate income and expenses of a partnership or an s corporation, including recent updates,.

Form 8825 2024 2025

Obtain the borrower’s business tax returns, including irs form 8825 for the most recent year. This article is a comprehensive guide to irs form 8825, titled rental real estate income and expenses of a partnership or an s corporation and. Partnerships and s corporations use form 8825 to report business income and deductible expenses from rental real estate activities. The.

Fillable Form 8825 Rental Real Estate And Expenses Of A

This article is a comprehensive guide to irs form 8825, titled rental real estate income and expenses of a partnership or an s corporation and. The steps described below should be followed: Information about form 8825, rental real estate income and expenses of a partnership or an s corporation, including recent updates, related. Partnerships and s corporations use form 8825.

All about the 8825 Linda Keith CPA

Partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss). Information about form 8825, rental real estate income and expenses of a partnership or an s corporation, including recent updates, related. Partnerships and s corporations use form 8825 to report business income and deductible expenses from rental real.

IRS Form 8825 Instructions Partnership & SCorp Rental

This article is a comprehensive guide to irs form 8825, titled rental real estate income and expenses of a partnership or an s corporation and. The steps described below should be followed: Obtain the borrower’s business tax returns, including irs form 8825 for the most recent year. Information about form 8825, rental real estate income and expenses of a partnership.

Form 8825 Rental Real Estate And Expenses Of A printable pdf

Obtain the borrower’s business tax returns, including irs form 8825 for the most recent year. The steps described below should be followed: Information about form 8825, rental real estate income and expenses of a partnership or an s corporation, including recent updates, related. This article is a comprehensive guide to irs form 8825, titled rental real estate income and expenses.

IRS Form 8825 Rental Real Estate and Expenses of a Partnership

Partnerships and s corporations use form 8825 to report business income and deductible expenses from rental real estate activities. Partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss). This article is a comprehensive guide to irs form 8825, titled rental real estate income and expenses of a.

Form 8825 2024

Partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss). Obtain the borrower’s business tax returns, including irs form 8825 for the most recent year. This article is a comprehensive guide to irs form 8825, titled rental real estate income and expenses of a partnership or an s.

Form 8825 Rental Real Estate and Expenses of a Partnership or

Partnerships and s corporations use form 8825 to report business income and deductible expenses from rental real estate activities. Information about form 8825, rental real estate income and expenses of a partnership or an s corporation, including recent updates, related. The steps described below should be followed: This article is a comprehensive guide to irs form 8825, titled rental real.

IRS Form 8825 Rental Real Estate and Expenses of a Partnership

The steps described below should be followed: Partnerships and s corporations use form 8825 to report business income and deductible expenses from rental real estate activities. Information about form 8825, rental real estate income and expenses of a partnership or an s corporation, including recent updates, related. This article is a comprehensive guide to irs form 8825, titled rental real.

Partnerships And S Corporations Use Form 8825 To Report Business Income And Deductible Expenses From Rental Real Estate Activities.

Obtain the borrower’s business tax returns, including irs form 8825 for the most recent year. The steps described below should be followed: Partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss). This article is a comprehensive guide to irs form 8825, titled rental real estate income and expenses of a partnership or an s corporation and.