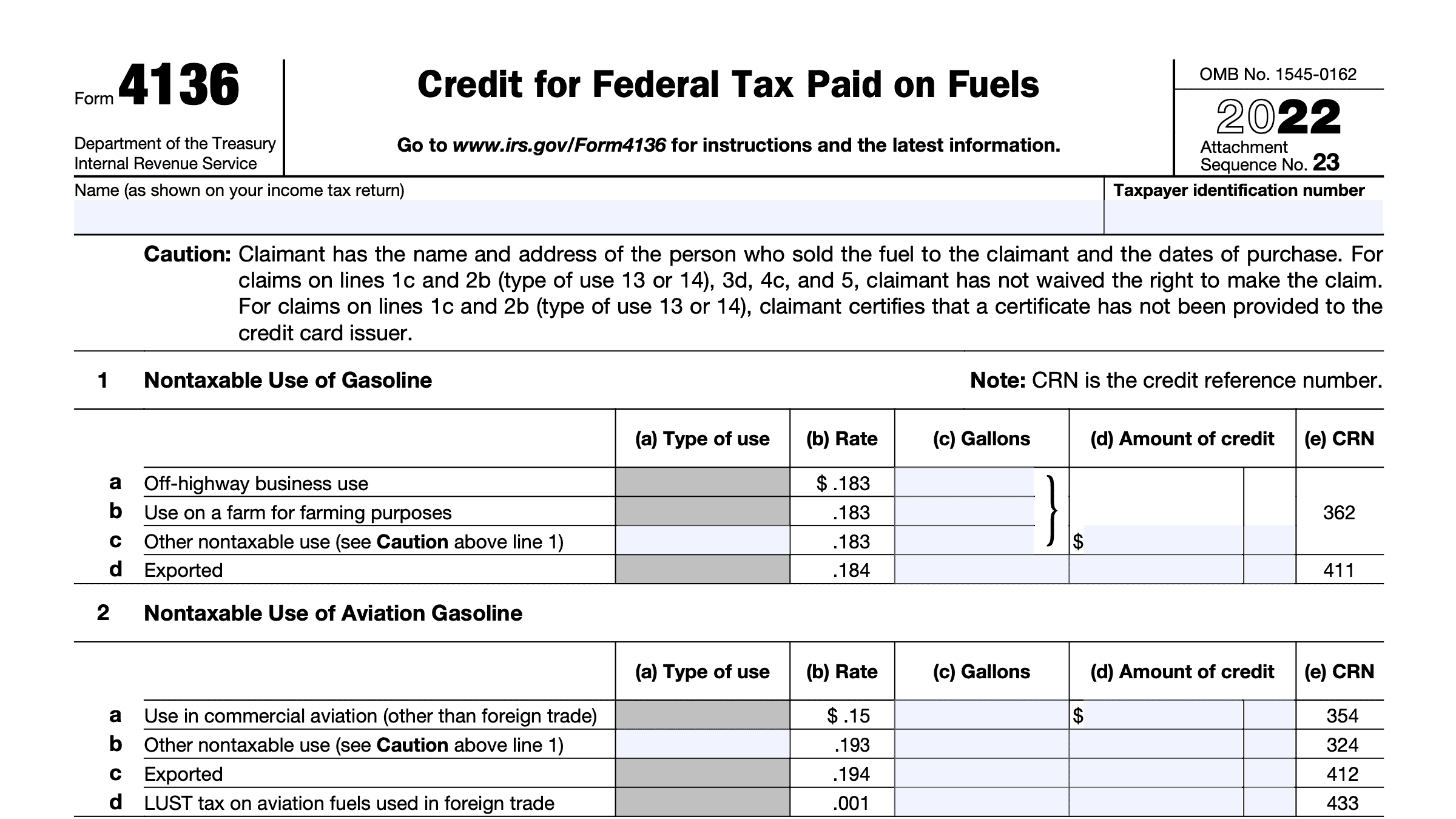

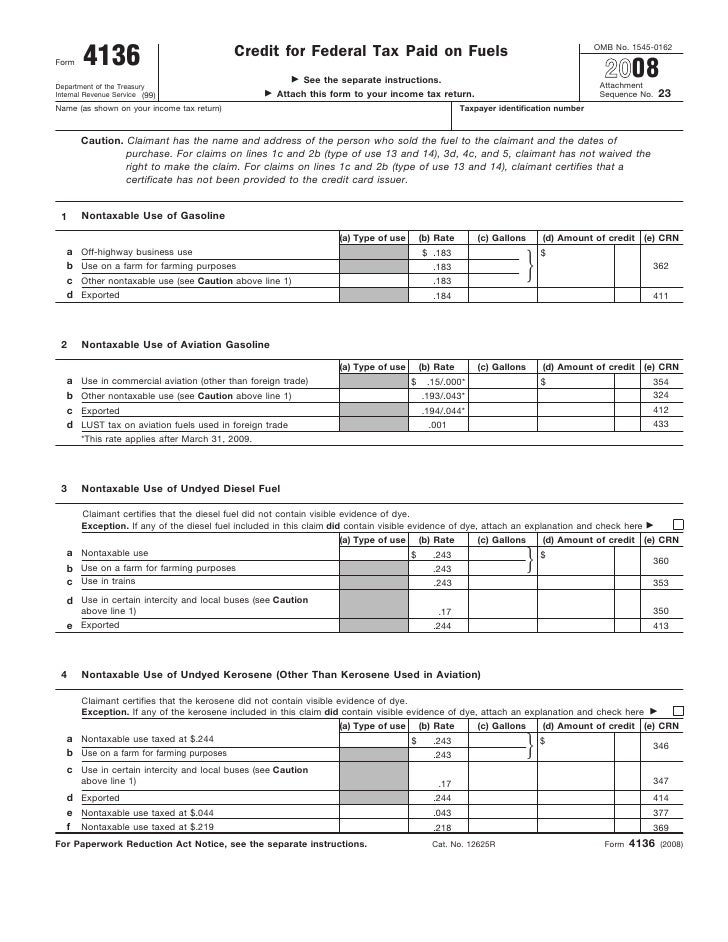

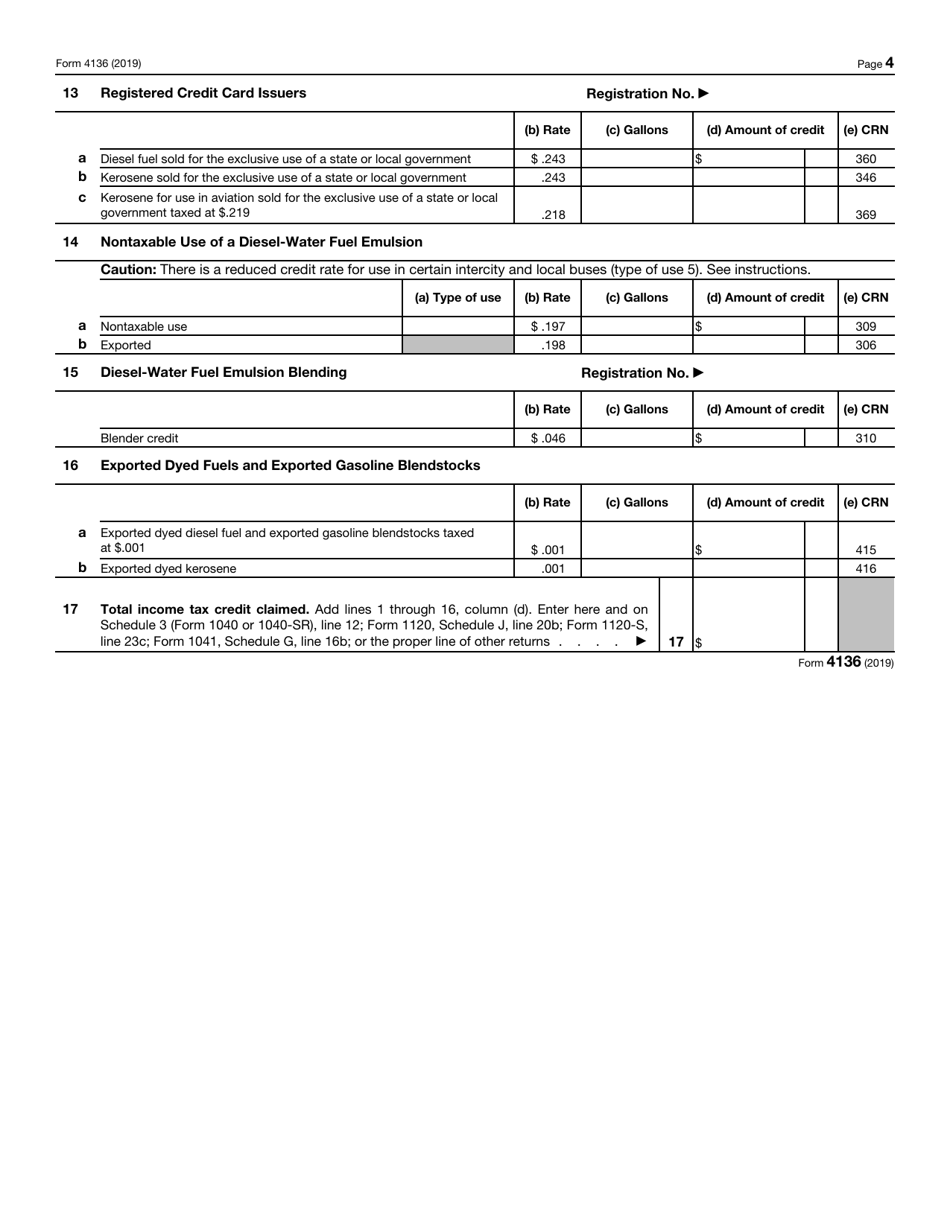

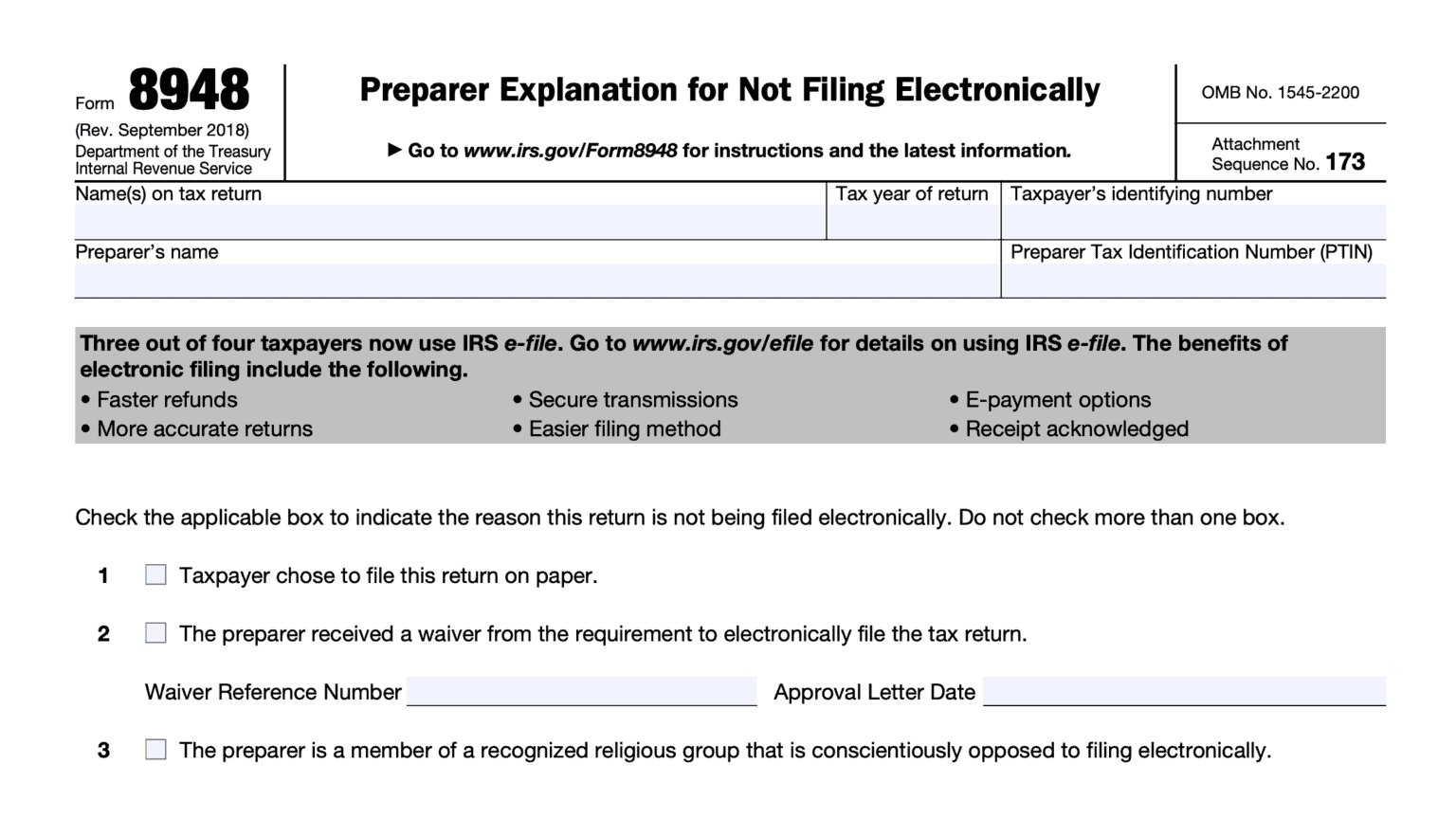

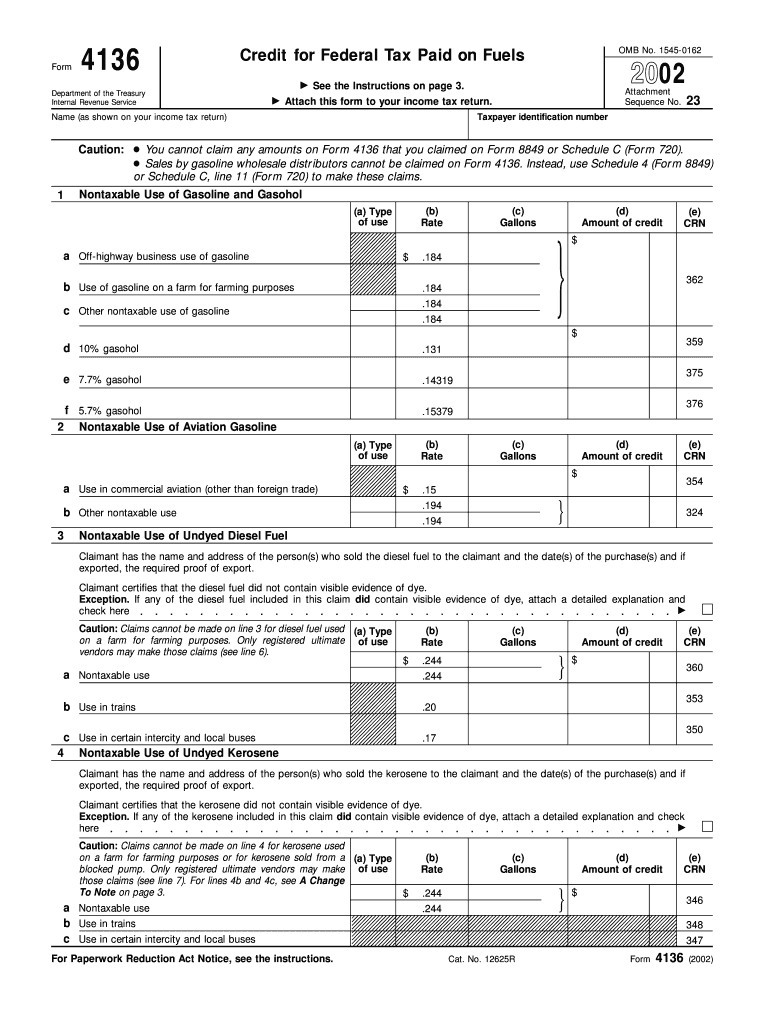

4136 Form - Irs form 4136, credit for federal tax paid on fuels, enables certain taxpayers to claim a fuel credit, depending on the. What is irs form 4136? Get instructions on filing and claiming the credit for. In a nutshell, irs form 4136 lets you claim a refund on certain federal fuel taxes you paid throughout the year. You pay a federal tax on every gallon of fuel you purchase, and irs form 4136 allows you to claim a credit for the federal taxes you pay on fuel. If you used gasoline, diesel,. Learn how to claim the tax credit for federal tax paid on fuel using form 4136. Information about form 4136, credit for federal tax paid on fuels, including recent updates, related forms and instructions on how to file.

Irs form 4136, credit for federal tax paid on fuels, enables certain taxpayers to claim a fuel credit, depending on the. Get instructions on filing and claiming the credit for. If you used gasoline, diesel,. Information about form 4136, credit for federal tax paid on fuels, including recent updates, related forms and instructions on how to file. What is irs form 4136? Learn how to claim the tax credit for federal tax paid on fuel using form 4136. In a nutshell, irs form 4136 lets you claim a refund on certain federal fuel taxes you paid throughout the year. You pay a federal tax on every gallon of fuel you purchase, and irs form 4136 allows you to claim a credit for the federal taxes you pay on fuel.

Get instructions on filing and claiming the credit for. Irs form 4136, credit for federal tax paid on fuels, enables certain taxpayers to claim a fuel credit, depending on the. You pay a federal tax on every gallon of fuel you purchase, and irs form 4136 allows you to claim a credit for the federal taxes you pay on fuel. Learn how to claim the tax credit for federal tax paid on fuel using form 4136. What is irs form 4136? In a nutshell, irs form 4136 lets you claim a refund on certain federal fuel taxes you paid throughout the year. Information about form 4136, credit for federal tax paid on fuels, including recent updates, related forms and instructions on how to file. If you used gasoline, diesel,.

IRS Form 4136 Instructions Credits For Federal Tax Paid on Fuels

Learn how to claim the tax credit for federal tax paid on fuel using form 4136. What is irs form 4136? Information about form 4136, credit for federal tax paid on fuels, including recent updates, related forms and instructions on how to file. In a nutshell, irs form 4136 lets you claim a refund on certain federal fuel taxes you.

Download Instructions for IRS Form 4136 Credit for Federal Tax Paid on

Learn how to claim the tax credit for federal tax paid on fuel using form 4136. You pay a federal tax on every gallon of fuel you purchase, and irs form 4136 allows you to claim a credit for the federal taxes you pay on fuel. Irs form 4136, credit for federal tax paid on fuels, enables certain taxpayers to.

Download Instructions for IRS Form 4136 Credit for Federal Tax Paid on

Get instructions on filing and claiming the credit for. You pay a federal tax on every gallon of fuel you purchase, and irs form 4136 allows you to claim a credit for the federal taxes you pay on fuel. Learn how to claim the tax credit for federal tax paid on fuel using form 4136. Irs form 4136, credit for.

Form 4136Credit for Federal Tax Paid on Fuel

What is irs form 4136? If you used gasoline, diesel,. Information about form 4136, credit for federal tax paid on fuels, including recent updates, related forms and instructions on how to file. You pay a federal tax on every gallon of fuel you purchase, and irs form 4136 allows you to claim a credit for the federal taxes you pay.

IRS Form 4136 Download Fillable PDF or Fill Online Credit for Federal

Get instructions on filing and claiming the credit for. Learn how to claim the tax credit for federal tax paid on fuel using form 4136. Information about form 4136, credit for federal tax paid on fuels, including recent updates, related forms and instructions on how to file. What is irs form 4136? In a nutshell, irs form 4136 lets you.

Form 4136Credit for Federal Tax Paid on Fuel

Get instructions on filing and claiming the credit for. You pay a federal tax on every gallon of fuel you purchase, and irs form 4136 allows you to claim a credit for the federal taxes you pay on fuel. What is irs form 4136? Learn how to claim the tax credit for federal tax paid on fuel using form 4136..

Form 4136 Credit For Federal Tax Paid on Fuels (2015) Free Download

Irs form 4136, credit for federal tax paid on fuels, enables certain taxpayers to claim a fuel credit, depending on the. Learn how to claim the tax credit for federal tax paid on fuel using form 4136. In a nutshell, irs form 4136 lets you claim a refund on certain federal fuel taxes you paid throughout the year. If you.

IRS Form 4136 2019 Fill Out, Sign Online and Download Fillable PDF

If you used gasoline, diesel,. Learn how to claim the tax credit for federal tax paid on fuel using form 4136. Get instructions on filing and claiming the credit for. Irs form 4136, credit for federal tax paid on fuels, enables certain taxpayers to claim a fuel credit, depending on the. In a nutshell, irs form 4136 lets you claim.

IRS Form 4136 Instructions Credits For Federal Tax Paid on Fuels

Get instructions on filing and claiming the credit for. What is irs form 4136? If you used gasoline, diesel,. In a nutshell, irs form 4136 lets you claim a refund on certain federal fuel taxes you paid throughout the year. Information about form 4136, credit for federal tax paid on fuels, including recent updates, related forms and instructions on how.

Form 4136 Fill in Version Credit for Federal Tax Paid on Fuels Fill

What is irs form 4136? In a nutshell, irs form 4136 lets you claim a refund on certain federal fuel taxes you paid throughout the year. Learn how to claim the tax credit for federal tax paid on fuel using form 4136. If you used gasoline, diesel,. Get instructions on filing and claiming the credit for.

You Pay A Federal Tax On Every Gallon Of Fuel You Purchase, And Irs Form 4136 Allows You To Claim A Credit For The Federal Taxes You Pay On Fuel.

Get instructions on filing and claiming the credit for. If you used gasoline, diesel,. Irs form 4136, credit for federal tax paid on fuels, enables certain taxpayers to claim a fuel credit, depending on the. In a nutshell, irs form 4136 lets you claim a refund on certain federal fuel taxes you paid throughout the year.

Information About Form 4136, Credit For Federal Tax Paid On Fuels, Including Recent Updates, Related Forms And Instructions On How To File.

What is irs form 4136? Learn how to claim the tax credit for federal tax paid on fuel using form 4136.