401K Contribution Tax Form - Find the forms, instructions, publications, educational products, and other related information useful for retirement plans in one. What tax documents do i need to file for a 401 (k) or ira? Because 401 (k) contributions are taken out of your paycheck before being taxed, they are not included in taxable income and they don’t need to. Learn how to accurately report 401 (k) contributions on your tax return to optimize your taxable income and avoid potential penalties. Here are the irs tax forms related to retirement accounts that may be require when you file your.

What tax documents do i need to file for a 401 (k) or ira? Find the forms, instructions, publications, educational products, and other related information useful for retirement plans in one. Learn how to accurately report 401 (k) contributions on your tax return to optimize your taxable income and avoid potential penalties. Because 401 (k) contributions are taken out of your paycheck before being taxed, they are not included in taxable income and they don’t need to. Here are the irs tax forms related to retirement accounts that may be require when you file your.

Learn how to accurately report 401 (k) contributions on your tax return to optimize your taxable income and avoid potential penalties. What tax documents do i need to file for a 401 (k) or ira? Because 401 (k) contributions are taken out of your paycheck before being taxed, they are not included in taxable income and they don’t need to. Find the forms, instructions, publications, educational products, and other related information useful for retirement plans in one. Here are the irs tax forms related to retirement accounts that may be require when you file your.

18 401k Form Templates free to download in PDF

Because 401 (k) contributions are taken out of your paycheck before being taxed, they are not included in taxable income and they don’t need to. Learn how to accurately report 401 (k) contributions on your tax return to optimize your taxable income and avoid potential penalties. Here are the irs tax forms related to retirement accounts that may be require.

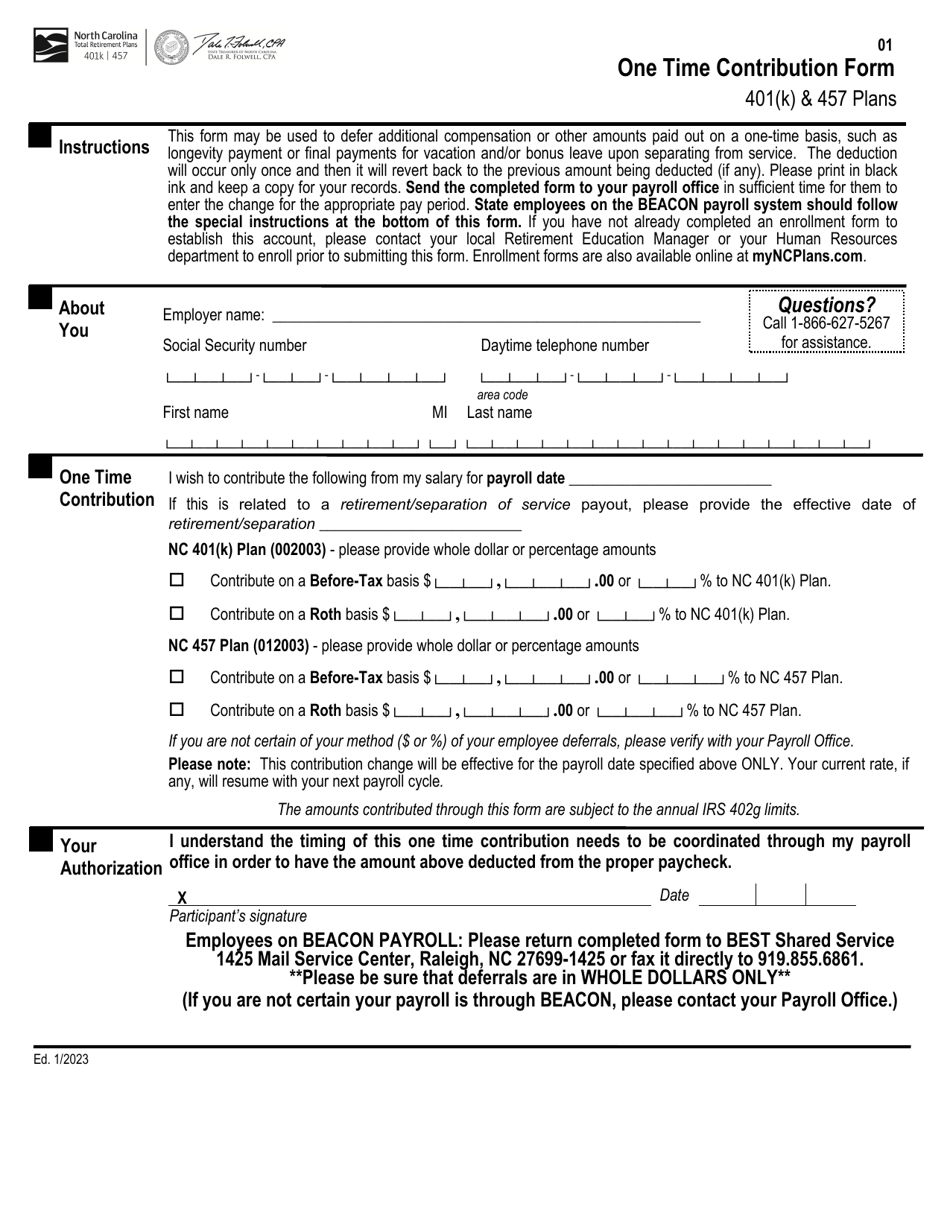

North Carolina One Time Contribution Form 401(K) & 457 Plans Fill

Here are the irs tax forms related to retirement accounts that may be require when you file your. Because 401 (k) contributions are taken out of your paycheck before being taxed, they are not included in taxable income and they don’t need to. Learn how to accurately report 401 (k) contributions on your tax return to optimize your taxable income.

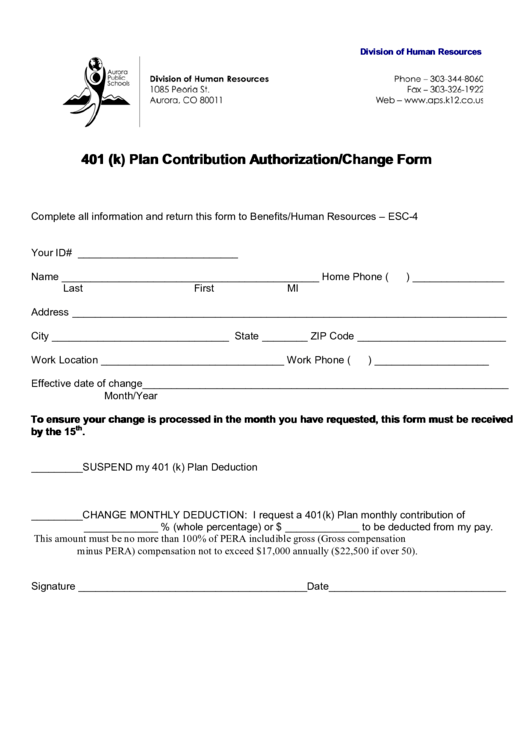

Fillable Online 401(k) Contribution Change Form Fax Email Print pdfFiller

What tax documents do i need to file for a 401 (k) or ira? Because 401 (k) contributions are taken out of your paycheck before being taxed, they are not included in taxable income and they don’t need to. Learn how to accurately report 401 (k) contributions on your tax return to optimize your taxable income and avoid potential penalties..

What is 401(k) tax form? Here's everything you need to know

Because 401 (k) contributions are taken out of your paycheck before being taxed, they are not included in taxable income and they don’t need to. What tax documents do i need to file for a 401 (k) or ira? Learn how to accurately report 401 (k) contributions on your tax return to optimize your taxable income and avoid potential penalties..

Contributions CLIENT PORTAL

Find the forms, instructions, publications, educational products, and other related information useful for retirement plans in one. Because 401 (k) contributions are taken out of your paycheck before being taxed, they are not included in taxable income and they don’t need to. What tax documents do i need to file for a 401 (k) or ira? Learn how to accurately.

Solo 401k Contribution Form Fill out & sign online DocHub

Because 401 (k) contributions are taken out of your paycheck before being taxed, they are not included in taxable income and they don’t need to. What tax documents do i need to file for a 401 (k) or ira? Find the forms, instructions, publications, educational products, and other related information useful for retirement plans in one. Here are the irs.

Solo 401k Contribution Calculator Walk Thru Solo 401k

Learn how to accurately report 401 (k) contributions on your tax return to optimize your taxable income and avoid potential penalties. Find the forms, instructions, publications, educational products, and other related information useful for retirement plans in one. Because 401 (k) contributions are taken out of your paycheck before being taxed, they are not included in taxable income and they.

Selfdirected Solo 401k Question Is a Form 1099R Required for

Find the forms, instructions, publications, educational products, and other related information useful for retirement plans in one. Because 401 (k) contributions are taken out of your paycheck before being taxed, they are not included in taxable income and they don’t need to. What tax documents do i need to file for a 401 (k) or ira? Here are the irs.

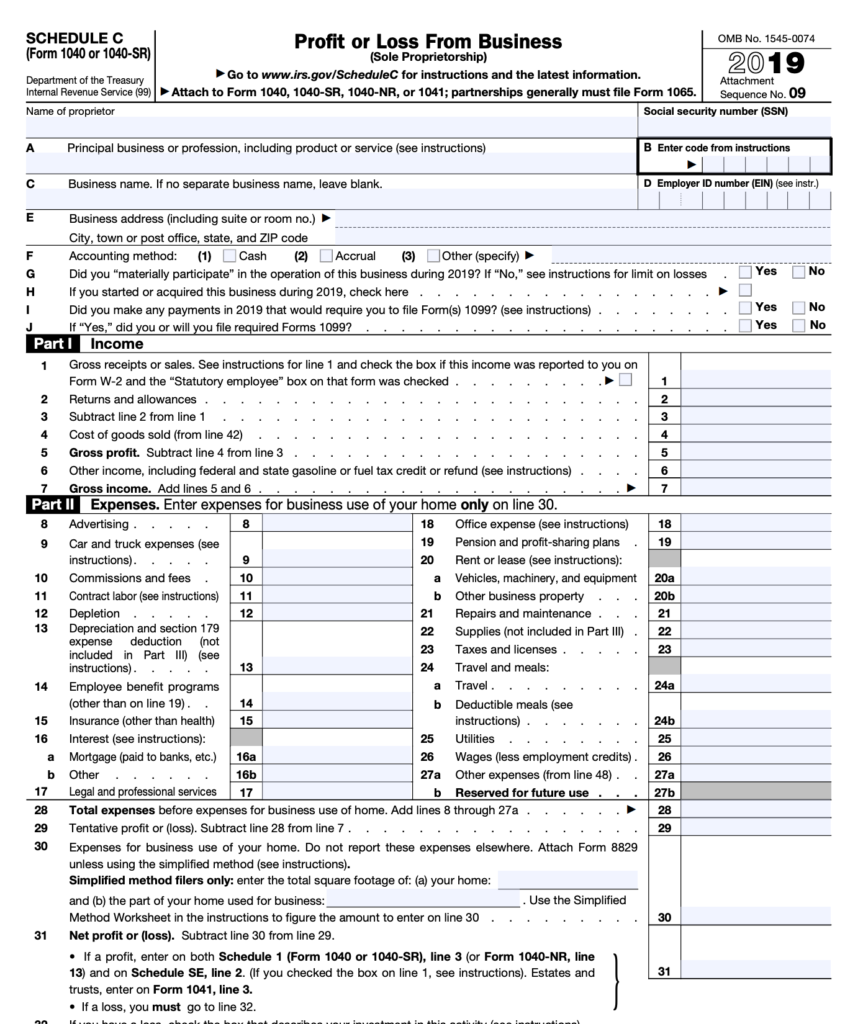

Where Do 401K Contributions Go On 1040 LiveWell

Learn how to accurately report 401 (k) contributions on your tax return to optimize your taxable income and avoid potential penalties. Because 401 (k) contributions are taken out of your paycheck before being taxed, they are not included in taxable income and they don’t need to. What tax documents do i need to file for a 401 (k) or ira?.

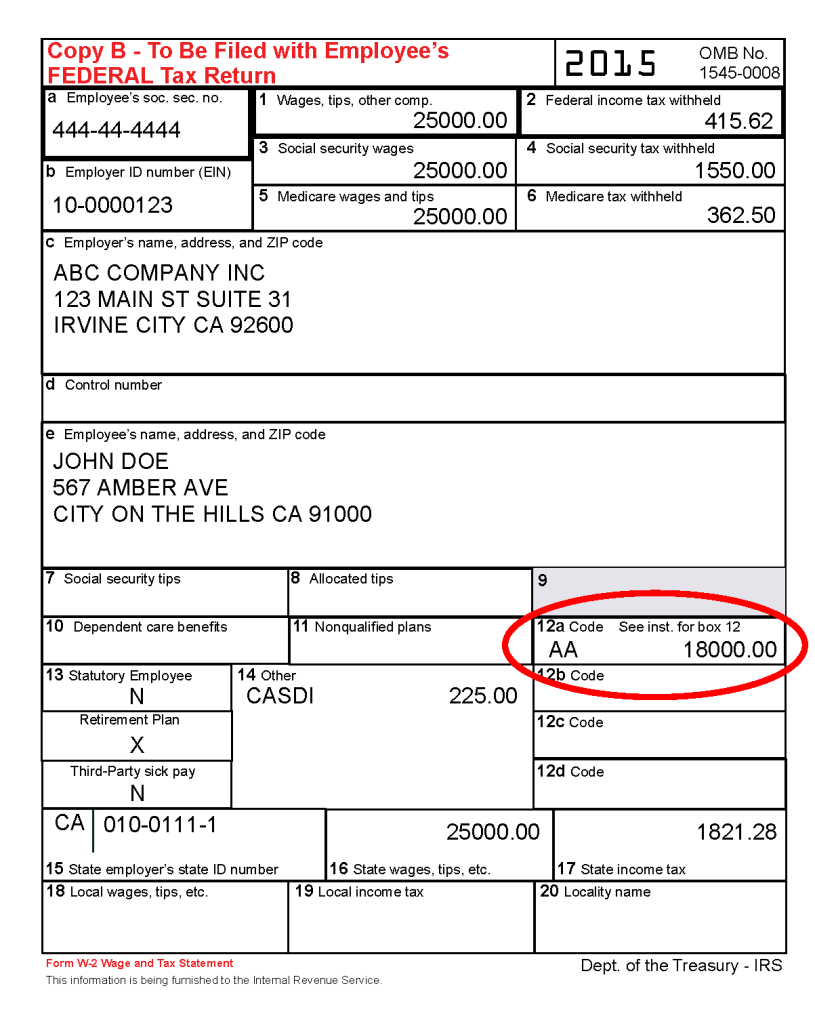

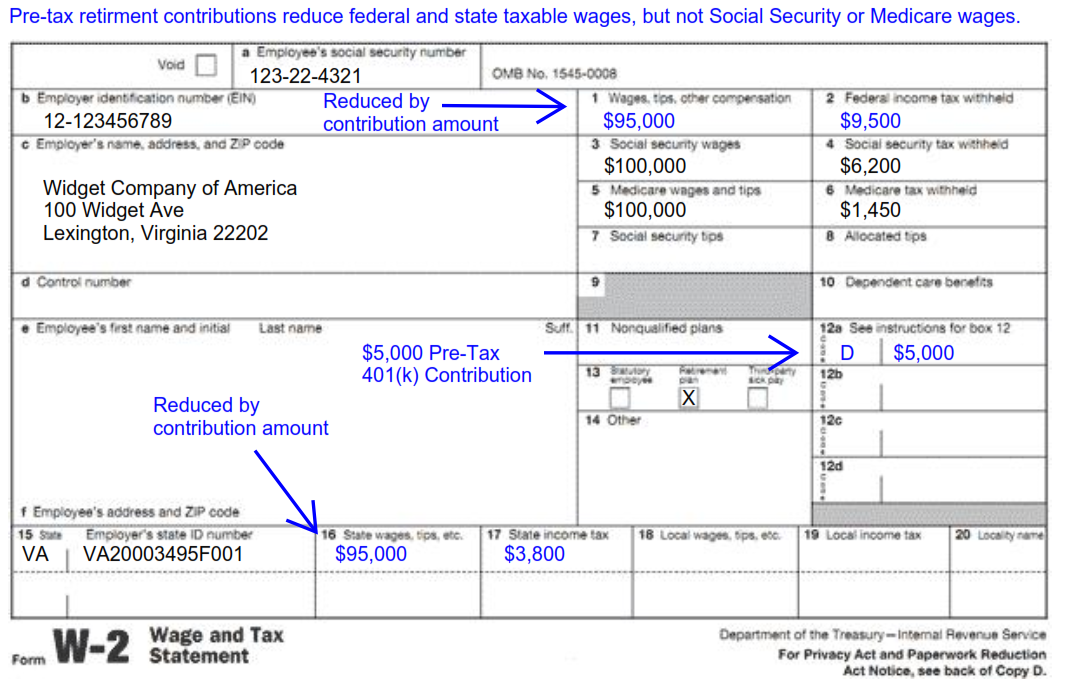

Understanding Tax Season Form W2 Remote Financial Planner

Because 401 (k) contributions are taken out of your paycheck before being taxed, they are not included in taxable income and they don’t need to. What tax documents do i need to file for a 401 (k) or ira? Here are the irs tax forms related to retirement accounts that may be require when you file your. Find the forms,.

What Tax Documents Do I Need To File For A 401 (K) Or Ira?

Here are the irs tax forms related to retirement accounts that may be require when you file your. Because 401 (k) contributions are taken out of your paycheck before being taxed, they are not included in taxable income and they don’t need to. Find the forms, instructions, publications, educational products, and other related information useful for retirement plans in one. Learn how to accurately report 401 (k) contributions on your tax return to optimize your taxable income and avoid potential penalties.