3Ceb Form - It pertains to international transactions and. 3ceb [see rule 10e] report from an accountant to be furnished under section 92e relating to international transaction(s) and. Form 3ceb is a report required to be furnished by an accountant under section 92e of the income tax act, 1961. Learn how to comply with transfer pricing regulations. According to section 92a to section 92f of the income tax act of 1961, if a company engages in any domestic or foreign transactions with any. The report from an accountant required to be furnished under section 92e by every person who has entered into an international transaction or a. Understand form 3ceb’s applicability, due dates, and the process of filing it online.

The report from an accountant required to be furnished under section 92e by every person who has entered into an international transaction or a. Understand form 3ceb’s applicability, due dates, and the process of filing it online. 3ceb [see rule 10e] report from an accountant to be furnished under section 92e relating to international transaction(s) and. According to section 92a to section 92f of the income tax act of 1961, if a company engages in any domestic or foreign transactions with any. Form 3ceb is a report required to be furnished by an accountant under section 92e of the income tax act, 1961. Learn how to comply with transfer pricing regulations. It pertains to international transactions and.

3ceb [see rule 10e] report from an accountant to be furnished under section 92e relating to international transaction(s) and. Form 3ceb is a report required to be furnished by an accountant under section 92e of the income tax act, 1961. It pertains to international transactions and. Learn how to comply with transfer pricing regulations. The report from an accountant required to be furnished under section 92e by every person who has entered into an international transaction or a. Understand form 3ceb’s applicability, due dates, and the process of filing it online. According to section 92a to section 92f of the income tax act of 1961, if a company engages in any domestic or foreign transactions with any.

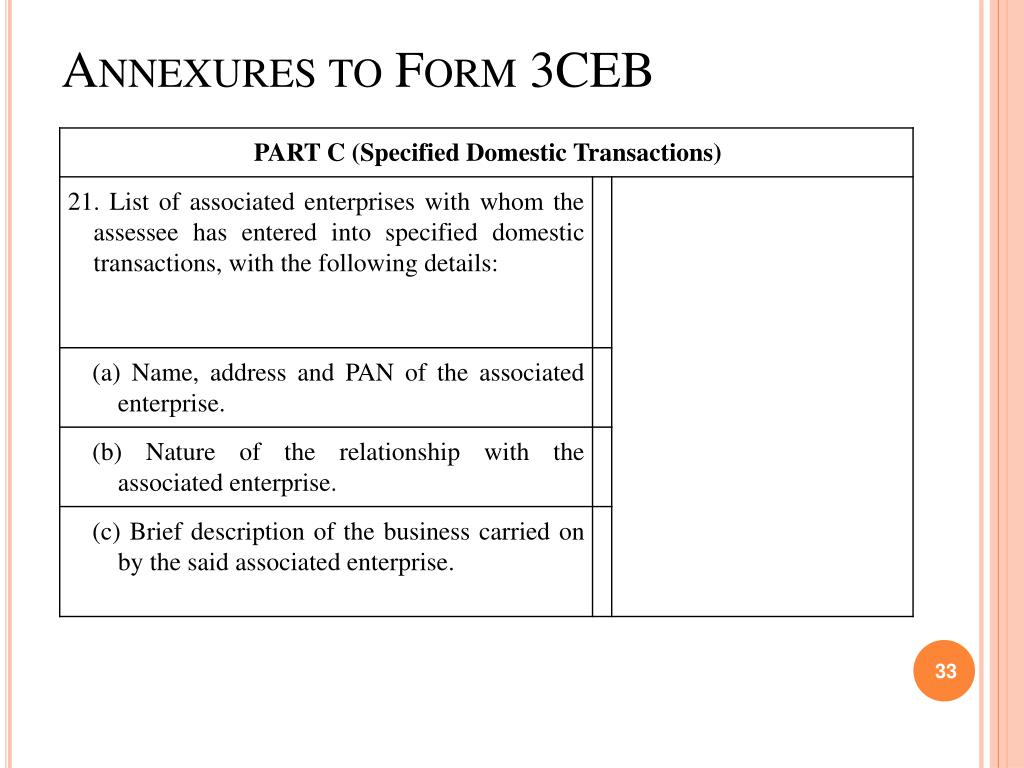

PPT Domestic Transfer Pricing PowerPoint Presentation, free download

Understand form 3ceb’s applicability, due dates, and the process of filing it online. According to section 92a to section 92f of the income tax act of 1961, if a company engages in any domestic or foreign transactions with any. The report from an accountant required to be furnished under section 92e by every person who has entered into an international.

Form 3CEB 3CEB Conten

It pertains to international transactions and. The report from an accountant required to be furnished under section 92e by every person who has entered into an international transaction or a. According to section 92a to section 92f of the income tax act of 1961, if a company engages in any domestic or foreign transactions with any. 3ceb [see rule 10e].

What is Form 3CEB Accountants Certificate? Enterslice

Learn how to comply with transfer pricing regulations. The report from an accountant required to be furnished under section 92e by every person who has entered into an international transaction or a. 3ceb [see rule 10e] report from an accountant to be furnished under section 92e relating to international transaction(s) and. Understand form 3ceb’s applicability, due dates, and the process.

Tax Department Releases Latest Utility and Schema of Form 3CEB

According to section 92a to section 92f of the income tax act of 1961, if a company engages in any domestic or foreign transactions with any. The report from an accountant required to be furnished under section 92e by every person who has entered into an international transaction or a. Understand form 3ceb’s applicability, due dates, and the process of.

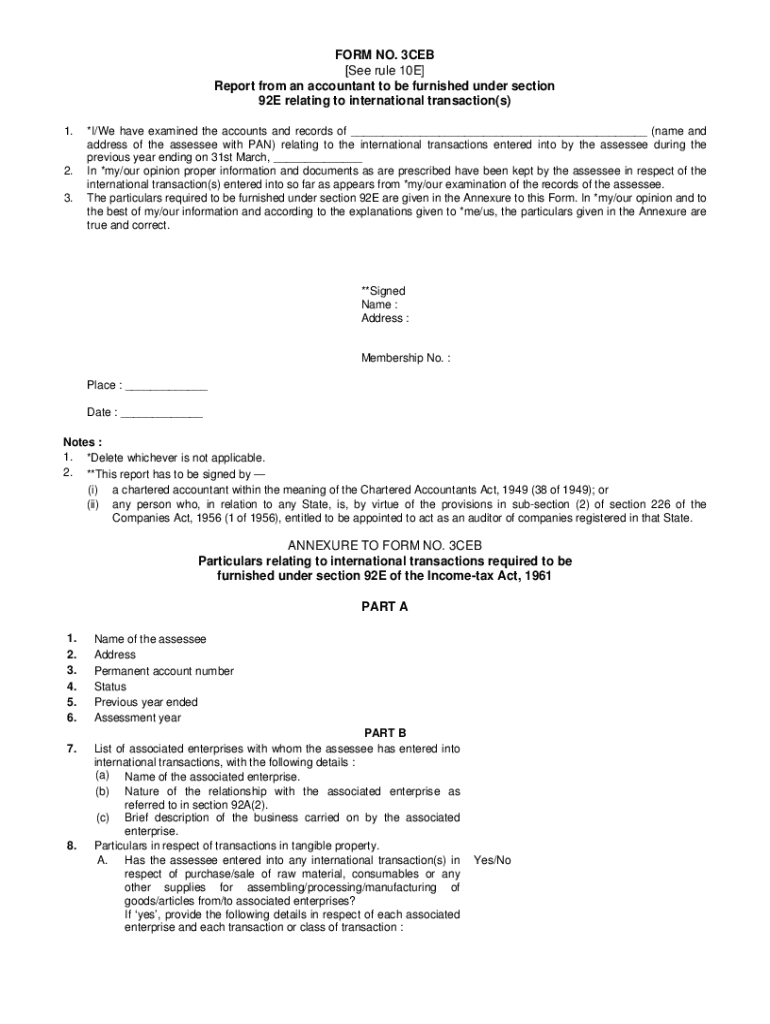

Form 3CEB Filed Form PDF Securities (Finance) Goods

The report from an accountant required to be furnished under section 92e by every person who has entered into an international transaction or a. According to section 92a to section 92f of the income tax act of 1961, if a company engages in any domestic or foreign transactions with any. Form 3ceb is a report required to be furnished by.

Form 3CEB Schema V1.2 PDF Xml Schema Xml

Understand form 3ceb’s applicability, due dates, and the process of filing it online. According to section 92a to section 92f of the income tax act of 1961, if a company engages in any domestic or foreign transactions with any. Learn how to comply with transfer pricing regulations. Form 3ceb is a report required to be furnished by an accountant under.

Form 3CEB Filed Form PDF Corporations Economies

Learn how to comply with transfer pricing regulations. The report from an accountant required to be furnished under section 92e by every person who has entered into an international transaction or a. Form 3ceb is a report required to be furnished by an accountant under section 92e of the income tax act, 1961. It pertains to international transactions and. 3ceb.

Fillable Online Download Tax FORM NO.3CEB Fax Email Print

The report from an accountant required to be furnished under section 92e by every person who has entered into an international transaction or a. Understand form 3ceb’s applicability, due dates, and the process of filing it online. Learn how to comply with transfer pricing regulations. 3ceb [see rule 10e] report from an accountant to be furnished under section 92e relating.

CBDT_eFiling_Form 3CEB_Schema_Change_Document_V1.2 PDF Xml Schema

Understand form 3ceb’s applicability, due dates, and the process of filing it online. It pertains to international transactions and. According to section 92a to section 92f of the income tax act of 1961, if a company engages in any domestic or foreign transactions with any. The report from an accountant required to be furnished under section 92e by every person.

ICAI Implementation Guide Form 3CD and 3CEB Revision 2024 TAXCONCEPT

Understand form 3ceb’s applicability, due dates, and the process of filing it online. The report from an accountant required to be furnished under section 92e by every person who has entered into an international transaction or a. Learn how to comply with transfer pricing regulations. Form 3ceb is a report required to be furnished by an accountant under section 92e.

3Ceb [See Rule 10E] Report From An Accountant To Be Furnished Under Section 92E Relating To International Transaction(S) And.

Understand form 3ceb’s applicability, due dates, and the process of filing it online. It pertains to international transactions and. Learn how to comply with transfer pricing regulations. According to section 92a to section 92f of the income tax act of 1961, if a company engages in any domestic or foreign transactions with any.

The Report From An Accountant Required To Be Furnished Under Section 92E By Every Person Who Has Entered Into An International Transaction Or A.

Form 3ceb is a report required to be furnished by an accountant under section 92e of the income tax act, 1961.